Question: please answer all 3 questions for a thumbs up Laurel, Inc., has debt outstanding with a coupon rate of 5.9% and a yield to maturity

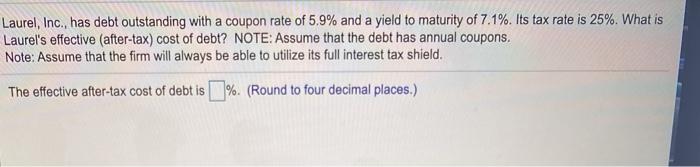

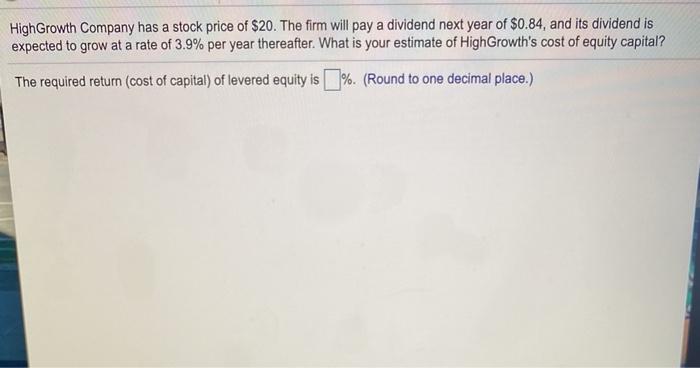

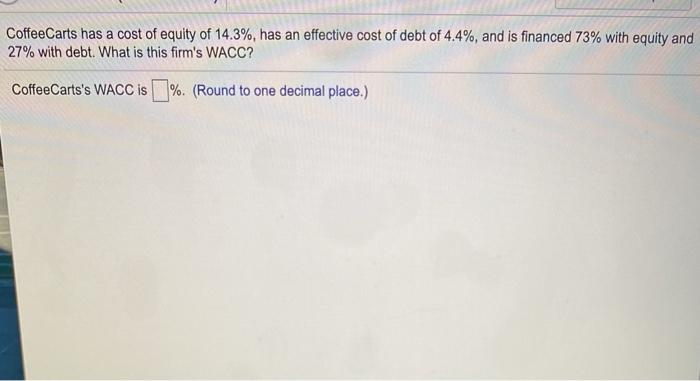

Laurel, Inc., has debt outstanding with a coupon rate of 5.9% and a yield to maturity of 7.1%. Its tax rate is 25%. What is Laurel's effective (after-tax) cost of debt? NOTE: Assume that the debt has annual coupons. Note: Assume that the firm will always be able to utilize its full interest tax shield. The effective after-tax cost of debt is % (Round to four decimal places.) High Growth Company has a stock price of $20. The firm will pay a dividend next year of $0.84, and its dividend is expected to grow at a rate of 3.9% per year thereafter. What is your estimate of High Growth's cost of equity capital? The required return (cost of capital) of levered equity is %. (Round to one decimal place.) CoffeeCarts has a cost of equity of 14.3%, has an effective cost of debt of 4.4%, and is financed 73% with equity and 27% with debt. What is this firm's WACC? CoffeeCarts's WACC is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts