Question: please open the image in a new tab for zoomed in version Laurel, Inc., has debt outstanding with a coupon rate of 5.9% and a

please open the image in a new tab for zoomed in version

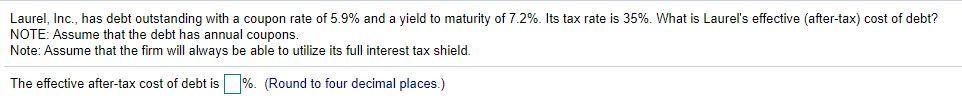

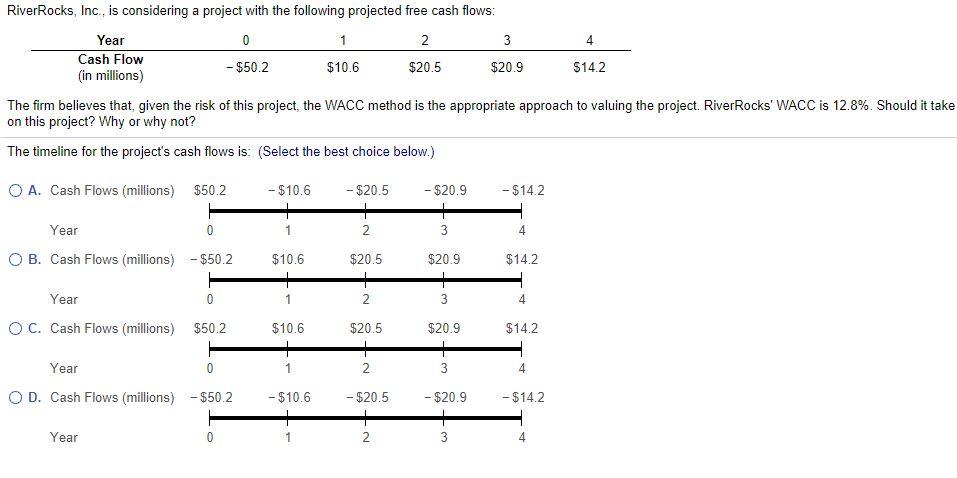

Laurel, Inc., has debt outstanding with a coupon rate of 5.9% and a yield to maturity of 7.2%. Its tax rate is 35%. What is Laurel's effective after-tax) cost of debt? NOTE: Assume that the debt has annual coupons. Note: Assume that the firm will always be able to utilize its full interest tax shield. The effective after-tax cost of debt is %. (Round to four decimal places.) 4 River Rocks, Inc., is considering a project with the following projected free cash flows: Year 1 2 3 Cash Flow - $50.2 $10.6 $20.5 $20.9 $14.2 (in millions) The firm believes that given the risk of this project, the WACC method is the appropriate approach to valuing the project. River Rocks' WACC is 12.8%. Should it take on this project? Why or why not? The timeline for the project's cash flows is: (Select the best choice below.) O A. Cash Flows (millions) $50.2 - $10.6 - $20.5 - $20.9 - $14.2 Year 0 1 2 3 4 1 O B. Cash Flows (millions) - $50.2 $10.6 $20.9 $14.2 $20.5 + 2 Year 0 2 3 4 O C. Cash Flows (millions) $50.2 $10.6 $20.9 $14.2 $20.5 + 2 Year 0 1 3 4 OD. Cash Flows (millions) - $50.2 - $10.6 - $20.9 - $14.2 - $20.5 + 2 W+N Year 0 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts