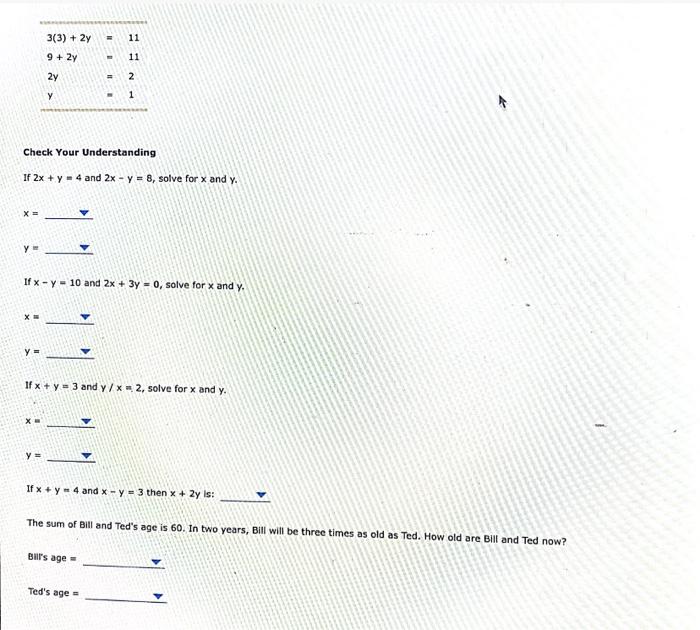

Question: Please answer all 3(3) + 2y 11 9 + 2y + 11 2y 2 Y 1 Check Your Understanding IF 2x + y - 4

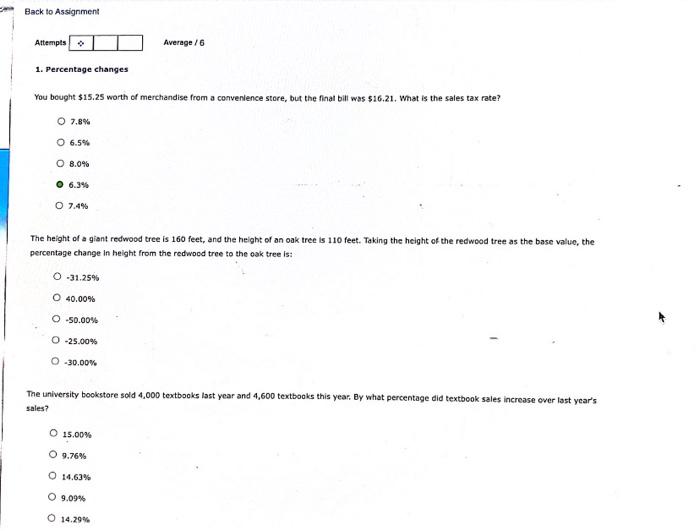

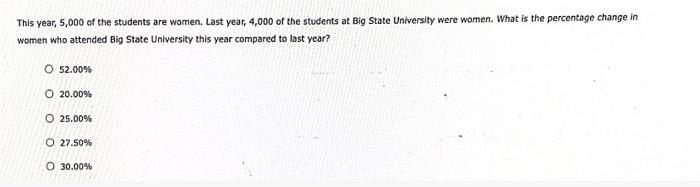

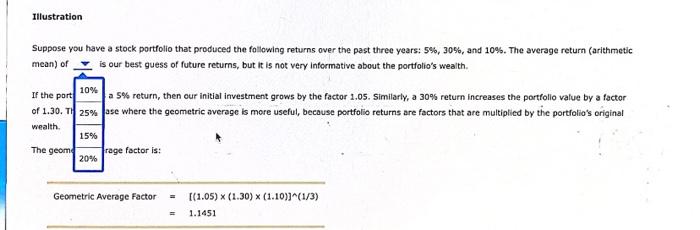

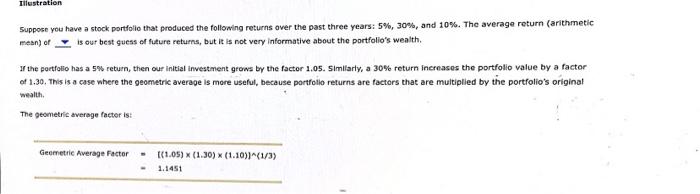

3(3) + 2y 11 9 + 2y + 11 2y 2 Y 1 Check Your Understanding IF 2x + y - 4 and 2x - y = 8, solve for x and y. X Y If x - y = 10 and 2x + 3y = 0, solve for x and y. X y = If x + y = 3 and y/x* 2. solve for x and y. X y = If x + y - 4 and x - y = 3 then x + 2y is: The sum of Bill and Ted's age is 60. In two years, Bill will be three times as old as Ted. How old are Bill and Ted now? Bull's age Ted's age Back to Assignment Attempts Average/6 1. Percentage changes You bought $15.25 worth of merchandise from a convenience store, but the final bill was $16.21. What is the sales tax rate? O 7.8% 0 6.596 O 8.0% 6.3% 0 7.4% The height of a giant redwood tree is 160 feet, and the height of an oak tree is 110 feet. Taking the height of the redwood tree as the base value, the percentage change in height from the redwood tree to the oak tree is: 0 -31.25% O 40.00% O -50.00% 0-25.00% 0 -30.00% The university bookstore sold 4.000 textbooks last year and 4,600 textbooks this year. By what percentage did textbook sales increase over last year's sales? O 15.00% 09.76% O 14.63% 09.09% O 14.29% This year, 5,000 of the students are women. Last year, 4,000 of the students at Big State University were women. What is the percentage change in women who attended Big State University this year compared to last year? O 52.00% 0 20.00% 0 25.00% 0 27.50% O 30.00% Illustration Suppose you have a stock portfolio that produced the following returns over the past three years: 5%, 30%, and 10%. The average return (arithmetic mean) of is our best guess of future returns, but it is not very informative about the portfolio's wealth 10% If the part a 5% return, then our initial investment grows by the factor 1.05. Similarly, a 30% return increases the portfolio value by a factor of 1.30. TI 25% ose where the geometric average is more useful, because portfolio returns are factors that are multiplied by the portfolio's original wealth. 15% The geom frage factor is: 20% Geometric Average Factor [(1.05) x (1.30) x (1.10)]^(1/3) 1.1451 Illustration Suppose you have a stock portfolio that produced the following returns over the past three years: 5%, 30%, and 10%. The average return (arithmetic mean) or is our best guess of future returns, but it is not very informative about the portfolio's wealth the portfolio has a 5return, then our initial investment grows by the factor 1.0. Similarly, a 30% return increases the portfolio value by a factor of 1.30. This is a case where the geometric average is more useful, because portfolio returns are factors that are multiplied by the portfolio's original wealth The geometric average factor is Geometric Average Factor (1.05) (1.30) (1.10)]^(1/3) 1.1451

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts