Question: please answer all 4 mc questions A stock has the payment of a declared dividend upcoming. The stock price would be expected to drop by

please answer all 4 mc questions

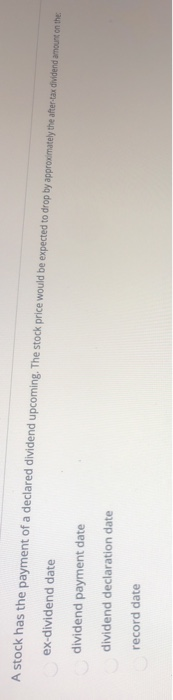

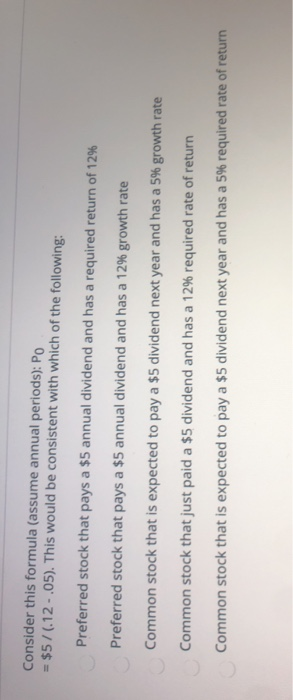

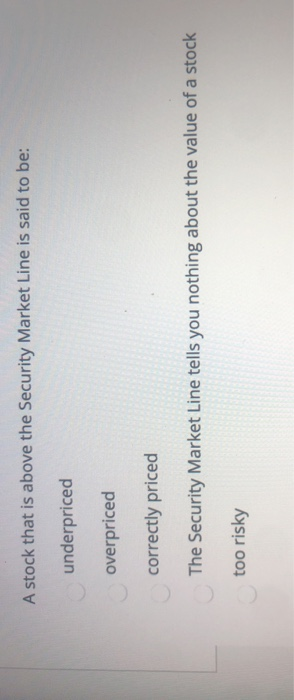

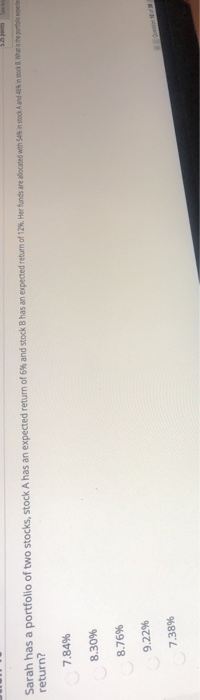

please answer all 4 mc questions A stock has the payment of a declared dividend upcoming. The stock price would be expected to drop by approximately the after-tax dividend amount on the ex-dividend date dividend payment date dividend declaration date record date Consider this formula (assume annual periods): Po = $5/(.12-.05). This would be consistent with which of the following: Preferred stock that pays a $5 annual dividend and has a required return of 12% Preferred stock that pays a $5 annual dividend and has a 12% growth rate Common stock that is expected to pay a $5 dividend next year and has a 5% growth rate Common stock that just paid a $5 dividend and has a 12% required rate of return Common stock that is expected to pay a $5 dividend next year and has a 5% required rate of return A stock that is above the Security Market Line is said to be: underpriced overpriced correctly priced The Security Market Line tells you nothing about the value of a stock too risky Sarah has a portfolio of two stocks, stock A has an expected return of 6% and stock Bhas an expected return of 12%. Her funds are allocated with an in stock and then has the per return? 7.84% 8.30% 8.76% 9.22% 7.38% A stock has the payment of a declared dividend upcoming. The stock price would be expected to drop by approximately the after-tax dividend amount on the ex-dividend date dividend payment date dividend declaration date record date Consider this formula (assume annual periods): Po = $5/(.12-.05). This would be consistent with which of the following: Preferred stock that pays a $5 annual dividend and has a required return of 12% Preferred stock that pays a $5 annual dividend and has a 12% growth rate Common stock that is expected to pay a $5 dividend next year and has a 5% growth rate Common stock that just paid a $5 dividend and has a 12% required rate of return Common stock that is expected to pay a $5 dividend next year and has a 5% required rate of return A stock that is above the Security Market Line is said to be: underpriced overpriced correctly priced The Security Market Line tells you nothing about the value of a stock too risky Sarah has a portfolio of two stocks, stock A has an expected return of 6% and stock Bhas an expected return of 12%. Her funds are allocated with an in stock and then has the per return? 7.84% 8.30% 8.76% 9.22% 7.38%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts