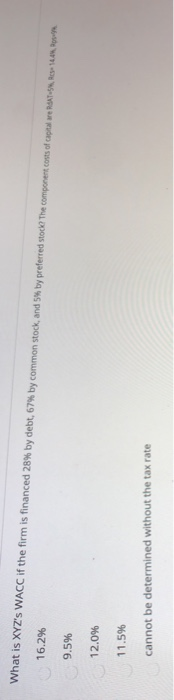

Question: please answer all 4 multiple choice questions (chegg policy allows 4 mc questions) 16.2% What is XYZ'S WACC if the firm is financed 28% by

please answer all 4 multiple choice questions (chegg policy allows 4 mc questions)

please answer all 4 multiple choice questions (chegg policy allows 4 mc questions)

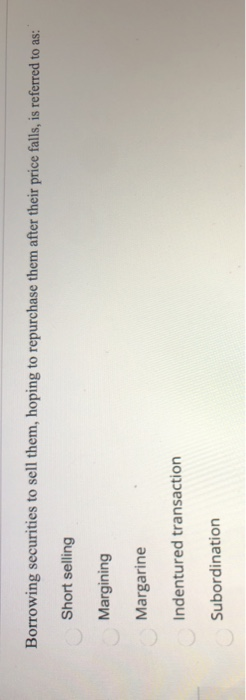

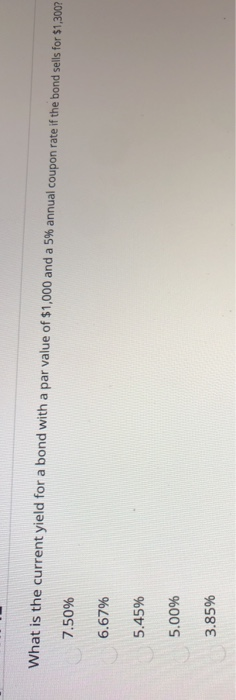

16.2% What is XYZ'S WACC if the firm is financed 28% by debt, 67% by common stock, and 5% by preferred stocle The component costs of capitale 9.5% 12.0% 11.5% cannot be determined without the tax rate Borrowing securities to sell them, hoping to repurchase them after their price falls, is referred to as: Short selling Margining Margarine Indentured transaction Subordination As evidenced by the CDGM, most stocks have a growth rate that is higher than the required rate of return. True False What is the current yield for a bond with a par value of $1,000 and a 5% annual coupon rate if the bond sells for $1,300? 7.50% 6.67% 5.45% 5.00% 3.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts