Question: please answer all 4 multiple choice questions (chegg policy allows 4 mc questions) Dual class. Which one of the following types of stock has a

please answer all 4 multiple choice questions (chegg policy allows 4 mc questions)

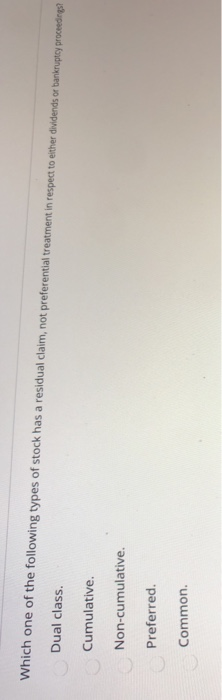

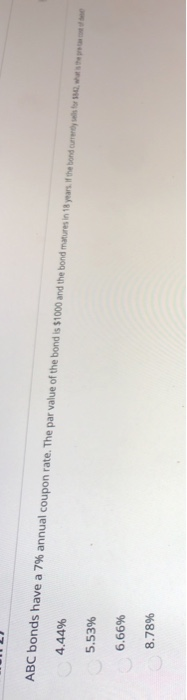

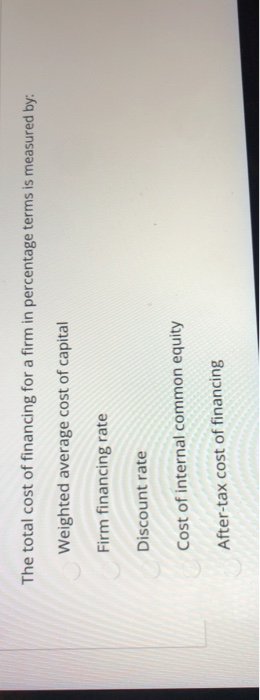

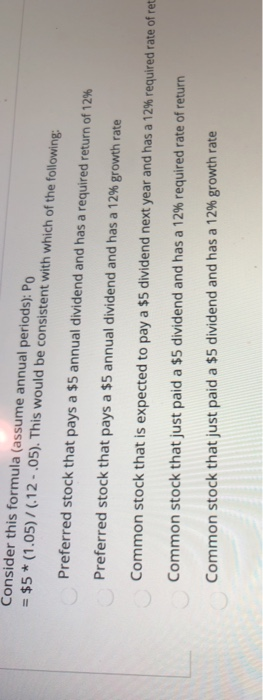

please answer all 4 multiple choice questions (chegg policy allows 4 mc questions)Dual class. Which one of the following types of stock has a residual claim, not preferential treatment in respect to either dividends or bankruptcy proceeding? Cumulative. Non-cumulative. Preferred. Common 4.44% ABC bonds have a 7% annual coupon rate. The par value of the bond is $1000 and the bond matures in 18 years. It the bord currently alter 5.53% 6.66% 8.78% The total cost of financing for a firm in percentage terms is measured by: Weighted average cost of capital Firm financing rate Discount rate Cost of internal common equity After-tax cost of financing Consider this formula (assume annual periods): PO = $5* (1.05)/(.12 - .05). This would be consistent with which of the following: Preferred stock that pays a $5 annual dividend and has a required return of 12% Preferred stock that pays a $5 annual dividend and has a 12% growth rate Common stock that is expected to pay a $5 dividend next year and has a 12% required rate of ret Common stock that just paid a $5 dividend and has a 12% required rate of return Common stock that just paid a $5 dividend and has a 12% growth rate Dual class. Which one of the following types of stock has a residual claim, not preferential treatment in respect to either dividends or bankruptcy proceeding? Cumulative. Non-cumulative. Preferred. Common 4.44% ABC bonds have a 7% annual coupon rate. The par value of the bond is $1000 and the bond matures in 18 years. It the bord currently alter 5.53% 6.66% 8.78% The total cost of financing for a firm in percentage terms is measured by: Weighted average cost of capital Firm financing rate Discount rate Cost of internal common equity After-tax cost of financing Consider this formula (assume annual periods): PO = $5* (1.05)/(.12 - .05). This would be consistent with which of the following: Preferred stock that pays a $5 annual dividend and has a required return of 12% Preferred stock that pays a $5 annual dividend and has a 12% growth rate Common stock that is expected to pay a $5 dividend next year and has a 12% required rate of ret Common stock that just paid a $5 dividend and has a 12% required rate of return Common stock that just paid a $5 dividend and has a 12% growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts