Question: please answer all 4 multiple choice questions Swanson Company had $250,000 of current assets and $90,000 of current liabilities before borrowing 560,000 from the bank

please answer all 4 multiple choice questions

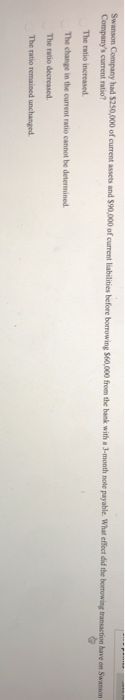

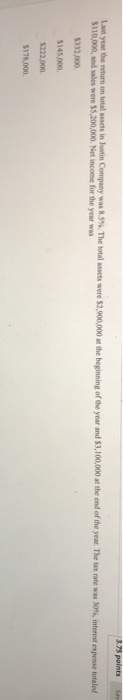

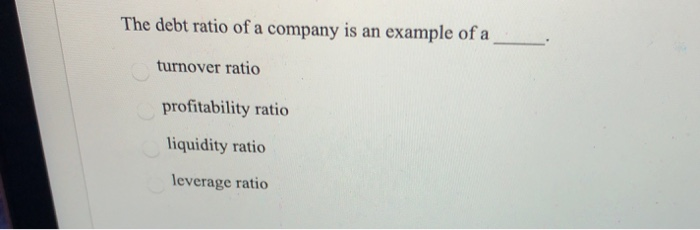

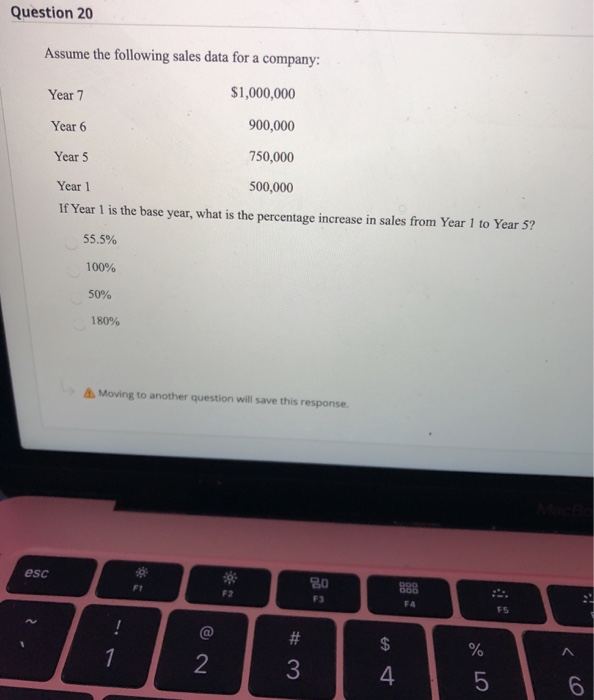

please answer all 4 multiple choice questions Swanson Company had $250,000 of current assets and $90,000 of current liabilities before borrowing 560,000 from the bank with a 3-month note payable. What effect did the borrowing transaction have on Swanson Company's current ratio? The ratio increased The change in the current ratio cannot be determined The ratio decreased The ratio remained unchanged 3.75 points S Last year the return on total assets in Justin Company was 5%. The total $110,000, and sales were 55,200,000. Net income for the year was were $2,900,000 M the beginning of the year and $1,100,000 at the end of the year. The tax rate was 10%, interest expense totaled 5222.000 $17.000 The debt ratio of a company is an example of a turnover ratio profitability ratio liquidity ratio leverage ratio Question 20 Assume the following sales data for a company: $1,000,000 Year 7 900,000 Year 6 750,000 Year 5 500,000 Year 1 If Year 1 is the base year, what is the percentage increase in sales from Year 1 to Year 5? 55.5% 100% 50% 180% Moving to another question will save this response esc # m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts