Question: please answer the following multiple choice and explain where necessary to make it easier for me to understand. Section A: Multiple Choice (60 points) 1.

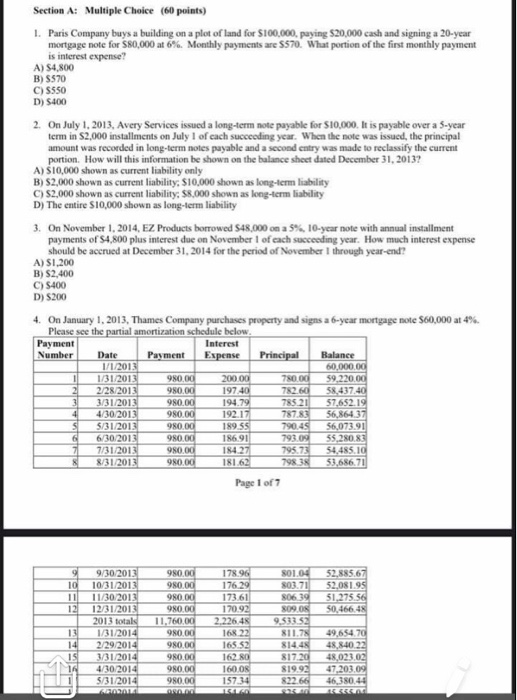

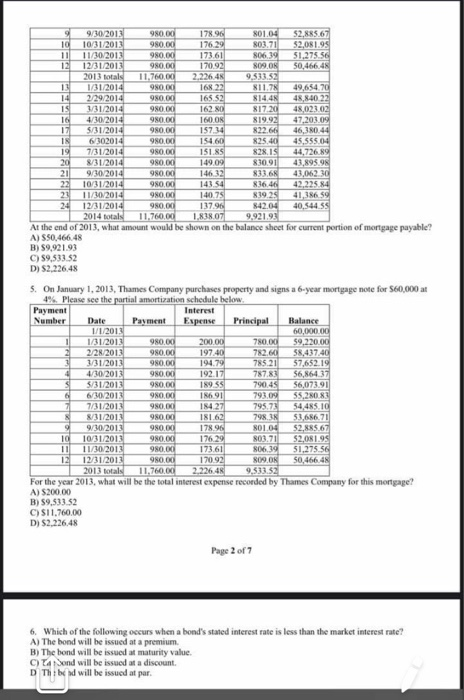

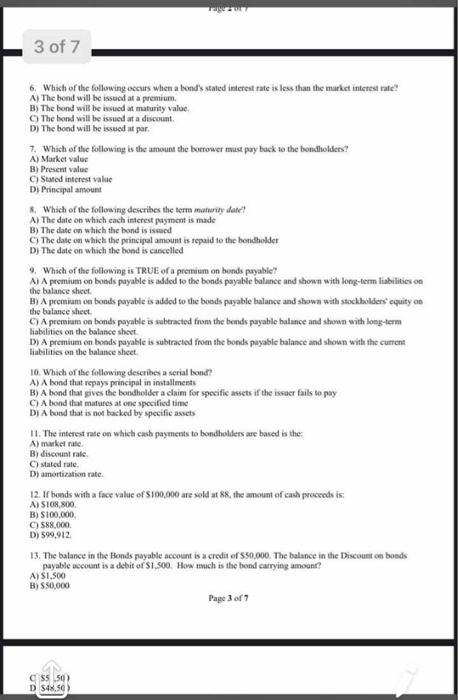

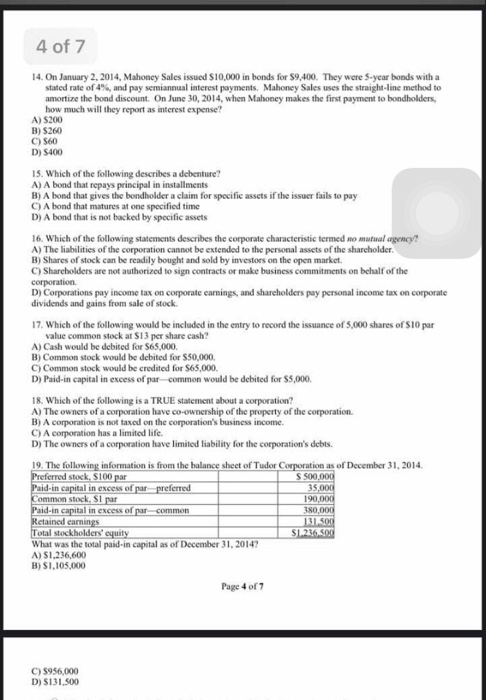

Section A: Multiple Choice (60 points) 1. Paris Company buys a building on a plot of land for S100,000, paying $20,000 cash and signing a 20-year mortgage note for $80,000 at 6%. Monthly payments are 5570 What portion of the first monthly payment is interest expense? A) $4,800 B) 5570 C) 5550 D) $400 2. On July 1, 2013, Avery Services issued a long-term note payable for $10,000. It is payable over a year Irm in S2,000 installments on July 1 of cach succeeding year. When the note was issued, the principal amount was recorded in long-term moles payable and a second entry was made to reclassify the current portion. How will this information be shown on the balance sheet dated December 31, 2013? A) S10,000 shown as current liability only B) $2,000 shown as current liability, S10,000 shown as long-term liability C) $2,000 shown as current liability: $8,000 shown as long-term liability D) The entire 510,000 shown as long-term liability 3. On November 1, 2014, EZ Products borrowed S48,000 on a 5% 10-year note with annual installment payments of S4,800 plus interest due on November 1 of each succeeding year. How much interest expense should be accrued at December 31, 2014 for the period of November through year-end? A) S1.200 B) $2,400 C) S400 D) $200 4. On January 1, 2013, Thames Company purchases property and signs a 6-year mortgage note $60,000 at 4% Please see the partial amortization schedule below. Payment Interest Number Date Payment Expense Principal Balance 1/1/2013 50,000.00 1/31/2013 980.00 20000 7800 59,22000 2/28/2013 980 od 197.40 78260 58.437.40 1/31/2013 980.00 194.79 7 85 21 57.652.19 4/30/2013 192217 787787 5626437 5/31/2013 90 od 199 55 790.4556.073 91 6/30/2013 980 od 16.91 793 552 7/31/2013 90 od 184.27 795.73 4.485 10 3120119 00181 62 7953 5168671 NO Page 1 of 7 ON 9/30/2013 10103112012 11 11 30 201 12 2012 2013 N 1/31/2014 2/29/2014 3/31/2014 4/10 2014 $/31/2014 Tanan- 9000 11.7 90 od 980 90 90 980.00 - 17896 10 52255 67 52.081.95 173.61 51.275 56 1209 SO90 .466 222549552 1622 $11. 49.6540 165 52 814.4548.840.23 162 81720 4802303 160 OS $19.92 47,203.09 15734 82266 46.350.44 REMER 9/30/2013 90 od 17896 01.04 52567 10/31/2013 980.00 176.29 80171 52.081.95 1102013 980.00 173.61 80639 51.275.56 12312013 980 12092 SOOS SO 2013 ota 11.760 0 2 122645 9.333.53 1/31/2014 950.00 16822 SIL. 19.654.70 2/29/2014 165 52 $144 48.84022 UU 2014 162 817 021 4/302014 16 OR 47.2010 $31 2014 90 157 1 22.66 16.00 6103014 154 25.4 45.555.04 197012014 Sood 1515 44,726.89 2014 ORO 149.00 83091 43.89SOR 219:30 2014 90.00 146 32 833. 6 43,06230 2210/31/2014 90.00 143 SE R160422225 21 11/30/2014 9 140.75 1926 41.18659 28120120149001379 4204 40 544 55 2014 otak 11.760.00 1.38 07 9 .921.91 At the end of 2013, what amount would be shown on the balance sheet for current portion of mortgage payable? A) SS0648 B5992193 C) 59,331.52 D) 52.226.45 5. On January 1, 2013, Thames Company purchases property and signs a 6-year mortgage note for $60,000 at 4%. Please see the partial amortization schedule below Payment interest Number Date Payment Expense Principal Balance 1/1/2013 60,000.00 1/31/2013 980 od 20000 7 80 59.220.00 22/2013 980.00 197.40 782.60 58,437.40 11112013 9 . 194.79 785 21 57,652.19 4/10/2017 ONO OG 192.17 78783 $6,86437 5/31/2013 980 INSS 79044 $6,073.91 610.2011 9800 18691 793.00 55.280.83 7/31/2011 980.00 184 271 795.73 54,485.1 12 980. 181.62 798 51.686.71 G9/2014 980 178.96 01 0452.88567 Id 10/11/2017 980 176.29 803.71 52.081.95 11 /2011 1716 806.30 1.2755 2312011 980. od 120.92 809 ON S04664 2013 totals 11.760,00 2.226.48 9 533 53 For the year 2013, what will be the total interest expense recorded by Thames Company for this mortgage A) 520000 B) S951152 C) SI1.760.00 DS2264 Page 2 of 7 6. Which of the following occurs when a bond's stated interest rate is less than the market interest rate? A) The band will be issued at a premium B) The hond will be issued at maturity value a nd will be issued at a discount D Thi will be issued at par C 3 of 7 6. Which of the following curs when a bond stated interest rate is less than the market interest rate A) The band will be in a premium B) The bond will be issued at maturity value The bond will be issued at a discount Di The bond will be 7. Which of the following is the amount the borrower must pay back to the bondholders A) Market value B) Presenta C) S interest Value D) Principal amount & Which of the following describes the term ma y dale A) The date on which each interest payment is made B) The date on which the hand is issued C) The date on which the principal amount is repaid to the bondholder D) The date on which the bond is cancelled 9. Which of the following is TRUE of a premium on bonds payable A) A premium on bonds payable is added to the bonds payable balance and shown with long-term ilities on the balance sheet B) A premium on bonds payable is added to the bonds payable balance and shown with stockholders' equity on the balance sheet C) A premium on bonds payable is subtracted from the bends payable balance and shown with long-term liabilities on the balance sheet D) A premium on bonds payable is subtracted from the bonds payable balance and shown with the current liabilities on the balance sheet 10. Which of the following describes a serial bond? A) A bond that repays principal in installments B) A bond that gives the bondholder a claim for specific assets if the issuer fails to pay C) A bond that matures at one specified time D) A bond that is not backed by specific assets 11. The interest rate on which cash payments to bondholders are based is the A) market rate B) discount atedrale ate C D the amount of cash proceeds is 12. If hands with a face value of $100,000 are sold at A) SION ROO BS100 000 CSO D) 599,912 bonds 13. The balance in the Bonds payable account is a credit of $50,000. The balance in the Discount payable account is a debt of SI S00. How much is the band carrying amo A) SI 500 RSS0000 Page 3 of 7 CSS 50) D$48.50) 4 of 7 14. On January 2, 2014, Mahoney Sales issued $10,000 in bonds for $9.400. They were 5-year bonds with a stated rate of 4%, and pay semiannual interest payments. Mahoney Sales uses the straight-line method to amortire the bond discount. On June 30, 2014, when Mahoney makes the first payment to bendholders how much will they report as interest expense? A) $200 B) 5260 C) 560 D) S400 15. Which of the following describes a dcbenture? A) A bond that repays principal in installments B) A bond that gives the bondholder a claim for specific assets if the issuer fails to pay C) A bond that matures at one specified time D) A bond that is not hacked by specific assets 16. Which of the following statements describes the corporate characteristic termed no m alagency! A) The liabilities of the corporation cannot be extended to the personal assets of the shareholder B) Shares of stock can be readily bought and sold by investors on the open market C) Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation D) Corporations pay income tax on corporate carnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock. 17. Which of the following would be included in the entry to record the issuance of 5,000 shares of S10 par value common stock at S13 per share cash? A) Cash would be debited for $65,000 B) Common stock would be debited for $50,000 C) Common stock would be credited for $65,000 D) Paid.in capital in excess of par-common would be debited for $5,000 18. Which of the following is a TRUE statement about a corporation? A) The owners of a corporation have co-ownership of the property of the corporation B) A corporation is not taxed on the corporation's business income. C) A corporation has a limited life. D) The owners of a corporation have limited liability for the corporation's debts. 19. The following information is from the balance sheet of Tudor Corporation as of December 31, 2014 Preferred stock, S100 par S 500.000 Paid in capital in excess of pur preferred 35.000 Common stock, Si par 190.000 Paid-in capital in excess of pur common 30.000 Retained carnings 131 500 Total stockholders' equity S1236 500 What was the total paid in capital as of December 31, 2014? A) 51.236,600 B) $1,105,000 Page 4 of 7 C) 5956,000 D) $131.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts