Question: please answer all 4 multiple choice questions What measures the total cost of financing for a firm in percentage terms? Weighted average cost of capital

please answer all 4 multiple choice questions

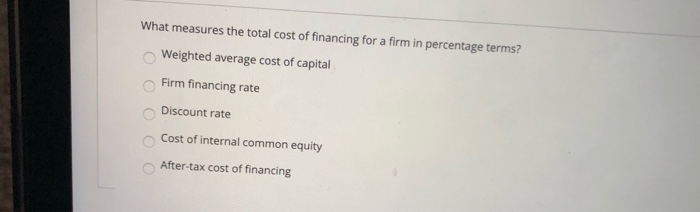

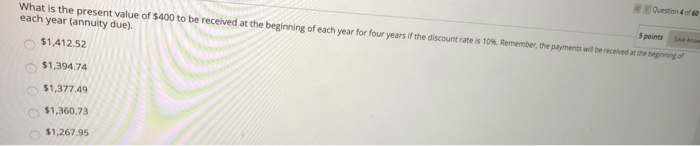

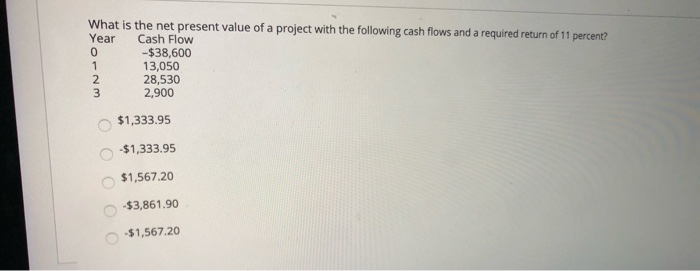

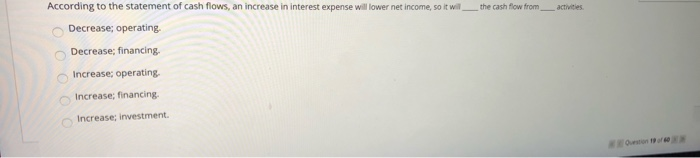

please answer all 4 multiple choice questionsWhat measures the total cost of financing for a firm in percentage terms? Weighted average cost of capital Firm financing rate Discount rate Cost of internal common equity After-tax cost of financing 5 points What is the present value of $400 to be received at the beginning of each year for four years if the discount rate is 10%. Remember, the payments will be received at the beginning of each year (annuity due). $1,412.52 $1,394.74 $1,377.49 $1,360.73 $1,267.95 What is the net present value of a project with the following cash flows and a required return of 11 percent? Year Cash Flow 0 -$38,600 1 13,050 2 28,530 3 2,900 $1,333.95 -$1,333.95 $1,567.20 -$3,861.90 -$1,567.20 the cash flow from activities According to the statement of cash flows, an increase in interest expense will lower net income, so it wil Decrease; operating Decrease; financing Increase operating Increase; financing Increase investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts