Question: PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONS Which one of the following should not be included in the cash flow time line of a new

PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONS

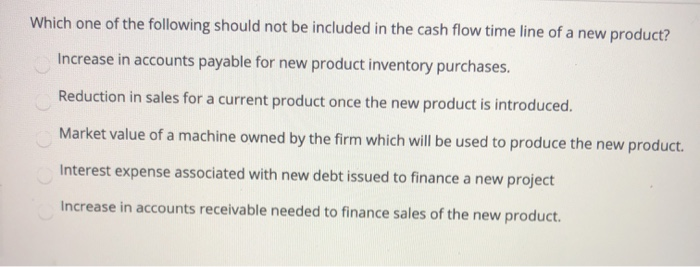

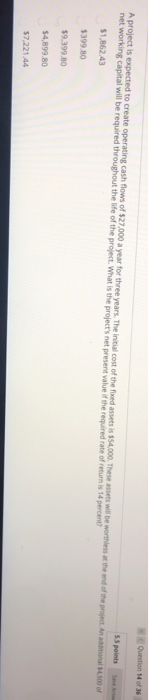

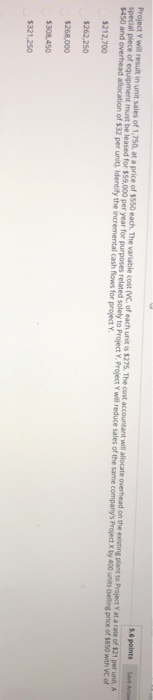

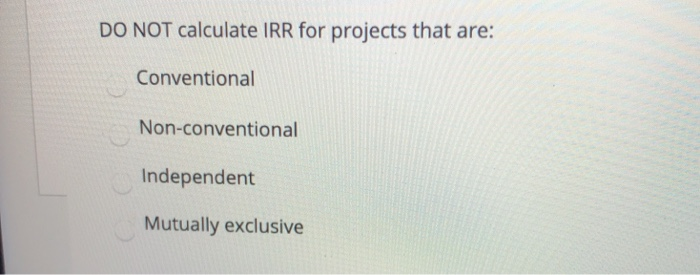

PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONSWhich one of the following should not be included in the cash flow time line of a new product? Increase in accounts payable for new product inventory purchases. Reduction in sales for a current product once the new product is introduced. Market value of a machine owned by the firm which will be used to produce the new product. Interest expense associated with new debt issued to finance a new project Increase in accounts receivable needed to finance sales of the new product. Question of 36 Spins A project is expected to create operating cash flows of $27.000 a year for three years. The initial cost of the feed assets is 554.000. These sets will be worthless at the end of the project. An additional 4500 of net working capital will be required throughout the life of the project. What is the project's net present value of the required rate of retum is 14 percent? 51,862.43 $399.80 59.399.80 $4,899.80 $7,221.44 5.6 points Project will result in unit sales of 1,750, at a price of $550 each. The variable cost of each unit is $27. The cost accountant will allocate overhead on the existing plant to Project at a rate of $21 per unit. A special piece of equipment must be leased for $59.000 per year for purposes related solely to Project Project will reduce sales of the same company's Project X by 400 units selling price of $850 with VC of 3450 and overhead location of 532 per unit) Identify the incremental cash flows for project Y. $212,700 $262.250 $268.000 $308,450 $321.250 DO NOT calculate IRR for projects that are: Conventional Non-conventional Independent Mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts