Question: please answer all 5 and show all work INVENTORY PROBLEM - CHAPTER 7 ABC, Inc. buys and sells one product. The following information is available

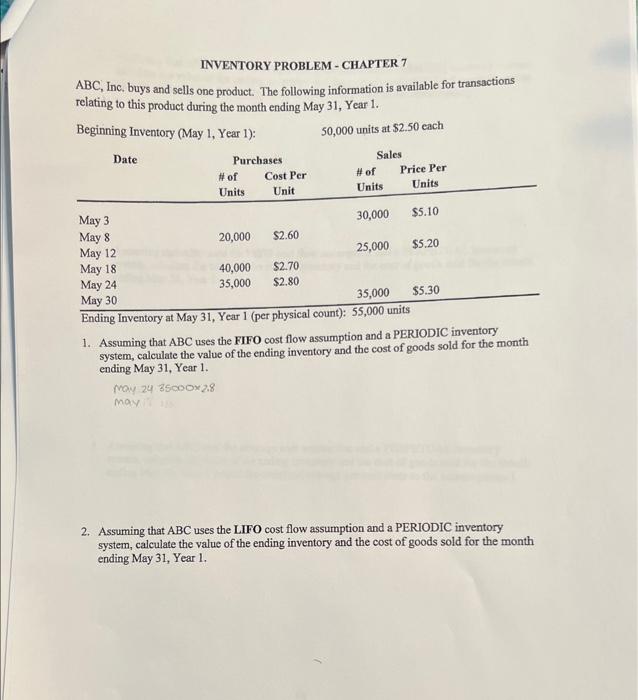

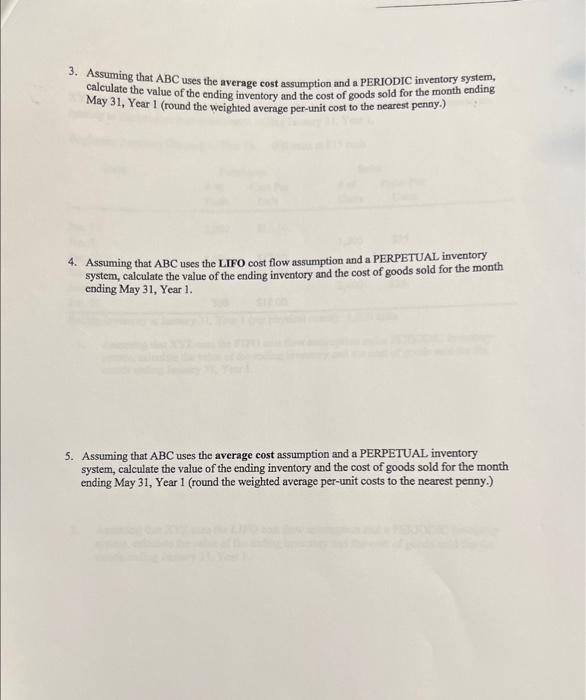

INVENTORY PROBLEM - CHAPTER 7 ABC, Inc. buys and sells one product. The following information is available for transactions relating to this product during the month ending May 31, Year 1. Beginning Inventory (May 1, Year 1): 50,000 units at $2.50each 1. Assuming that ABC uses the FIFO cost flow assumption and a PERIODIC inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1. May 24350002.8 2. Assuming that ABC uses the LIFO cost flow assumption and a PERIODIC inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1. 3. Assuming that ABC uses the average cost assumption and a PERIODIC inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1 (round the weighted average per-unit cost to the nearest penny.). 4. Assuming that ABC uses the LIFO cost flow assumption and a PERPETUAL inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1. 5. Assuming that ABC uses the average cost assumption and a PERPETUAL inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1 (round the weighted average per-unit costs to the nearest penny.) INVENTORY PROBLEM - CHAPTER 7 ABC, Inc. buys and sells one product. The following information is available for transactions relating to this product during the month ending May 31, Year 1. Beginning Inventory (May 1, Year 1): 50,000 units at $2.50each 1. Assuming that ABC uses the FIFO cost flow assumption and a PERIODIC inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1. May 24350002.8 2. Assuming that ABC uses the LIFO cost flow assumption and a PERIODIC inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1. 3. Assuming that ABC uses the average cost assumption and a PERIODIC inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1 (round the weighted average per-unit cost to the nearest penny.). 4. Assuming that ABC uses the LIFO cost flow assumption and a PERPETUAL inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1. 5. Assuming that ABC uses the average cost assumption and a PERPETUAL inventory system, calculate the value of the ending inventory and the cost of goods sold for the month ending May 31, Year 1 (round the weighted average per-unit costs to the nearest penny.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts