Question: please answer all 9 parts and please read instructions carefully, thank you! a. Calculate the value of the bond. b. How does the value change

please answer all 9 parts and please read instructions carefully, thank you!

please answer all 9 parts and please read instructions carefully, thank you!

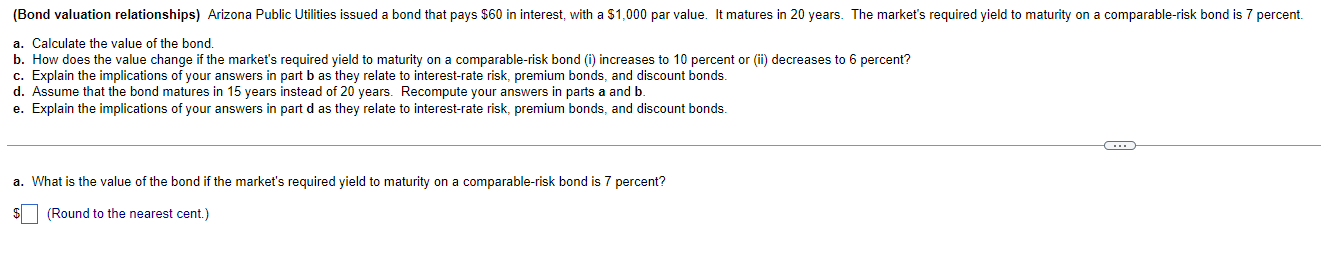

a. Calculate the value of the bond. b. How does the value change if the market's required yield to maturity on a comparable-risk bond (i) increases to 10 percent or (ii) decreases to 6 percent? c. Explain the implications of your answers in part b as they relate to interest-rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 15 years instead of 20 years. Recompute your answers in parts a and b. e. Explain the implications of your answers in part d as they relate to interest-rate risk, premium bonds, and discount bonds. a. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 7 percent? 9 (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts