Question: Please answer all a, b, c, d, e! Taxable income and pretax financial income would be identical for Tony Wonder Corporation except for its treatment

Please answer all a, b, c, d, e!

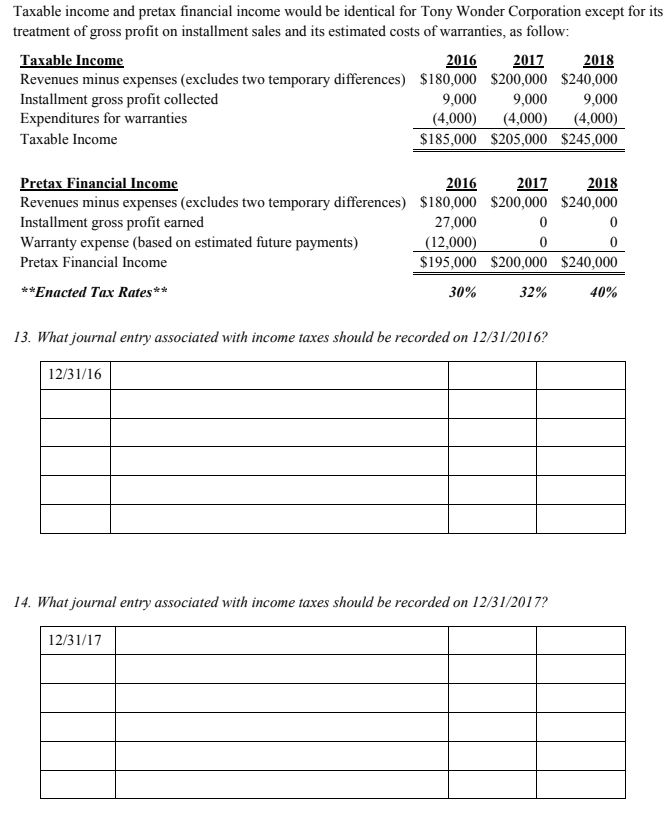

Taxable income and pretax financial income would be identical for Tony Wonder Corporation except for its treatment of gross profit on installment sales and its estimated costs of warranties, as follow: 2016201 2018 $200,000 9,000 (4,000 (4,000 (4,000) $185,000 $205,000 $245,000 Revenues minus expenses (excludes two temporary differences) Installment gross profit collected Expenditures for warranties $180,000 9,000 $240,000 9,000 Iaxable Income retax Financial Income Revenues minus expenses (excludes two temporary differences) Installment gross profit earned Warranty expense (based on estimated future payments) Pretax Financial Income 20162017 2018 $240,000 $200,000 $180,000 27,000 12,000) 0 $195,000 $200,000 $240,000 Enacted Tax Rates 30% 32% 40% 13. What journal entry associated with income taxes should be recorded on 12/31/2016? 12/31/16 14. What journal entry associated with income taxes should be recorded on 12/31/2017? 12/31/17 Taxable income and pretax financial income would be identical for Tony Wonder Corporation except for its treatment of gross profit on installment sales and its estimated costs of warranties, as follow: 2016201 2018 $200,000 9,000 (4,000 (4,000 (4,000) $185,000 $205,000 $245,000 Revenues minus expenses (excludes two temporary differences) Installment gross profit collected Expenditures for warranties $180,000 9,000 $240,000 9,000 Iaxable Income retax Financial Income Revenues minus expenses (excludes two temporary differences) Installment gross profit earned Warranty expense (based on estimated future payments) Pretax Financial Income 20162017 2018 $240,000 $200,000 $180,000 27,000 12,000) 0 $195,000 $200,000 $240,000 Enacted Tax Rates 30% 32% 40% 13. What journal entry associated with income taxes should be recorded on 12/31/2016? 12/31/16 14. What journal entry associated with income taxes should be recorded on 12/31/2017? 12/31/17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts