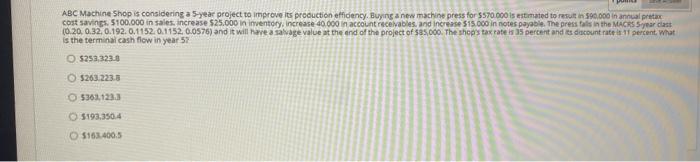

Question: please answer all ABC Machine Shop is considering a 5-year project to improve its production effidency, Buying a new machine press for 5570.000 is estimated

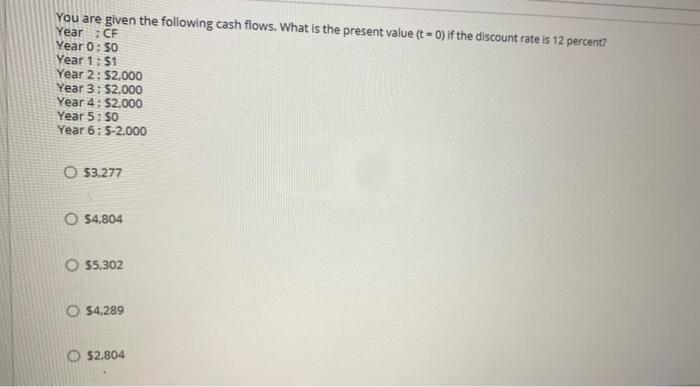

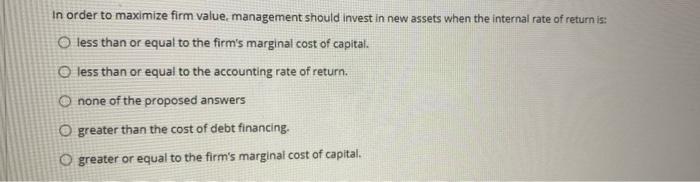

ABC Machine Shop is considering a 5-year project to improve its production effidency, Buying a new machine press for 5570.000 is estimated to result in 590.000 in annual pret cost savings $100.000 in sales, increase 525.000 in inventory Increase 40.000 in account receivables, and increase $15.000 in notes payable. The press fals in the MACRS Synarcast (0.20 0.32 0.192.0.1152 0.1152. 0.0576) and it will have a salvage value at the end of the project of $85.000. The shops tax rate is a percent and its discount rate is 15 percent What is the terminal cash flow in year 57 5253,3238 5263.223.3 5361.123.3 5193.350.4 5163.400.5 You are given the following cash flows. What is the present value (t = 0) if the discount rate is 12 percent Year : CF Year 0:50 Year 1:51 Year 2: $2,000 Year 3: $2.000 Year 4: $2.000 Year 5:50 Year 6: 5-2.000 53.277 O $4,804 O 55.302 $4,289 52.804 In order to maximize firm value, management should invest in new assets when the internal rate of return is: o less than or equal to the firm's marginal cost of capital. O less than or equal to the accounting rate of return. O none of the proposed answers O greater than the cost of debt financing. greater or equal to the firm's marginal cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts