Question: Please answer all!! answer all please 13) The comelation coefficients between severul puirs of stocks are as follows: Cop(L,B)=85;Cop(A,C)=,60,Cog(A,D)=,45, Each stock has an expected retum

Please answer all!! answer all please

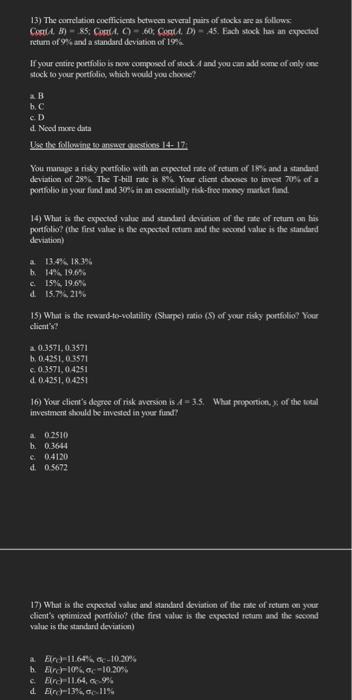

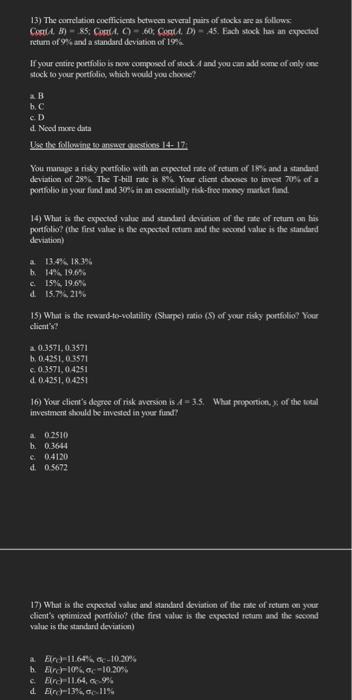

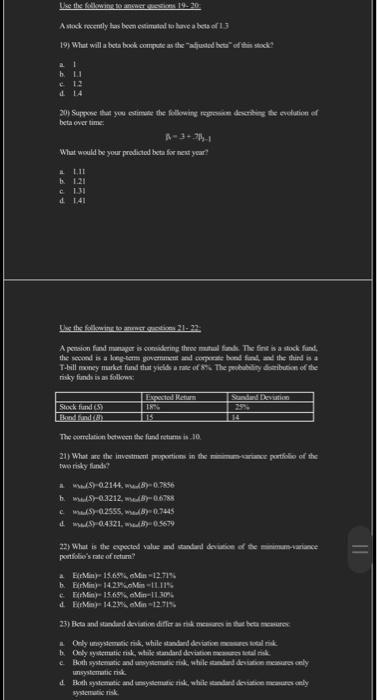

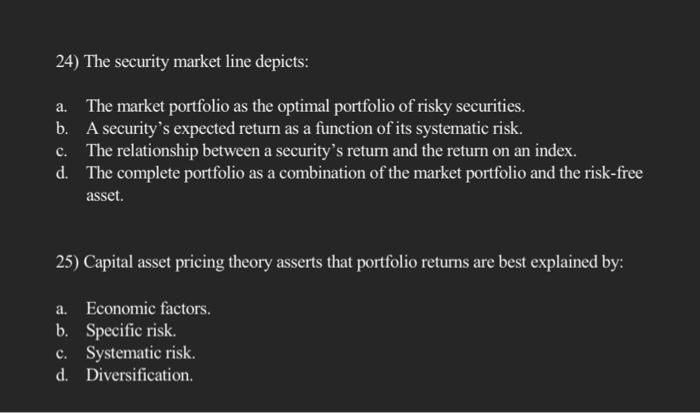

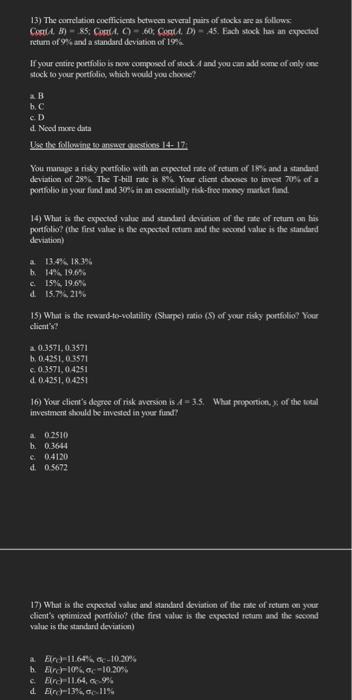

13) The comelation coefficients between severul puirs of stocks are as follows: Cop(L,B)=85;Cop(A,C)=,60,Cog(A,D)=,45, Each stock has an expected retum of 9% and a standird deviation of 195 . If your entire portiolio is new composed of stock, A and you can add sume of only one stock to your potfolio, which would you chore?? a. B b. C c. D d. Nocd more data Wec the followaing bu answy grostions. 14. 17 You manage a risky portfolio with an erpected rate of return of 18x and a standard deriation of 28%. The Th bill nate is 8%. Your client chooses to invest 70 s of a portfolio in your fand and 300 s in an cssentidly ribk-free mancy maiket fiend. 14) What is the expectod value and standurd deviation of the nte of return an his portfolio? (the first value is the expected return and the second value is the standard deciation) a 13,4618.395 b. 14%19.68 c. 15%19.6V d. 1577=21% 15) What is the reward-to-volatility (Starpe) ratio (5) of your risky portfolio? Your clicat?s? a. 0.3571,0.3571 b. 0.4251,03571 c. 0.3571,0.4251 d. 0.4251,0.4251 16) Your client's degree of risk avorsion is A=5.5. What proportion y; of the toeal investment stould be invesed in your furd? a. 02510 b. 03644 c. 0.4120 d. 05672 17) What is the copectad value and standard deviation of the rate of retum en your client's optimized portfolio? (the first value is the eyocted retum and the second value is the standud deviation) a Eird=11.64\$s c10.2005 b. E(rc=10i,ac10.20% c. E(ra) 11.64,=9% d. E(rc)=13%,c11% b. II cit 12 d. 1.4 beta over time: R2=3+3p1 What would be your prodicted beta fise neat year? ab.cd.1.111.211.311.41 nisky fund is as follews: twa rishy fundo? b. wisis) 03212 , whe c i muis) poitifla's rate of retum? A. E(cMin) 15.69: 0 Man =1271% d. Dif:ing 14.2.76is aMin =12.71\%, unsystematic nisk sysderwaticrisk, 24) The security market line depicts: a. The market portfolio as the optimal portfolio of risky securities. b. A security's expected return as a function of its systematic risk. c. The relationship between a security's return and the return on an index. d. The complete portfolio as a combination of the market portfolio and the risk-free asset. 25) Capital asset pricing theory asserts that portfolio returns are best explained by: a. Economic factors. b. Specific risk. c. Systematic risk. d. Diversification