Question: please answer all ASAP. will give thumbs up Crest Coal Company purchased a mining site for $500,000 on July 1, 2021. The company expects to

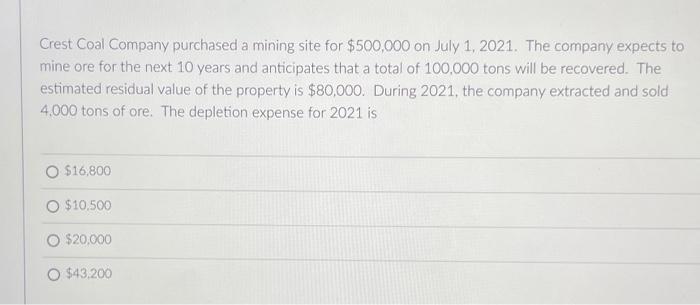

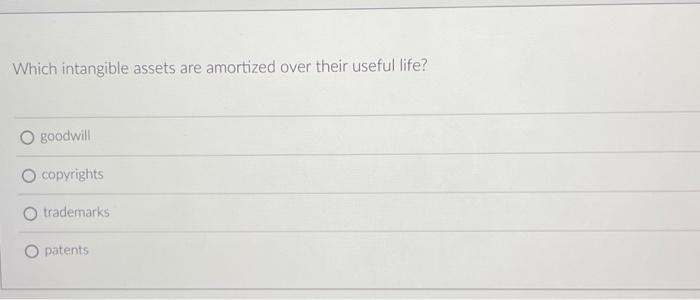

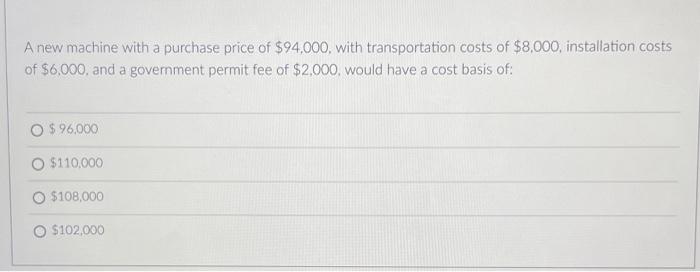

Crest Coal Company purchased a mining site for $500,000 on July 1, 2021. The company expects to mine ore for the next 10 years and anticipates that a total of 100.000 tons will be recovered. The estimated residual value of the property is $80,000. During 2021, the company extracted and sold 4.000 tons of ore. The depletion expense for 2021 is $16,800 O $10,500 O $20,000 O $43,200 Which intangible assets are amortized over their useful life? goodwill copyrights O trademarks O patents A new machine with a purchase price of $94,000, with transportation costs of $8,000, installation costs of $6,000, and a government permit fee of $2,000 would have a cost basis of: $ 96,000 O $110,000 O $108,000 O $102,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts