Question: please answer all correctly for thumbs up thanks Dunked Donuts is considering a project for a new bottled beverage called Dunked-It-Cino. The project woul require

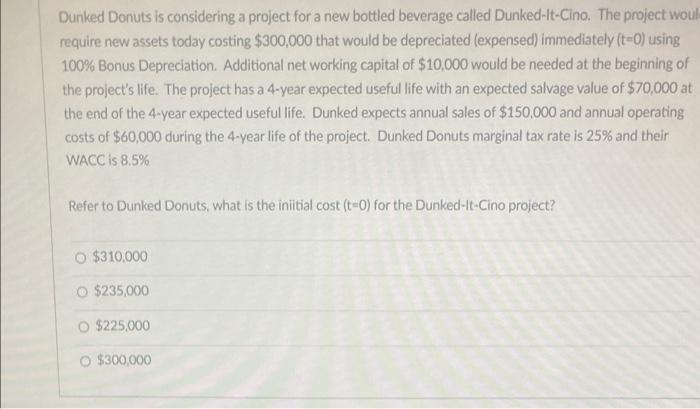

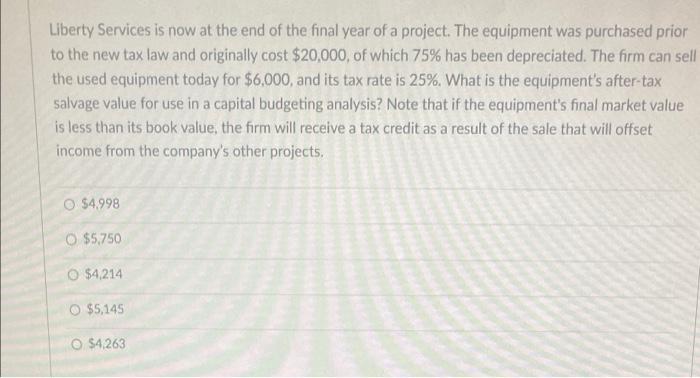

Dunked Donuts is considering a project for a new bottled beverage called Dunked-It-Cino. The project woul require new assets today costing $300,000 that would be depreciated (expensed) immediately (t=0) using 100% Bonus Depreciation. Additional net working capital of $10,000 would be needed at the beginning of the project's life. The project has a 4-year expected useful life with an expected salvage value of $70,000 at the end of the 4-year expected useful life. Dunked expects annual sales of $150,000 and annual operating costs of $60,000 during the 4-year life of the project. Dunked Donuts marginal tax rate is 25% and their WACC is 8.5% Refer to Dunked Donuts, what is the initial cost (t=0) for the Dunked-It-Cino project? $310,000 $235,000 O $225,000 $300,000 Liberty Services is now at the end of the final year of a project. The equipment was purchased prior to the new tax law and originally cost $20,000, of which 75% has been depreciated. The firm can sell the used equipment today for $6,000, and its tax rate is 25%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value, the firm will receive a tax credit as a result of the sale that will offset income from the company's other projects. $4.998 O $5,750 $4,214 O $5,145 $4,263

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts