Question: Dunked Donuts is considering a project for a new bottled beverage called Dunked-It- Cino. The project would require new assets today costing $300,000 that

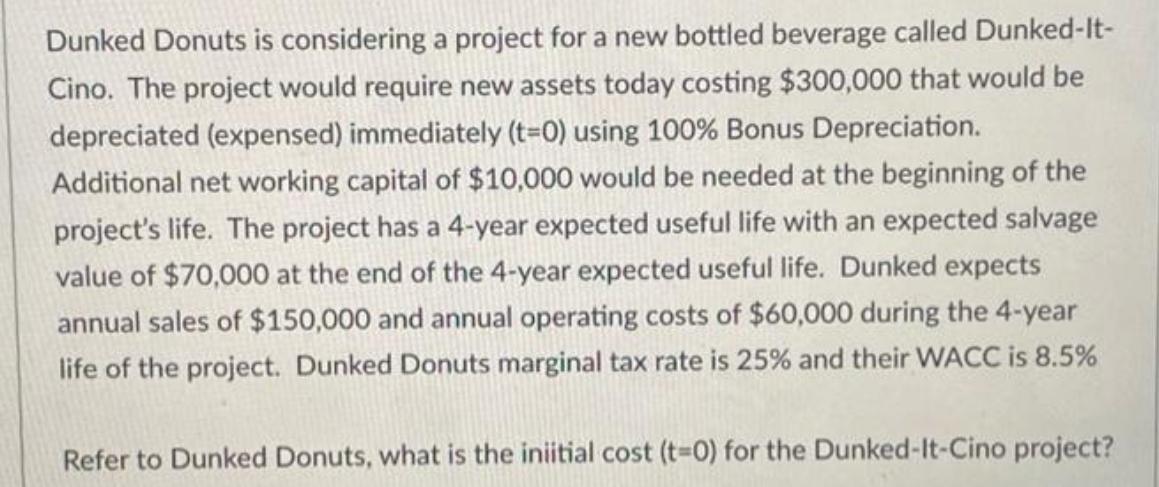

Dunked Donuts is considering a project for a new bottled beverage called Dunked-It- Cino. The project would require new assets today costing $300,000 that would be depreciated (expensed) immediately (t=0) using 100% Bonus Depreciation. Additional net working capital of $10,000 would be needed at the beginning of the project's life. The project has a 4-year expected useful life with an expected salvage value of $70,000 at the end of the 4-year expected useful life. Dunked expects annual sales of $150,000 and annual operating costs of $60,000 during the 4-year life of the project. Dunked Donuts marginal tax rate is 25% and their WACC is 8.5% Refer to Dunked Donuts, what is the initial cost (t=0) for the Dunked-It-Cino project?

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

To calculate the initial cost t0 for the DunkedItCino pr... View full answer

Get step-by-step solutions from verified subject matter experts