Question: Please answer all elements to the question for a rate, even though its long, as per chegg policy it still only counts as one question,

Please answer all elements to the question for a rate, even though its long, as per chegg policy it still only counts as one question, thank you

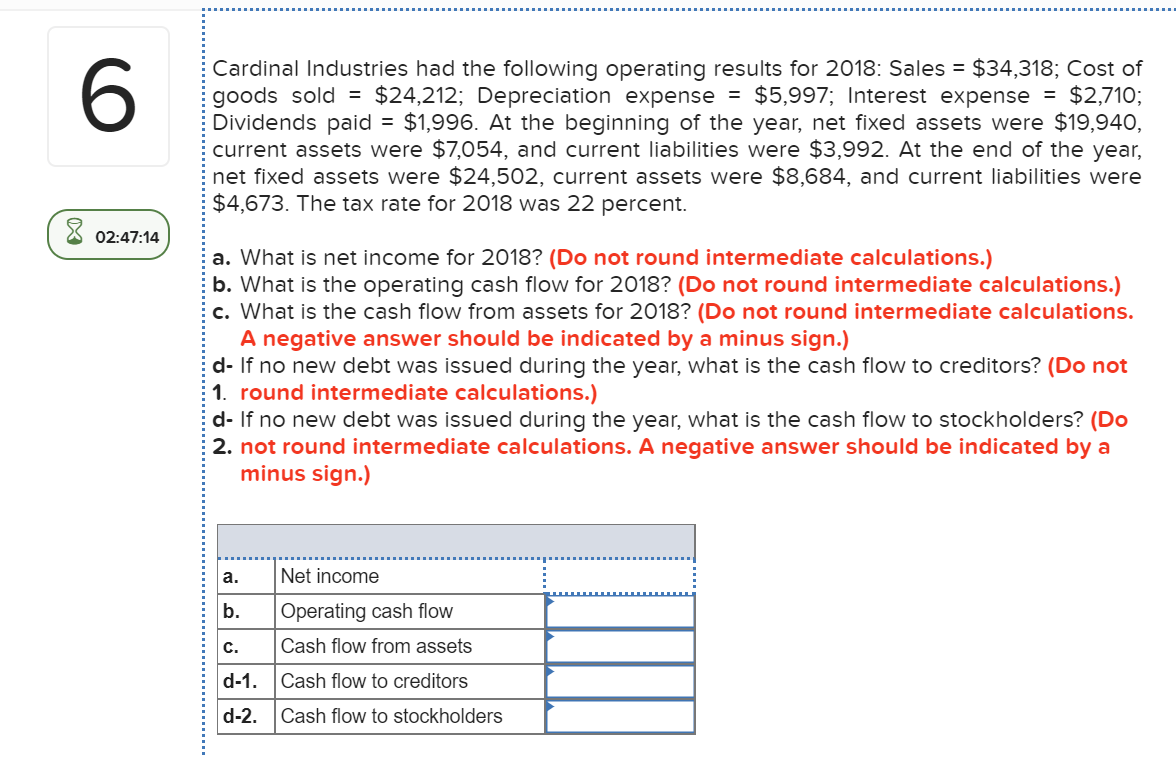

Cardinal Industries had the following operating results for 2018: Sales = $34,318; Cost of goods sold = $24,212; Depreciation expense = $5,997; Interest expense = $2,710; Dividends paid = $1,996. At the beginning of the year, net fixed assets were $19,940, current assets were $7,054, and current liabilities were $3,992. At the end of the year, net fixed assets were $24,502, current assets were $8,684, and current liabilities were $4,673. The tax rate for 2018 was 22 percent. 8 02:47:14 a. What is net income for 2018? (Do not round intermediate calculations.) b. What is the operating cash flow for 2018? (Do not round intermediate calculations.) c. What is the cash flow from assets for 2018? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) d- If no new debt was issued during the year, what is the cash flow to creditors? (Do not 1. round intermediate calculations.) d- If no new debt was issued during the year, what is the cash flow to stockholders? (Do 2. not round intermediate calculations. A negative answer should be indicated by a minus sign.) Net income Operating cash flow Cash flow from assets Cash flow to creditors Cash flow to stockholders d-1. d-2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts