Question: PLEASE ANSWER ALL EMPTY CELLS OF THE TABLE IN THE LAST IMAGE USING THE SAME FORMAT AS IN THE EXAMPLE, THANK YOU!!! 2.1: Would your

PLEASE ANSWER ALL EMPTY CELLS OF THE TABLE IN THE LAST IMAGE USING THE SAME FORMAT AS IN THE EXAMPLE, THANK YOU!!!

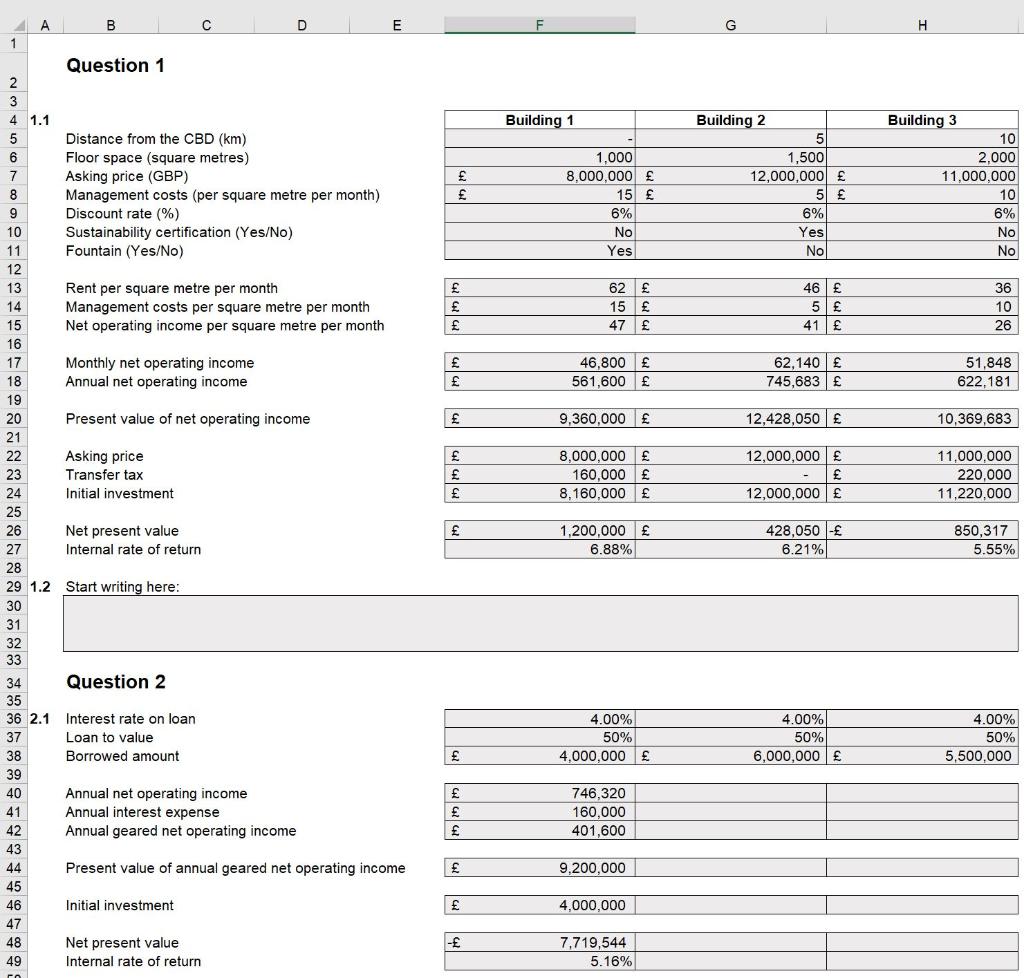

2.1: Would your answer to Question 1.2 change if you were to finance the asking price of each building with a 50% loan-to-value mortgage? The loan bears interest at a rate of 4% and can be rolled over forever. The discount rate of 6% is still applicable.

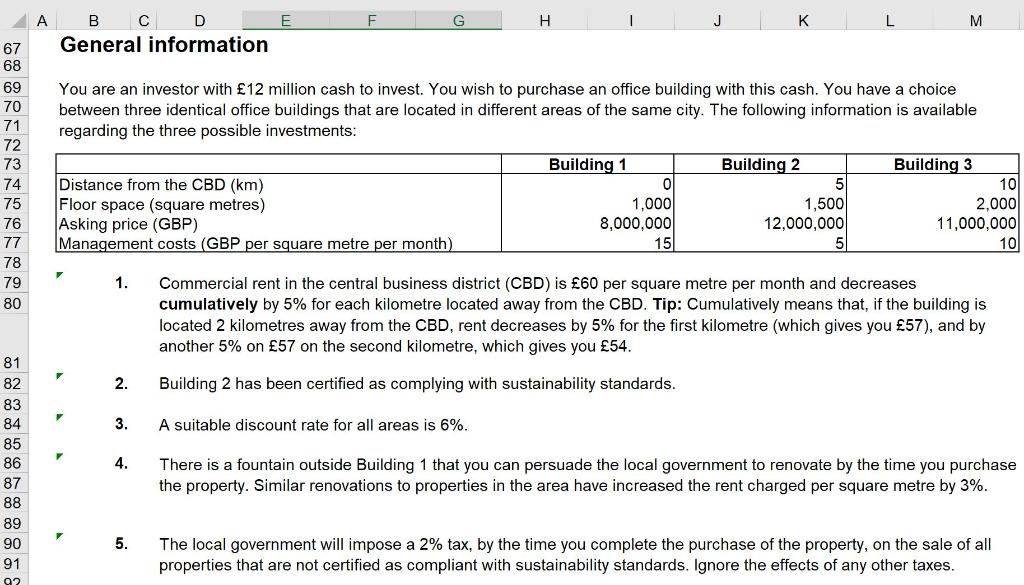

You are an investor with 12 million cash to invest. You wish to purchase an office building with this cash. You have a choice between three identical office buildings that are located in different areas of the same city. The following information is available regarding the three possible investments: 1. Commercial rent in the central business district (CBD) is 60 per square metre per month and decreases cumulatively by 5% for each kilometre located away from the CBD. Tip: Cumulatively means that, if the building is located 2 kilometres away from the CBD, rent decreases by 5% for the first kilometre (which gives you 57 ), and by another 5% on 57 on the second kilometre, which gives you 54. 2. Building 2 has been certified as complying with sustainability standards. 3. A suitable discount rate for all areas is 6%. 4. There is a fountain outside Building 1 that you can persuade the local government to renovate by the time you purchase the property. Similar renovations to properties in the area have increased the rent charged per square metre by 3%. 5. The local government will impose a 2% tax, by the time you complete the purchase of the property, on the sale of all properties that are not certified as compliant with sustainability standards. Ignore the effects of any other taxes. 1.2 Start writing here: Question 2 2.1 Interest rate on loan Loan to value Borrowed amount Annual net operating income Annual interest expense Annual geared net operating income \begin{tabular}{|l|l|l|l|} \hline & 746,320 & \\ \hline & 160,000 & & \\ \hline & 401,600 & & \\ \hline \end{tabular} Present value of annual geared net operating income Initial investment Net present value Internal rate of return You are an investor with 12 million cash to invest. You wish to purchase an office building with this cash. You have a choice between three identical office buildings that are located in different areas of the same city. The following information is available regarding the three possible investments: 1. Commercial rent in the central business district (CBD) is 60 per square metre per month and decreases cumulatively by 5% for each kilometre located away from the CBD. Tip: Cumulatively means that, if the building is located 2 kilometres away from the CBD, rent decreases by 5% for the first kilometre (which gives you 57 ), and by another 5% on 57 on the second kilometre, which gives you 54. 2. Building 2 has been certified as complying with sustainability standards. 3. A suitable discount rate for all areas is 6%. 4. There is a fountain outside Building 1 that you can persuade the local government to renovate by the time you purchase the property. Similar renovations to properties in the area have increased the rent charged per square metre by 3%. 5. The local government will impose a 2% tax, by the time you complete the purchase of the property, on the sale of all properties that are not certified as compliant with sustainability standards. Ignore the effects of any other taxes. 1.2 Start writing here: Question 2 2.1 Interest rate on loan Loan to value Borrowed amount Annual net operating income Annual interest expense Annual geared net operating income \begin{tabular}{|l|l|l|l|} \hline & 746,320 & \\ \hline & 160,000 & & \\ \hline & 401,600 & & \\ \hline \end{tabular} Present value of annual geared net operating income Initial investment Net present value Internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts