Question: please answer all fill in the blanke correctly for a good rating! a. Use the Black-Scholes formula to find the value of the following call

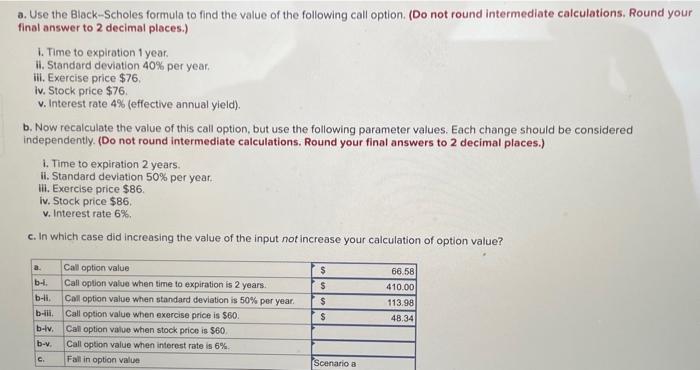

a. Use the Black-Scholes formula to find the value of the following call option. (Do not round intermediate calculations, Round yo final answer to 2 decimal places.) 1. Time to expiration 1 year. ii. Standard deviation 40% per year. iii. Exercise price $76 iv. Stock price $76. v. Interest rate 4% (effective annual yield). b. Now recalculate the value of this call option, but use the following parameter values. Each change should be considered independently. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) i. Time to expiration 2 years. ii. Standard deviation 50% per year. iii. Exercise price $86 iv. Stock price $86. v. Interest rate 6%. c. In which case did increasing the value of the input not increase your calculation of option value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts