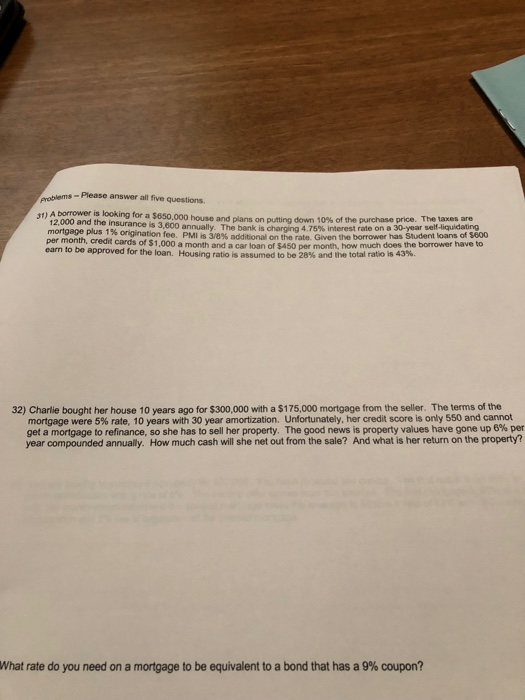

Question: - Please answer all five questions. 1t) A borrower is looking for a S650.000 house and plans on putting down 10% of the purchase price.

- Please answer all five questions. 1t) A borrower is looking for a S650.000 house and plans on putting down 10% of the purchase price. The taxes are is 3,600 annually The bank is charging 475% interest rate on a 30-year self-liquidating mortgage plus 1% origination fee. per month, credit cards $1 earn to be approved for the loan. PMI is 38% additional on the rate Given the borrower has Student loans of $600 cs of $1,000 a month and a car loan of $450 per month, how much does the borrower have to Housing ratio is assumed to be 26% and the total ratio is 43%. 32) Charlie bought her house 10 years ago for $300,000 with a $175,000 mortgage from the seller. The terms of the mortgage were 5% rate, 10 years with 30 year amortization. Unfortunately, her credit score is only 550 and cannot get a mortgage to refinance, so she has to sell her property. The good news is property values have gone up 6% per year compounded annually. How much cash will she net out from the sale? And what is her return on the property? What rate do you need on a mortgage to be equivalent to a bond that has a 9% coupon? - Please answer all five questions. 1t) A borrower is looking for a S650.000 house and plans on putting down 10% of the purchase price. The taxes are is 3,600 annually The bank is charging 475% interest rate on a 30-year self-liquidating mortgage plus 1% origination fee. per month, credit cards $1 earn to be approved for the loan. PMI is 38% additional on the rate Given the borrower has Student loans of $600 cs of $1,000 a month and a car loan of $450 per month, how much does the borrower have to Housing ratio is assumed to be 26% and the total ratio is 43%. 32) Charlie bought her house 10 years ago for $300,000 with a $175,000 mortgage from the seller. The terms of the mortgage were 5% rate, 10 years with 30 year amortization. Unfortunately, her credit score is only 550 and cannot get a mortgage to refinance, so she has to sell her property. The good news is property values have gone up 6% per year compounded annually. How much cash will she net out from the sale? And what is her return on the property? What rate do you need on a mortgage to be equivalent to a bond that has a 9% coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts