Question: please answer all for like 1- A 10 -vear bond is issued with a face value of $1,000, paying interest of $60 a year. If

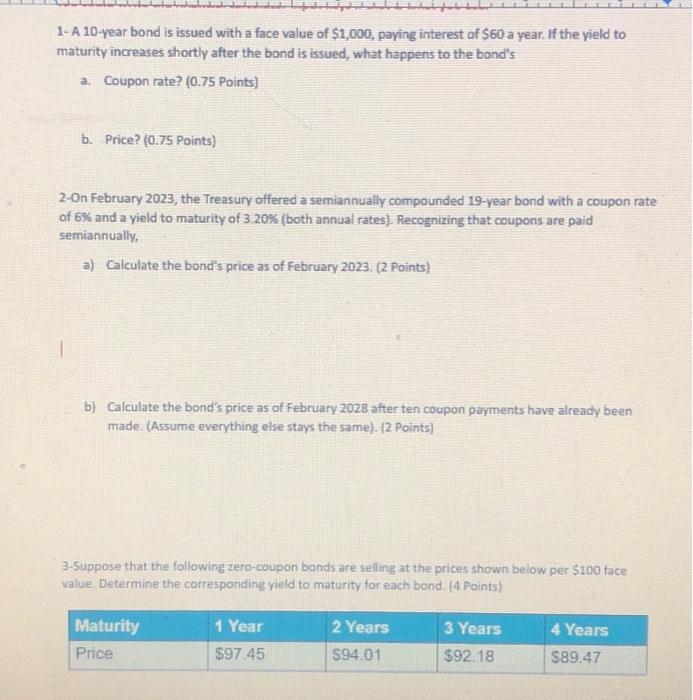

1- A 10 -vear bond is issued with a face value of $1,000, paying interest of $60 a year. If the vield to maturity increases shortly after the bond is issued, what happens to the bond's a. Coupon rate? (0.75 Points ) b. Price? (0.75 Points) 2-On February 2023, the Treasury offered a semiannually compounded 19-year bond with a coupon rate of 6% and a yield to maturity of 3.20% (both annual rates). Recognizing that coupons are paid semiannually, a) Calculate the bond's price as of February 2023. (2 Points) b) Calculate the bond's price as of February 2028 after ten coupon payments have already been made. (Assume everything else stays the same). (2 Points) 3.5uppose that the following zero-coupon bonds are selling at the prices shown below per $100 face value. Determine the corresponding yield to maturity for each bond. (4 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts