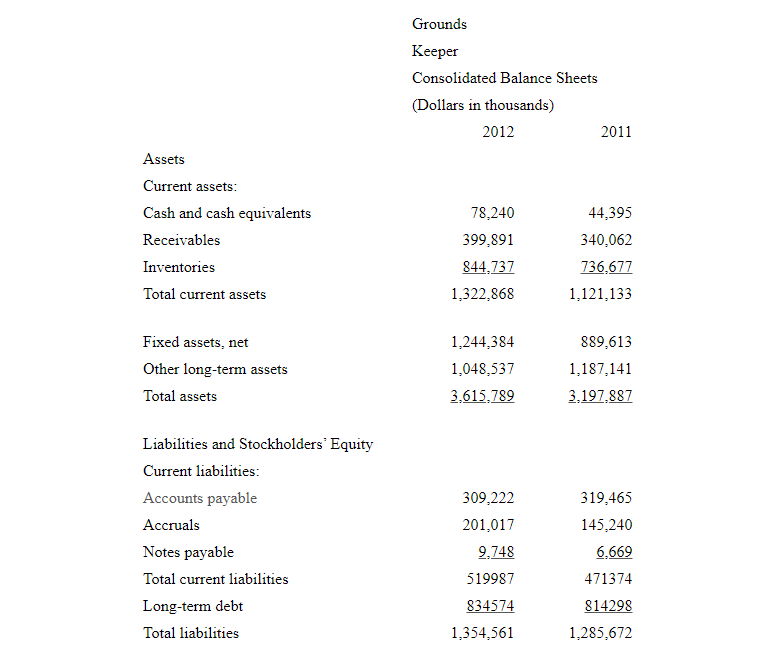

Question: Grounds Keeper Consolidated Balance Sheets (Dollars in thousands) 2012 2011 Assets Current assets: Cash and cash equivalents Receivables Inventories Total current assets 78,240 399,891 844,737

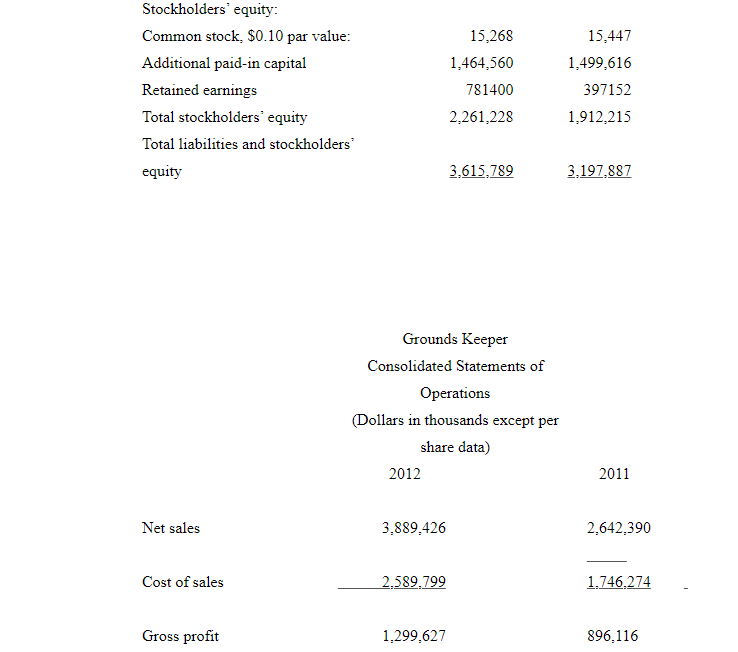

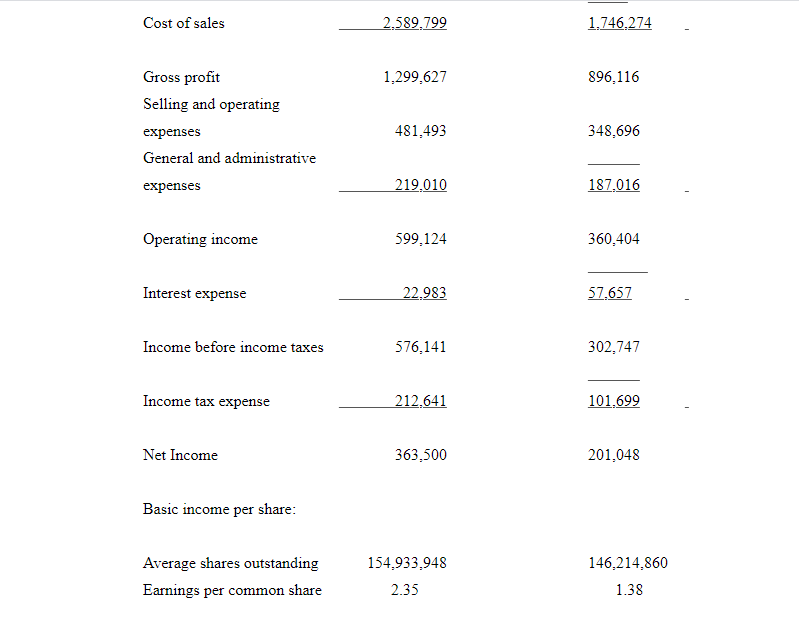

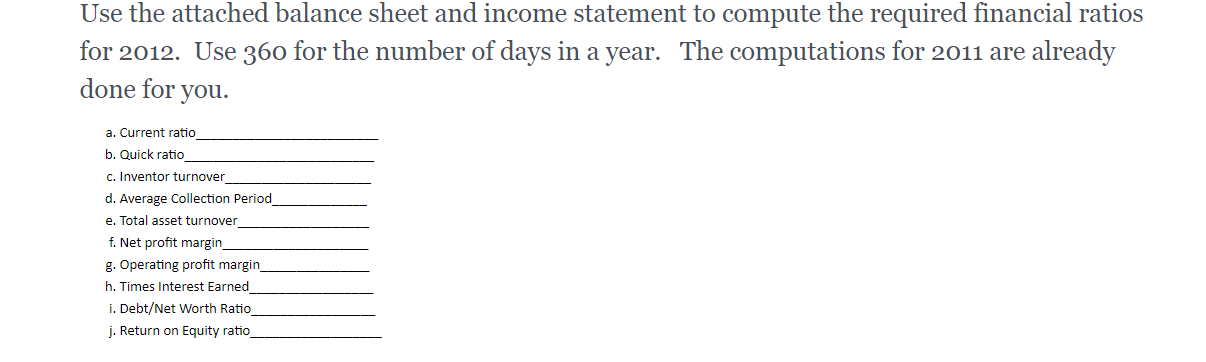

Grounds Keeper Consolidated Balance Sheets (Dollars in thousands) 2012 2011 Assets Current assets: Cash and cash equivalents Receivables Inventories Total current assets 78,240 399,891 844,737 1,322,868 44,395 340,062 736,677 1.121.133 Fixed assets, net Other long-term assets Total assets 1,244,384 1,048,537 3.615,789 889.613 1,187,141 3.197.887 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities 309,222 201,017 9.748 519987 319,465 145,240 6.669 471374 834574 814298 1,285,672 1,354,561 Stockholders' equity: Common stock. $0.10 par value: Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 15,268 1,464,560 781400 2,261,228 15,447 1,499,616 397152 1,912,215 3.615,789 3.197.887 Grounds Keeper Consolidated Statements of Operations (Dollars in thousands except per share data) 2012 2011 Net sales 3.889.426 2,642,390 Cost of sales 2.589.799 1.746.274 Gross profit 1.299.627 896.116 Cost of sales 2.589.799 1.746.274 1.299.627 896,116 Gross profit Selling and operating expenses General and administrative expenses 481,493 348.696 219.010 187.016 Operating income 599,124 360,404 Interest expense 22.983 57.657 Income before income taxes 576.141 302,747 Income tax expense 212.641 101.699 Net Income 363,500 201,048 Basic income per share: Average shares outstanding Earnings per common share 154.933.948 2.35 146,214,860 1.38 Use the attached balance sheet and income statement to compute the required financial ratios for 2012. Use 360 for the number of days in a year. The computations for 2011 are already done for you. a. Current ratio b. Quick ratio c. Inventor turnover d. Average Collection Period e. Total asset turnover f. Net profit margin g. Operating profit margin h. Times Interest Earned i. Debt/Net Worth Ratio j. Return on Equity ratio Using the computed financial ratios from question 1, compare Grounds Keeper's performance from 2011 to 2012. Address what areas the company has improved and what areas it has not a. Liquidity b. Activity / turnover / efficiency c. Profitability d. Leverage / use of debt / solvency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts