Question: Please answer all for rate :) Thank you / The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $44,880 and $71,910, respectively,

Please answer all for rate :)

Thank you /\

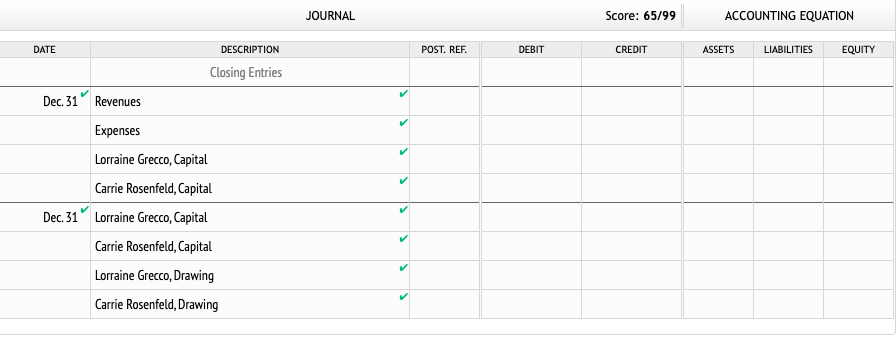

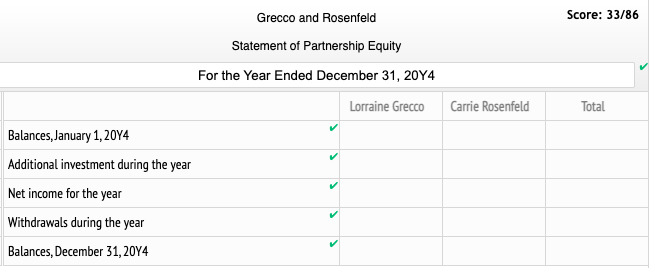

The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $44,880 and $71,910, respectively, on January 1, 20Y4, the beginning of the fiscal year. On March 10, Grecco invested an additional $7,750. During the year, Grecco and Rosenfeld withdrew $30,730 and $38,870, respectively, and net income for the year was $62,000. Revenues were $483,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income.

a. Journalize the entries to close (1) the revenues and expenses and (2) the drawing accounts on December 31

b. Prepare a statement of partnership equity for the current year for the partnership of Grecco and Rosenfeld.

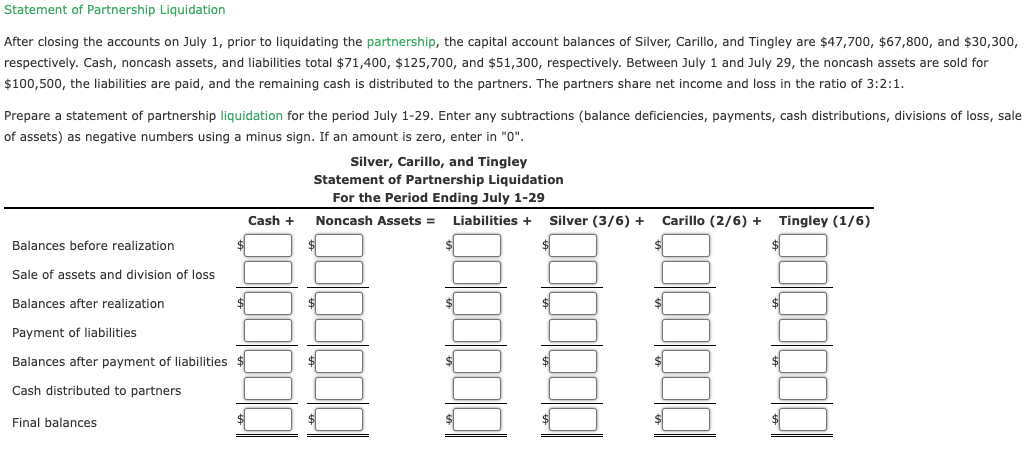

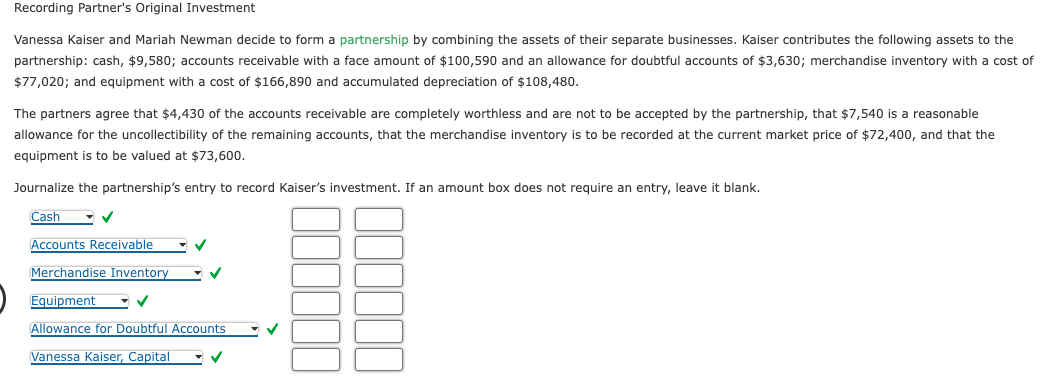

After closing the accounts on July 1 , prior to liquidating the partnership, the capital account balan $47,700, $67,800, and $30,300, respectively. Cash, noncash assets, and liabilities total $71,400,$125,700, and $51,300, respectively. Between July 1 and July 29 , the noncash assets are sold for $100,500, the liabilities are paid, and the remaining cash is distributed to the partners. The partners share in in 3:2:1. Prepare a statement of partnership liquidation for the period July 1-29. Enter any subtractions (balance deficiencies, payments, cash distributions, sale of assets) as negative numbers using a minus sign. If an amount is zero, enter in " 0". partnership: cash, $9,580; accounts receivable with a face amount of $100,590 and an allowance for doubtful accounts of $3,630; merchandise inventory with a cost of $77,020; and equipment with a cost of $166,890 and accumulated depreciation of $108,480. allowance for the uncollectibility of the remaining accounts, that the merchandise inventory is to be recorded at the current market price of $72, and that the equipment is to be valued at $73,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts