Question: PLEASE ANSWER ALL FOUR QUESTIONS BELOW! Suppose you have a stock market portfolio with a beta of 1.32 that is currently worth $348 million. You

PLEASE ANSWER ALL FOUR QUESTIONS BELOW!

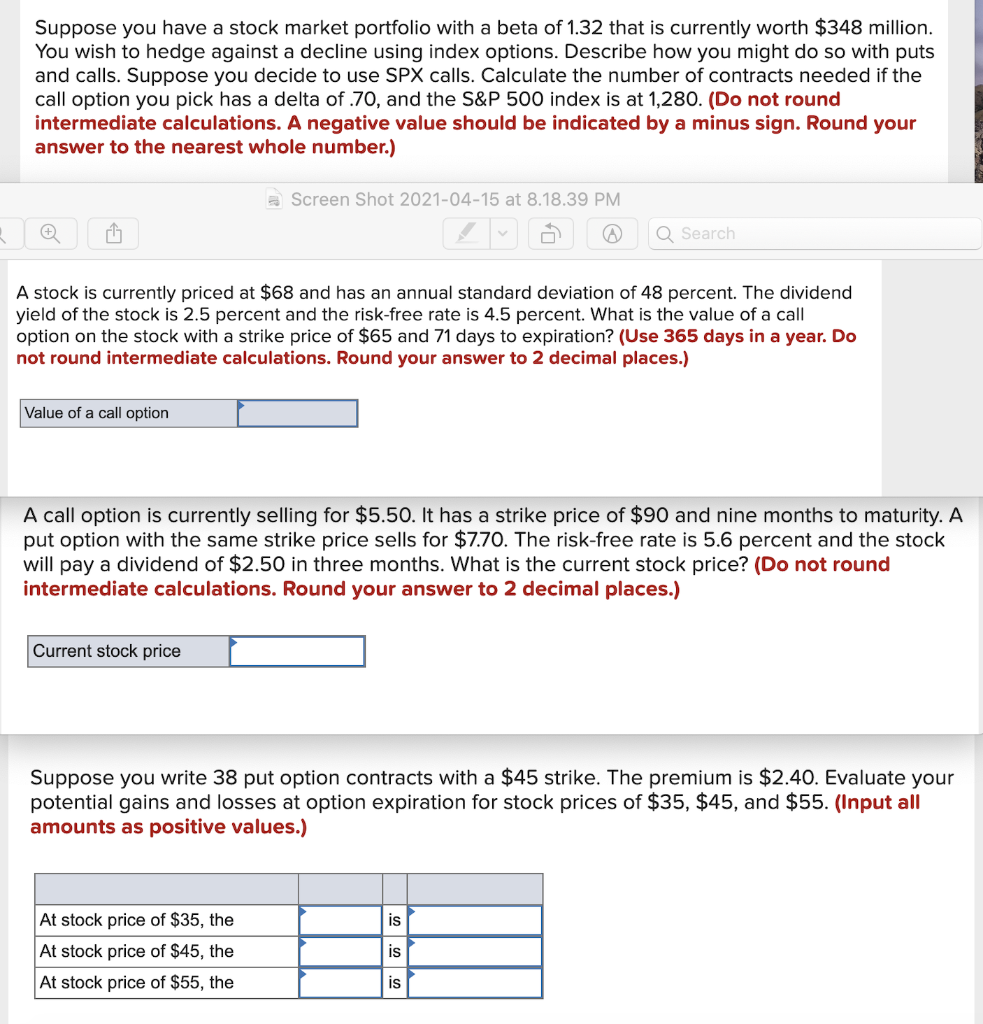

Suppose you have a stock market portfolio with a beta of 1.32 that is currently worth $348 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of.70, and the S&P 500 index is at 1,280. (Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.) Screen Shot 2021-04-15 at 8.18.39 PM Q Search A stock is currently priced at $68 and has an annual standard deviation of 48 percent. The dividend yield of the stock is 2.5 percent and the risk-free rate is 4.5 percent. What is the value of a call option on the stock with a strike price of $65 and 71 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of a call option A call option is currently selling for $5.50. It has a strike price of $90 and nine months to maturity. A put option with the same strike price sells for $7.70. The risk-free rate is 5.6 percent and the stock will pay a dividend of $2.50 in three months. What is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock price Suppose you write 38 put option contracts with a $45 strike. The premium is $2.40. Evaluate your potential gains and losses at option expiration for stock prices of $35, $45, and $55. (Input all amounts as positive values.) is At stock price of $35, the At stock price of $45, the At stock price of $55, the is is Suppose you have a stock market portfolio with a beta of 1.32 that is currently worth $348 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of.70, and the S&P 500 index is at 1,280. (Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.) Screen Shot 2021-04-15 at 8.18.39 PM Q Search A stock is currently priced at $68 and has an annual standard deviation of 48 percent. The dividend yield of the stock is 2.5 percent and the risk-free rate is 4.5 percent. What is the value of a call option on the stock with a strike price of $65 and 71 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of a call option A call option is currently selling for $5.50. It has a strike price of $90 and nine months to maturity. A put option with the same strike price sells for $7.70. The risk-free rate is 5.6 percent and the stock will pay a dividend of $2.50 in three months. What is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock price Suppose you write 38 put option contracts with a $45 strike. The premium is $2.40. Evaluate your potential gains and losses at option expiration for stock prices of $35, $45, and $55. (Input all amounts as positive values.) is At stock price of $35, the At stock price of $45, the At stock price of $55, the is is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts