Question: PLEASE ANSWER ALL FOUR QUESTIONS CORRECTLY 16. Answer the following questions. (Note: Use your formula sheet) The present value of a perpetuity with a cash

PLEASE ANSWER ALL FOUR QUESTIONS CORRECTLY

16.

Answer the following questions. (Note: Use your formula sheet)

The present value of a perpetuity with a cash flow of $100 and an interest rate of 1% is $1000?

True

False

The present value of a growing perpetuity where the first cash flow is $200, the interest rate is 5%, and the growth rate is 3% is $10,000?

True

False

18.

Which of the following statements is correct?

A.

Some owners in a limited liability company carry unlimited liability

B.

A limited partnership is referred to as such, because unlike a standard partnership it limits the number of owners a business can have

C.

A corporation is solely responsible for payings its outstanding obligations (not its owners)

D.

If an owner has unlimited liability, he/she is not responsible for any of the company's obligations

19.

20.

20.

XYZ Corporation has net debt of $450 M and an enterprise value of $900 M. Based on this information answer the following questions.

XYZ Corporation's debt to enterprise value ratio is 2

True

False

The debt-to-enterprise value ratio measures the size of a company's debt relative to the overall value of the business (its enterprise value).

True

False

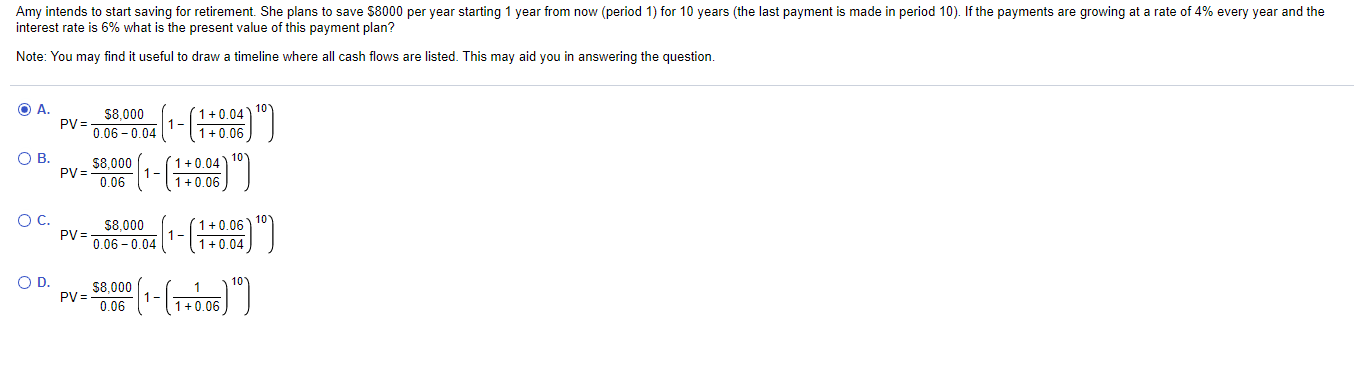

Amy intends to start saving for retirement. She plans to save $8000 per year starting 1 year from now (period 1) for 10 years (the last payment is made in period 10). If the payments are growing at a rate of 4% every year and the interest rate is 6% what is the present value of this payment plan? Note: You may find it useful to draw a timeline where all cash flows are listed. This may aid you in answering the question. OA. $8,000 PV = 0.06 -0.04 1- 1 +0.04 1 +0.06 2)") :)) . $8,000 PV = 0.06 1 - 1 +0.04 1 +0.06 OC. 10 PV = $8,000 0.06 -0.04 1 - 1 +0.06 1 +0.04 OD $8,000 PV = 0.06 1-61 1 1 +0.06 ))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts