Question: please answer all four questions. d) would it be unusual if the sample proportion of tax returns for which no tax was paid was less

please answer all four questions. d) would it be unusual if the sample proportion of tax returns for which no tax was paid was less than 0.26?

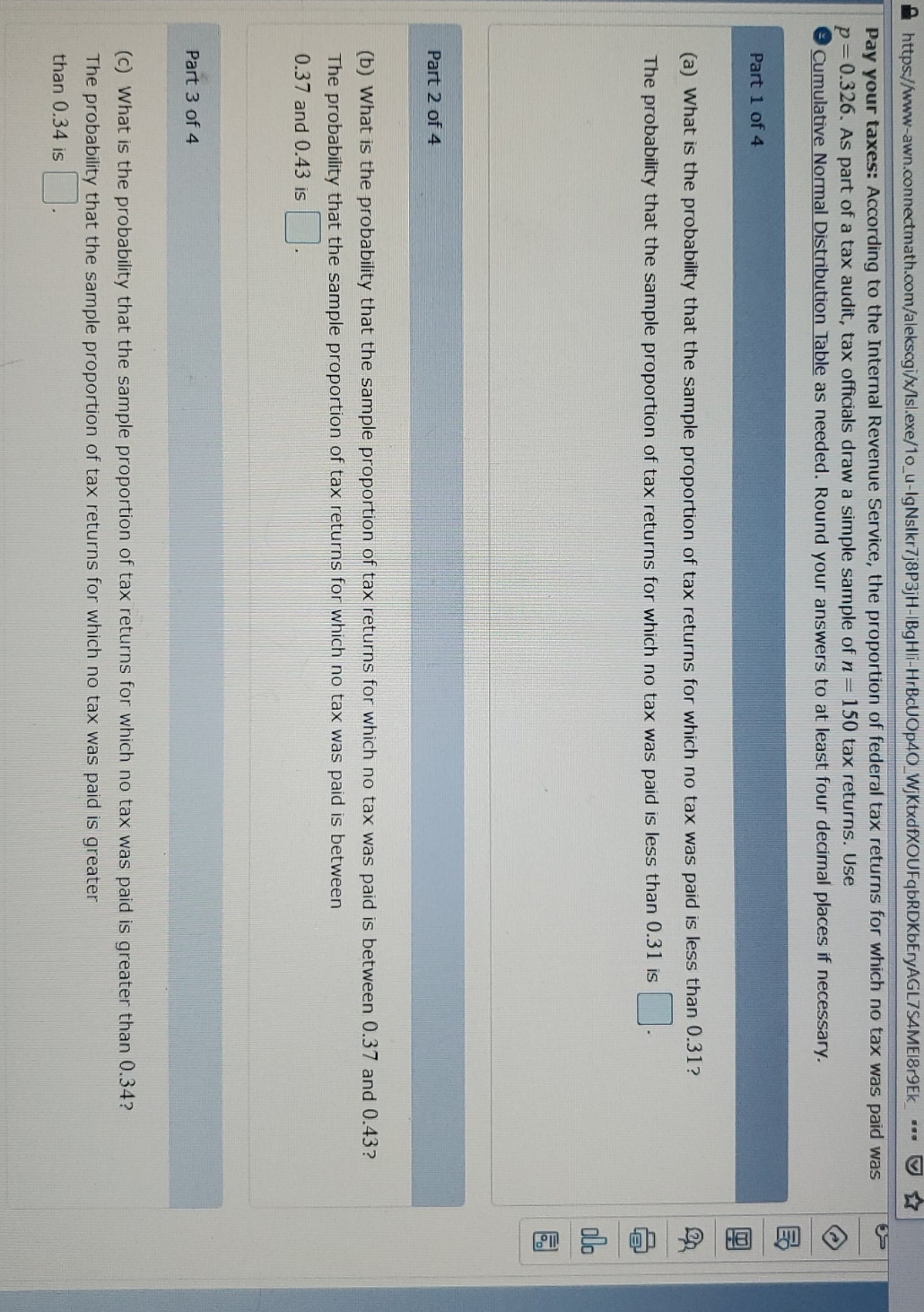

https://www-awn.connectmath.com/alekscgi/x/Isl.exe/10_u-IgNslkr7j8P3jH-IBgHli-HrBcUOp40_WjKoxdfxOUFqbRDKbEryAGL7S4ME189Ek_ Pay your taxes: According to the Internal Revenue Service, the proportion of federal tax returns for which no tax was paid was p =0.326. As part of a tax audit, tax officials draw a simple sample of n - 150 tax returns. Use Cumulative Normal Distribution Table as needed. Round your answers to at least four decimal places if necessary. Part 1 of 4 (a) What is the probability that the sample proportion of tax returns for which no tax was paid is less than 0.31? The probability that the sample proportion of tax returns for which no tax was paid is less than 0.31 is Part 2 of 4 (b) What is the probability that the sample proportion of tax returns for which no tax was paid is between 0.37 and 0.43? The probability that the sample proportion of tax returns for which no tax was paid is between 0.37 and 0.43 is Part 3 of 4 (c) What is the probability that the sample proportion of tax returns for which no tax was paid is greater than 0.34? The probability that the sample proportion of tax returns for which no tax was paid is greater than 0.34 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts