Question: please answer all I really need help on these. don't know if my answer is right please help Question 9 (1 point) In April Planters,

please answer all I really need help on these.

don't know if my answer is right please help

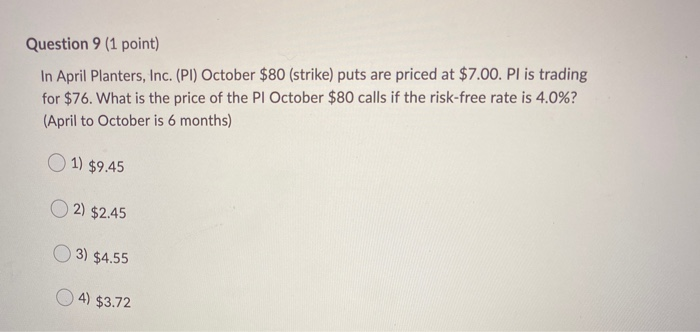

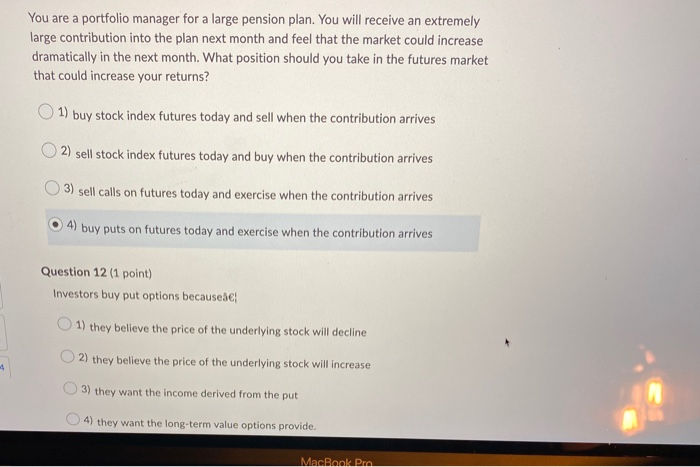

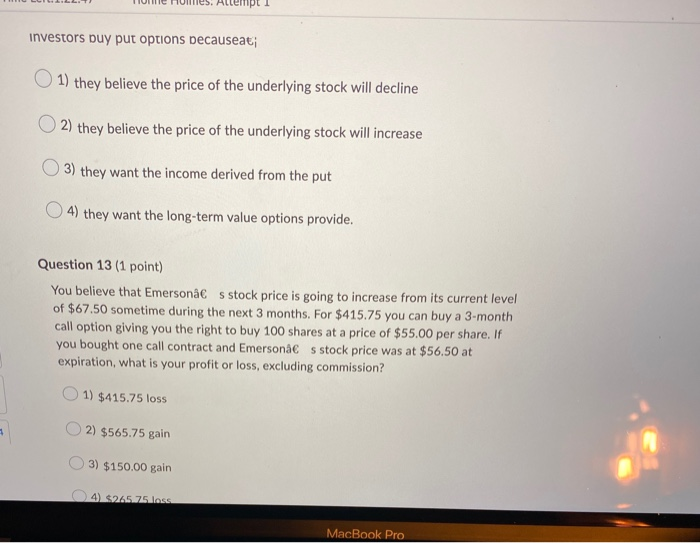

Question 9 (1 point) In April Planters, Inc. (PI) October $80 (strike) puts are priced at $7.00. Pl is trading for $76. What is the price of the PI October $80 calls if the risk-free rate is 4.0%? (April to October is 6 months) 1) $9.45 2) $2.45 3) $4.55 4) $3.72 You are a portfolio manager for a large pension plan. You will receive an extremely large contribution into the plan next month and feel that the market could increase dramatically in the next month. What position should you take in the futures market that could increase your returns? 1) buy stock index futures today and sell when the contribution arrives 2) sell stock index futures today and buy when the contribution arrives 3) sell calls on futures today and exercise when the contribution arrives 4) buy puts on futures today and exercise when the contribution arrives Question 12 (1 point) Investors buy put options becausede 1) they believe the price of the underlying stock will decline 2) they believe the price of the underlying stock will increase 3) they want the income derived from the put 4) they want the long-term value options provide. MacBook Pro THU LILI.LL. TIU Fulles. Altempt 1 investors buy put options becauseat 1) they believe the price of the underlying stock will decline 2) they believe the price of the underlying stock will increase 3) they want the income derived from the put 4) they want the long-term value options provide. Question 13 (1 point) You believe that Emerson s stock price is going to increase from its current level of $67.50 sometime during the next 3 months. For $415.75 you can buy a 3 month call option giving you the right to buy 100 shares at a price of $55.00 per share. If you bought one call contract and Emerson s stock price was at $56.50 at expiration, what is your profit or loss, excluding commission? 1) $415.75 loss 2) $565.75 gain 3) $150.00 gain 4 $245.75. less MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts