Question: please answer all. i will upvote Problem 2 Intro Idaho Engineering Inc. has a target capital structure of 32% debt, 10% preferred stock and 58%

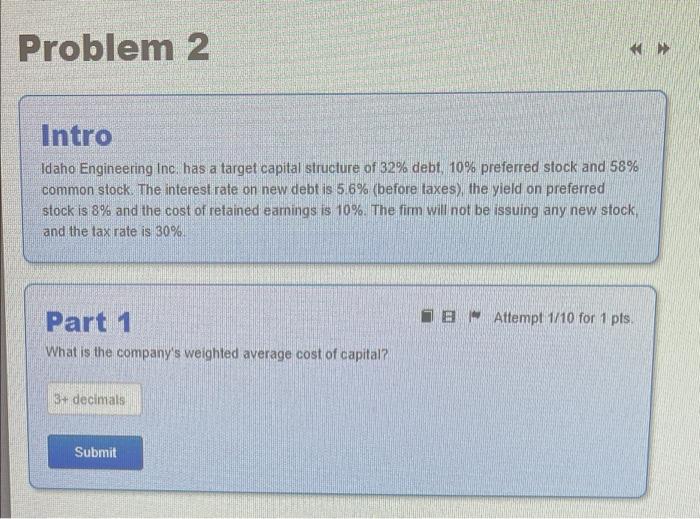

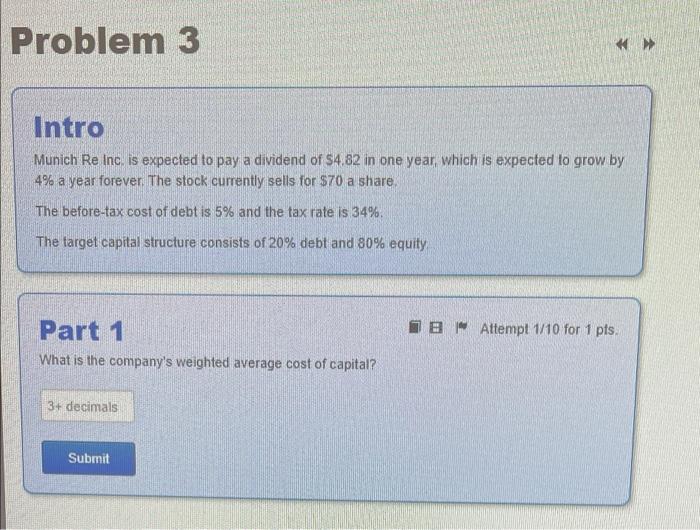

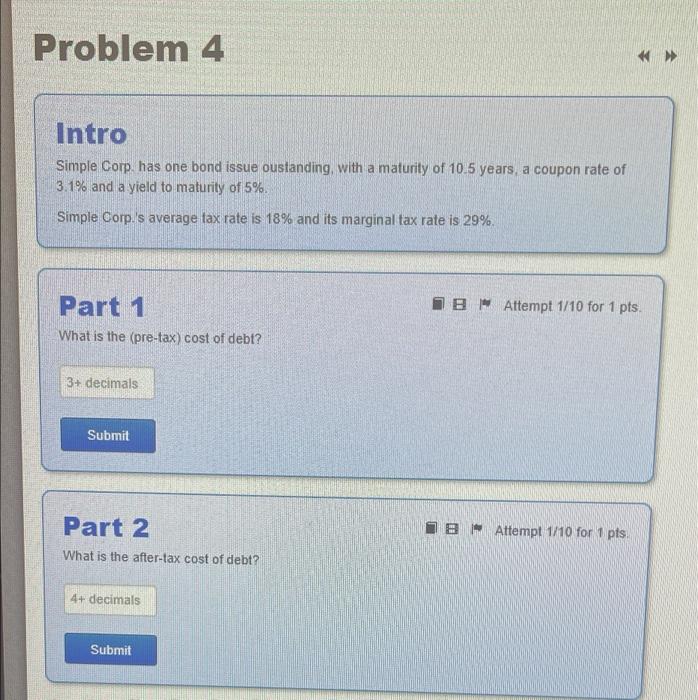

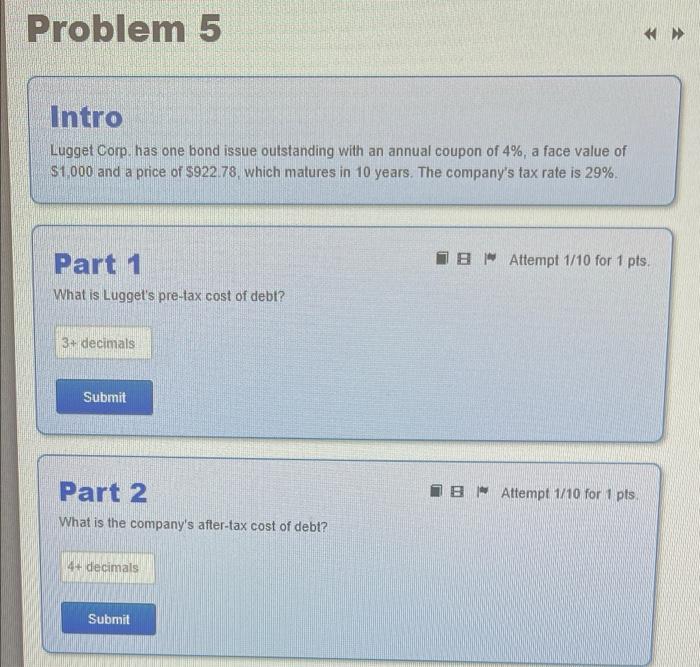

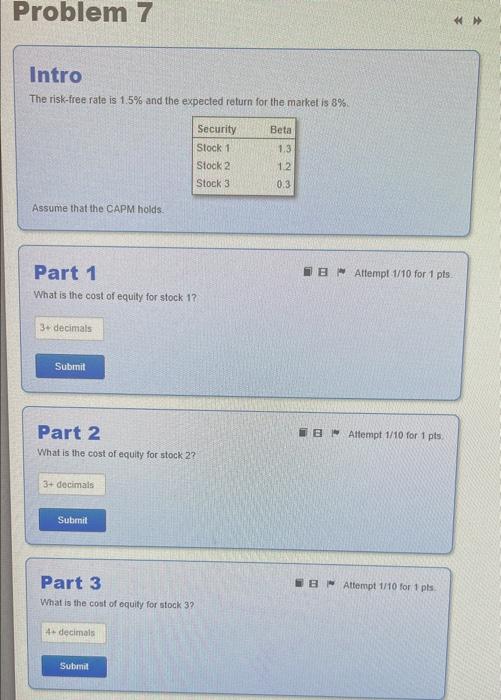

Problem 2 Intro Idaho Engineering Inc. has a target capital structure of 32% debt, 10% preferred stock and 58% common stock. The interest rate on new debt is 5.6% (before taxes), the yield on preferred stock is 8% and the cost of retained earnings is 10%. The firm will not be issuing any new stock, and the tax rate is 30% Part 1 What is the company's weighted average cost of capital? 3+ decimals * Submit BAttempt 1/10 for 1 pts. Problem 3 Intro Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $70 a share. The before-tax cost of debt is 5% and the tax rate is 34%. The target capital structure consists of 20% debt and 80% equity. Part 1 What is the company's weighted average cost of capital? 3+ decimals > Submit BAttempt 1/10 for 1 pts. Problem 4 Intro Simple Corp. has one bond issue oustanding, with a maturity of 10.5 years, a coupon rate of 3.1% and a yield to maturity of 5%. Simple Corp.'s average tax rate is 18% and its marginal tax rate is 29%. Part 1 What is the (pre-tax) cost of debt? 3+ decimals Submit Part 2 What is the after-tax cost of debt? 4+ decimals Submit BAttempt 1/10 for 1 pts. BAttempt 1/10 for 1 pts. Problem 5 Intro Lugget Corp. has one bond issue outstanding with an annual coupon of 4%, a face value of $1,000 and a price of $922.78, which matures in 10 years. The company's tax rate is 29%. Part 1 What is Lugget's pre-tax cost of debt? 3+ decimals Submit Part 2 What is the company's after-tax cost of debt? 14+ decimals Submit B Attempt 1/10 for 1 pts. B Attempt 1/10 for 1 pts. Problem 7 Intro The risk-free rate is 1.5% and the expected return for the market is 8%. Assume that the CAPM holds. Part 1 What is the cost of equity for stock 1? 3+ decimals Submit Part 2 What is the cost of equity for stock 2? 3+ decimals Submit Part 3 What is the cost of equity for stock 3? Security Stock 1 Stock 2 Stock 3 4+ decimals Submit Beta 1.3 1.2 0.3 B Attempt 1/10 for 1 pts. BAttempt 1/10 for 1 pts BAttempt 1/10 for 1 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts