Question: please answer all if them same question. will give good feedback Required information (The following information applies to the questions displayed below.) The Shirt Shop

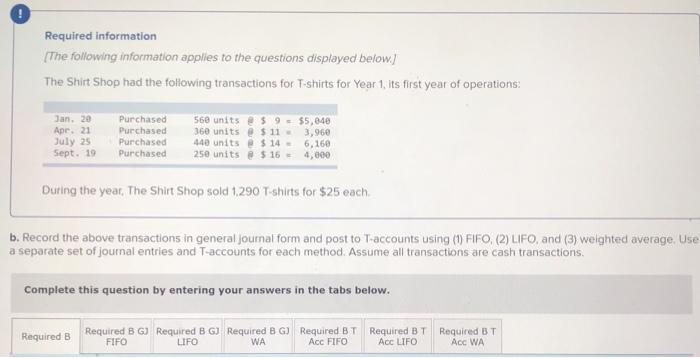

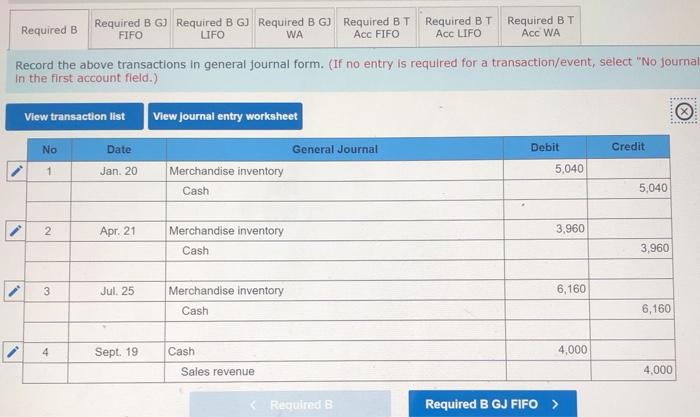

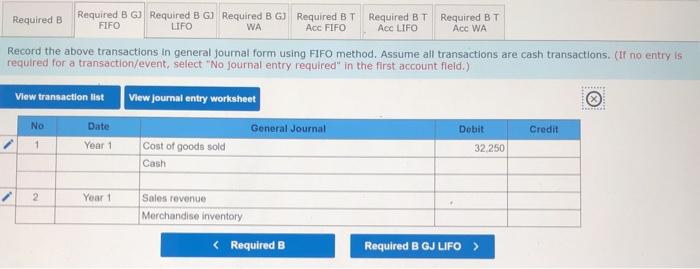

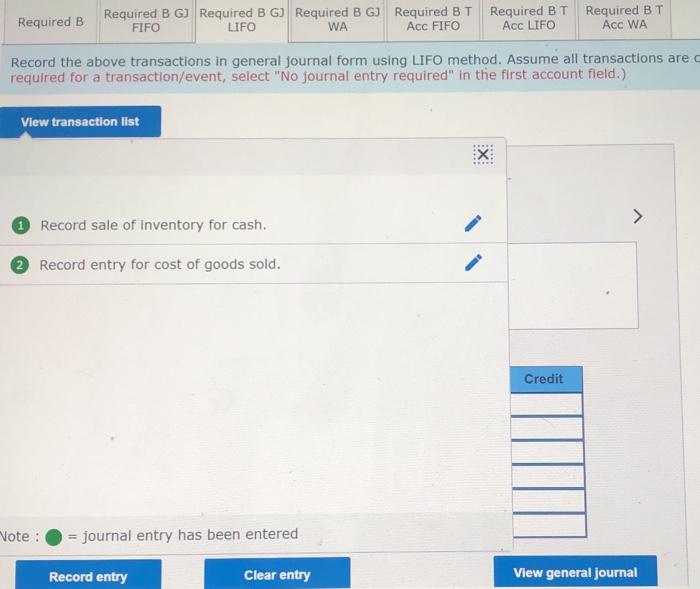

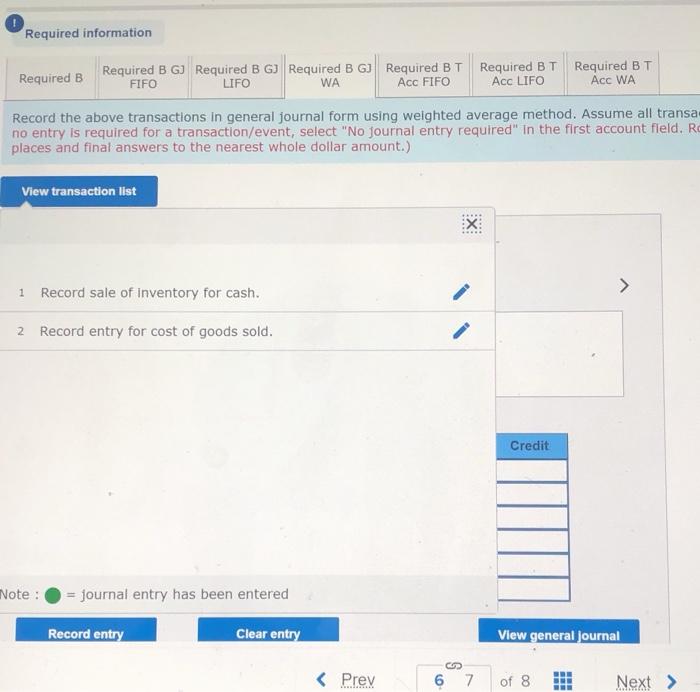

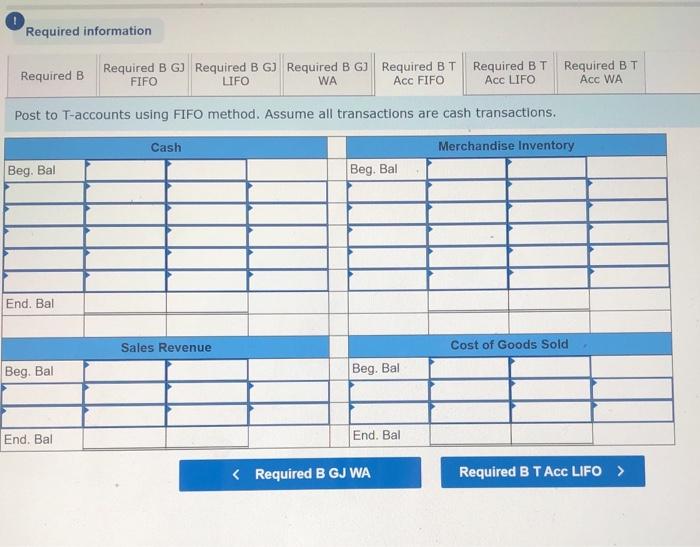

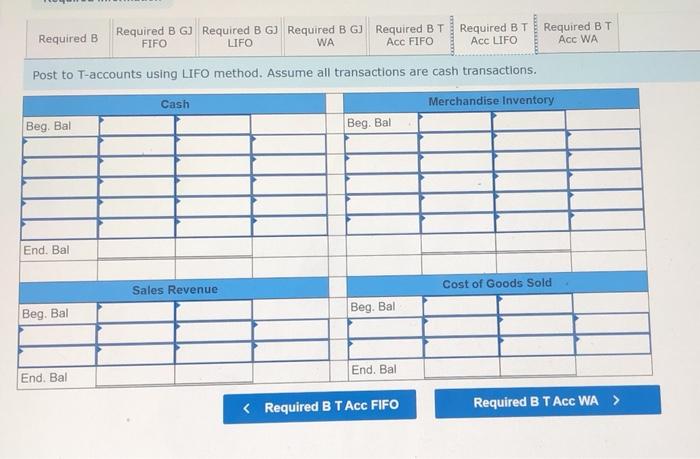

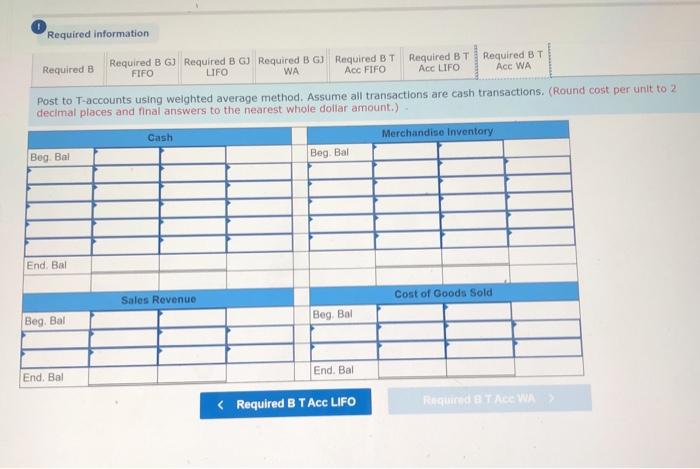

Required information (The following information applies to the questions displayed below.) The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: Jan. 20 Apr. 21 July 25 Sept. 19 Purchased Purchased Purchased Purchased 568 units @ $9 = 55,848 360 units @ $11 3,960 440 units $146.160 250 units $16 4,000 During the year. The Shirt Shop sold 1,290 T-shirts for $25 each b. Record the above transactions in general Journal form and post to Taccounts using (1) FIFO (2) LIFO, and (3) weighted average Use a separate set of journal entries and T-accounts for each method. Assume all transactions are cash transactions. Complete this question by entering your answers in the tabs below. Required B Required BG Required 8 GJ Required BG Required BT FIFO LIFO WA Acc FIFO Required BT Acc LIFO Required BT Acc WA Required B Required B G Required B GJ Required B G Required BT FIFO LIFO WA Acc FIFO Required BT Acc LIFO Required BT Acc WA Record the above transactions in general Journal form. (If no entry is required for a transaction/event, select "No Journal in the first account field.) View transaction list View journal entry worksheet No Date Debit Credit 1 Jan. 20 General Journal Merchandise inventory Cash 5,040 5,040 Apr. 21 3,960 Merchandise inventory Cash 3,960 3 Jul. 25 6,160 Merchandise inventory Cash 6,160 4 Sept. 19 Cash 4,000 Sales revenue 4,000 Required B Required B GJ FIFO > Required B Required BG Required B G Required BG Required BT Required BT Required BT FIFO LIFO WA Acc FIFO Acc LIFO Acc WA Record the above transactions in general Journal form using FIFO method. Assume all transactions are cash transactions. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Dobit Credit 1 Year 1 Cost of goods sold 32.250 Cash 2 Year 1 Sales revenue Merchandise inventory Required B Required B GJ Required B GJ Required B GJ Required BT FIFO LIFO WA Acc FIFO Required BT Acc LIFO Required BT Acc WA Record the above transactions in general Journal form using LIFO method. Assume all transactions are required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X Record sale of Inventory for cash. Record entry for cost of goods sold. Credit Vote : = journal entry has been entered Record entry Clear entry View general Journal Required information Required B Required B GJ Required B GJ Required B GJ Required BT FIFO LIFO WA Acc FIFO Required BT Required BT Acc LIFO Acc WA Record the above transactions in general journal form using weighted average method. Assume all transa no entry is required for a transaction/event, select "No journal entry required" in the first account field. RC places and final answers to the nearest whole dollar amount.) View transaction list X > 1 Record sale of Inventory for cash. 2 Record entry for cost of goods sold. Credit Note : = journal entry has been entered Record entry Clear entry View general Journal G Required information Required B Required B GJ Required B GJ Required B G Required BT FIFO LIFO WA Acc FIFO Required BT Acc LIFO Required BT Acc WA Post to T-accounts using FIFO method. Assume all transactions are cash transactions. Cash Merchandise Inventory Beg. Bal Beg. Bal End. Bal Sales Revenue Cost of Goods Sold Beg. Bal Beg. Bal End. Bal End. Bal Required B Required B G Required B G Required BG Required BT Required BT Required BT FIFO LIFO WA Acc FIFO Acc LIFO Acc WA Post to T-accounts using LIFO method. Assume all transactions are cash transactions. Cash Merchandise Inventory Beg. Bal Beg. Bal End. Bal Sales Revenue Cost of Goods Sold Beg. Bal Beg. Bal End. Bal End. Bal Required information Required B G Required B G Required B G Required BT FIFO LIFO WA Acc FIFO Required BT Required BT Acc LIFO Acc WA Required B Post to T-accounts using weighted average method. Assume all transactions are cash transactions. (Round cost per unit to 2 decimal places and final answers to the nearest whole dollar amount.) Cash Merchandise Inventory Beg Bal Beg. Bal End. Bal Sales Revenue Cost of Goods Sold Beg Bal Beg, Bal End, Bal End. Bal (Required B T Acc LIFO Regd B TALE WA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts