Question: please answer all info needed is there thank you Net Benefits Estimation: Benefit - Cost Now, you will have to work on the following exercise

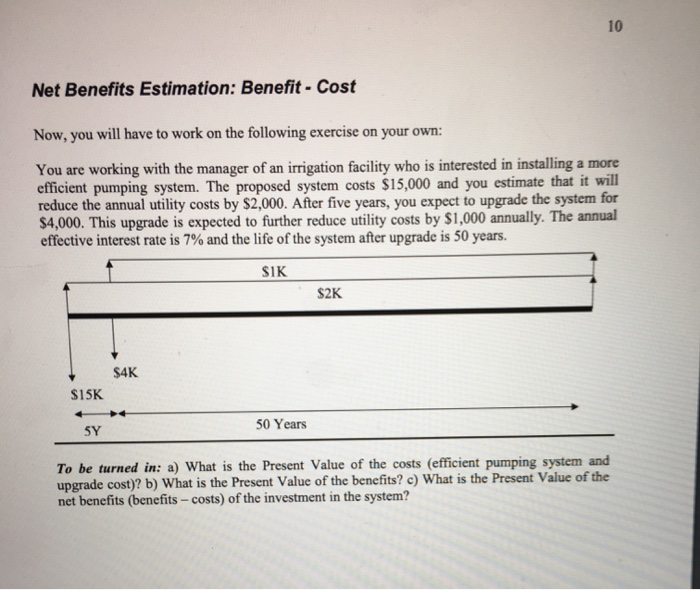

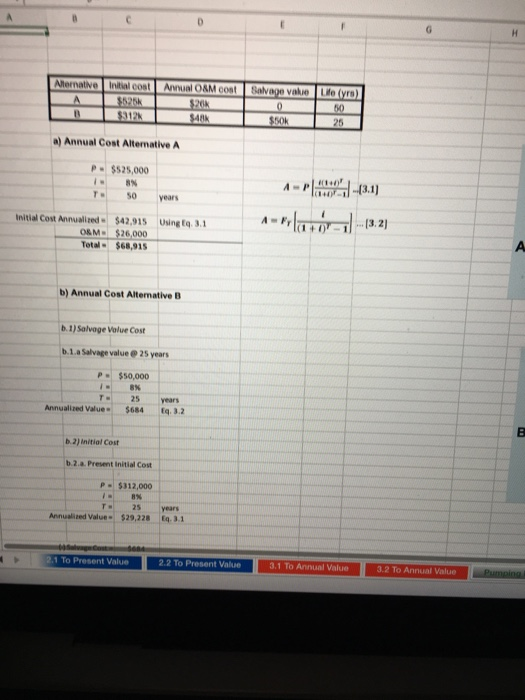

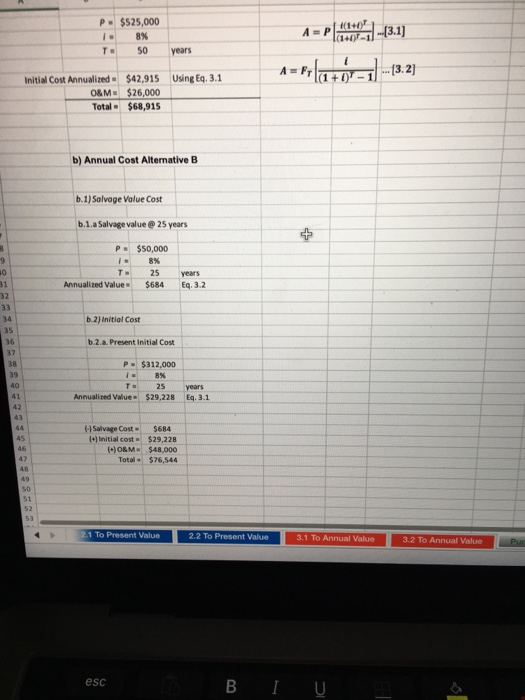

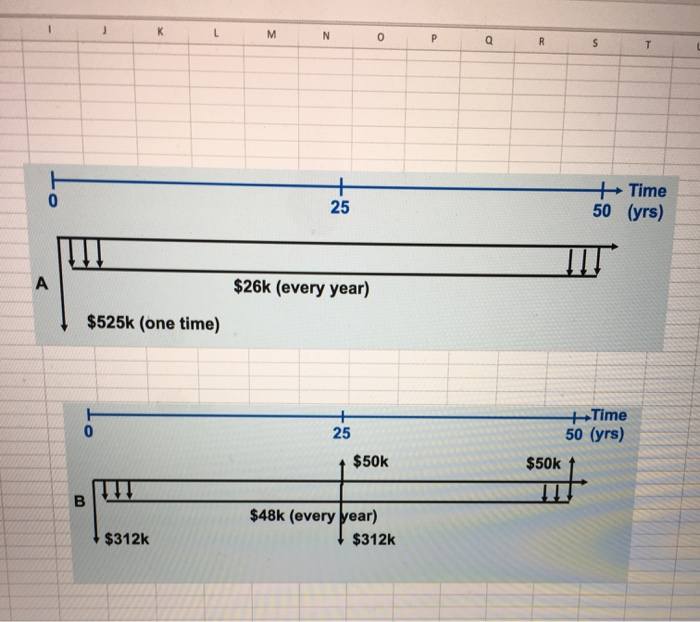

Net Benefits Estimation: Benefit - Cost Now, you will have to work on the following exercise on your own: You are working with the manager of an irrigation facility who is interested in installing a more efficient pumping system. The proposed system costs $15,000 and you estimate that it will reduce the annual utility costs by $2,000. After five years, you expect to upgrade the system for $4,000. This upgrade is expected to further reduce utility costs by $1,000 annually. The annual effective interest rate is 7% and the life of the system after upgrade is 50 years. SIK S2K $4K SISK 5Y 50 Years To be turned in: a) What is the Present Value of the costs (efficient pumping system and upgrade cost)? b) What is the Present Value of the benefits? c) What is the Present Value of the net benefits (benefits - costs) of the investment in the system? Alternative Lille (yrs) Initial cost $120 312 Annual O&M costSalvage value $20 SAK a) Annual Cost Alternative A P. $525,000 ON So 1- P -13.11 years A = Flas - (.2] Using 3.1 Initial Cost Annualized ORM Total $42,915 $26.000 $68,915 b) Annual Cost Alternative B 1) Salvage Value Cost b. 1.a Salvage value 25 years PE $50,000 IN Annualized Values $684 Eq.3.2 2) initial Cost 2. Prevent initial Cow P $312.000 An d Value $29,228 3.1 2.1 To Present Value 2.2 To Present Value 3.1 To Annual Value 3.2 To Annual Value P - $525,000 8% 50 A = P600,)-(3.1) years Using Eq. 3.1 Initial Cost Annualized O&M - Total $42,915 $26,000 $68,915 b) Annual Cost Alternative B b.1) Salvage Value Cost b.1.a Salvage value @25 year P $50,000 8% T- 25 Annualized Value $684 years Eq. 3.2 b.2) Initial Cost b.2.a. Present initial Cost P - $312.000 & Annualired Value years Eq.3.1 $29,228 Salvage Cost () Initial cost ( O&M Total $684 $29,228 $48.000 $76,544 2.1 To Present Value 2.2 To Present Value 3.1 To Annual Vale 3.2 To Annual Value Pur esc BI U O P Q + Time 50 (yrs) $26k (every year) $525k (one time) 25 + Time 50 (yrs) $50k 1 + $50k $48k (every year) $312k $312k

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts