Question: please answer all O Answer all questions .30 points Circle the letter for the correct answer If an asset is sold for less than is

please answer all

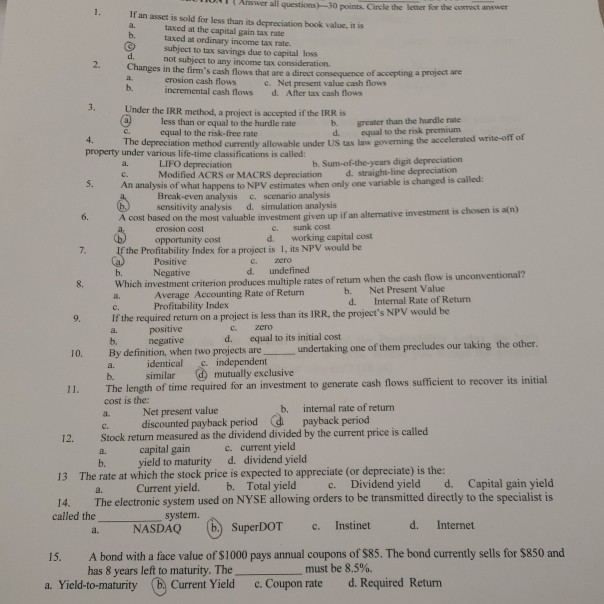

O Answer all questions .30 points Circle the letter for the correct answer If an asset is sold for less than is depreciation book value, it is taxed at the capital gain tax rate taxed at ordinary income tax rate. subject to tax savings due to capital loss d. not subject to any income tax consideration Changes in the firm's cash flows that are a dirst consequence of accepting a project are erosion cash flows e Net present value cash flows incremental cash flows After tax cash flows Under the IRR method, a project is accepted if the IRR is a) less than or equal to the hundle rate b r eater than the hurdle rate c. equal to the risk-free rate d. equal to the risk premium The depreciation method currently allowable under US tax law gwering the accelerated write-off of property under various life-time classifications is called: a. LIFO depreciation b. Sum-of-the-years digat de c. Modified ACRS or MACRS depreciation de straight-line depreciation An analysis of what happens to NPV estimates when only one variable is changed is called: a Break-even analysis e scenario analysis 6 sensitivity analysis d. simulation analysis A cost based on the most valuable investment given up if an alternative investment is chosen is min) erosion cost c. sunk cost b opportunity cost d working capital cast If the Profitability Index for a project is 1. its NPV would be (a) Positive b. Negative d. undefined Which investment criterion produces multiple rates of return when the cash flow is unconventional? a. Average Accounting Rate of Return b. Net Present Value c. Profitability Index d. Internal Rate of Return If the required return on a project is less than its IRR, the project's NPV would be a. positive zero negative d equal to its initial cost By definition, when two projects are undertaking one of them precludes our taking the other a. identical c. independent similar d mutually exclusive The length of time required for an investment to generate cash flows sufficient to recover its initial cost is the: a. Net present value b. internal rate of return c d iscounted payback period (d payback period 12. Stock return measured as the dividend divided by the current price is called a capital gain c. current yield b. yield to maturity d. dividend yield 13 The rate at which the stock price is expected to appreciate (or depreciate) is the: a. Current yield. b. Total yield c. Dividend yield d. Capital gain yield 14. The electronic system used on NYSE allowing orders to be transmitted directly to the specialist is called the system. a. NASDAQ (6.) SuperDOT C. Instinet d . Internet 15. A bond with a face value of $1000 pays annual coupons of $85. The bond currently sells for $850 and has 8 years left to maturity. The must be 8.5%. a. Yield-to-maturity (b) Current Yield c. Coupon rate d . Required Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts