Question: Please answer all of it. If not, please skip! Also SHOW WORK Please! 7. You want to purchase an automobile for $24,172. The dealer offers

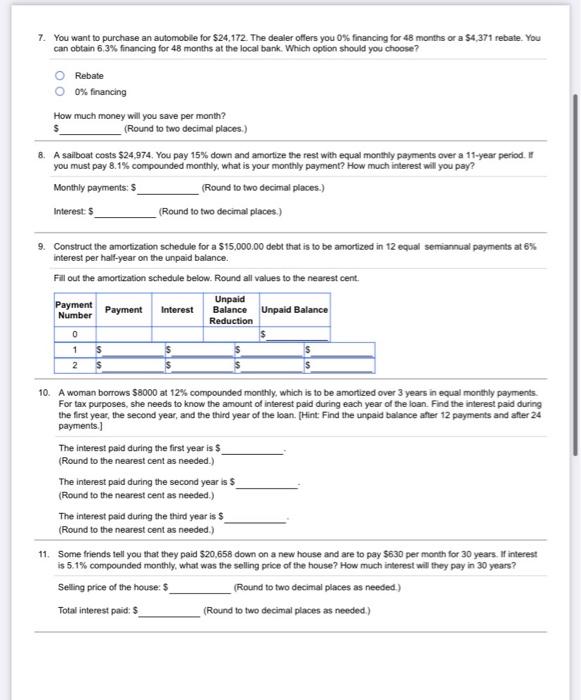

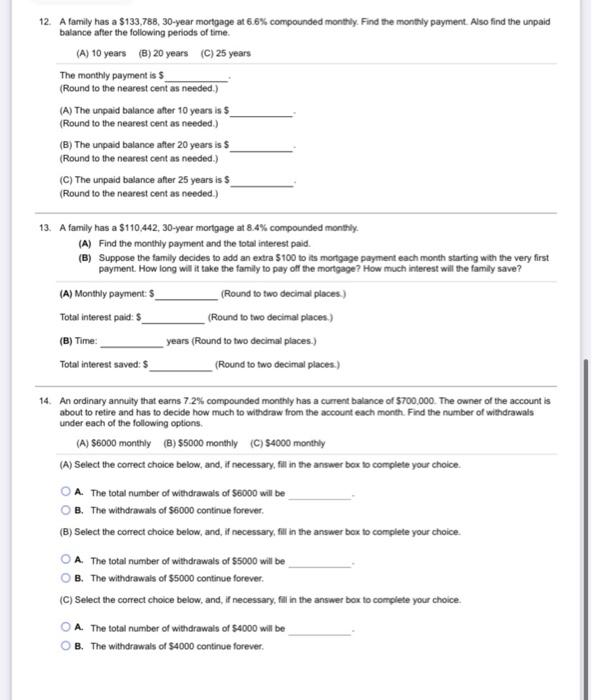

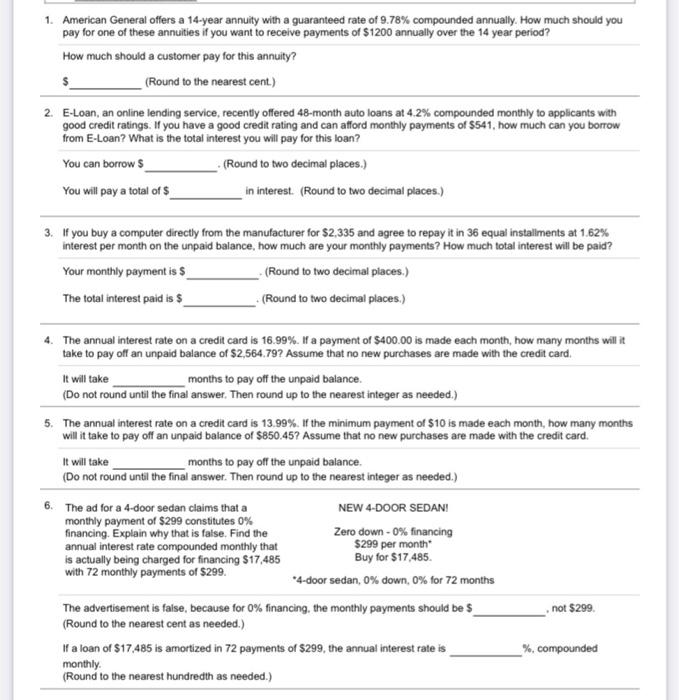

7. You want to purchase an automobile for $24,172. The dealer offers you 0% financing for 48 months or a $4,371 rebate You can obtain 6.3% financing for 48 months at the local bank. Which option should you choose? Rebate 0% financing How much money will you save per month? (Round to two decimal places.) 8. A sailboat costs $24.974. You pay 15% down and amortize the rest with equal monthly payments over a 11-year period. I you must pay 8.1% compounded monthly, what is your monthly payment? How much interest will you pay? Monthly payments: $ (Round to two decimal places.) Interest: $ (Round to two decimal places.) 9. Construct the amortization schedule for a $15,000.00 debt that is to be amortized in 12 equal semiannual payments at 6% interest per half-year on the unpaid balance. Fil out the amortization schedule below. Round all values to the nearest cent. Unpaid Payment Payment Interest Balance Unpaid Balance Reduction 0 15 2 $ Number 10. A woman borrows $8000 at 12% compounded monthly, which is to be amortized over 3 years in equal monthly payments. For tax purposes, she needs to know the amount of interest paid during each year of the loan. Find the interest paid during the first year , the second year, and the third year of the loan. (Hint: Find the unpaid balance after 12 payments and after 24 payments. The interest paid during the first year is $ (Round to the nearest cent as needed.) The interest paid during the second year is $ (Round to the nearest cent as needed.) The interest paid during the third year is $_ (Round to the nearest cent as needed.) 11. Some friends tell you that they paid $20,658 down on a new house and are to pay $630 per month for 30 years. If interest is 5.1% compounded monthly, what was the selling price of the house? How much interest will they pay in 30 years? Selling price of the house: $ (Round to two decimal places as needed) Total interest paid $ (Round to two decimal places as needed.) 12. A family has a $133,788, 30-year mortgage at 6.6% compounded monthly. Find the monthly payment. Also find the unpaid balance after the following periods of time. (A) 10 years (8) 20 years (C) 25 years The monthly payment is (Round to the nearest cent as needed.) (A) The unpaid balance after 10 years is 5 (Round to the nearest cent as needed.) (B) The unpaid balance after 20 years is $ (Round to the nearest cent as needed.) (C) The unpaid balance after 25 years is (Round to the nearest cent as needed.) 13. A family has a $110.442, 30-year mortgage at 8.4% compounded monthly (A) Find the monthly payment and the total interest paid. (B) Suppose the family decides to add an extra $100 to its mortgage payment each month starting with the very first payment. How long will it take the family to pay of the mortgage? How much interest will the family save? (A) Monthly payment: $ (Round to two decimal places) Total interest paid: 5 (Round to two decimal places) (B) Time: years (Round to two decimal places.) Total interest saved: $ (Round to two decimal places.) 14. An ordinary annuity that earns 72% compounded monthly has a current balance of 5700,000. The owner of the account is about to retire and has to decide how much to withdraw from the account each month. Find the number of withdrawals under each of the following options. (A) $6000 monthly B} $5000 monthly C) 54000 monthly (A) Select the correct choice below, and, if necessary, fill in the answer box to complete your choice A. The total number of withdrawals of $6000 will be B. The withdrawals of $6000 continue forever (B) Select the correct choice below, and, if necessary, fill in the answer box to complete your choice. OA. The total number of withdrawals of $5000 will be OB. The withdrawals of $5000 continue forever. (C) Select the correct choice below, and, if necessary, fill in the answer box to complete your choice A. The total number of withdrawals of $4000 will be OB. The withdrawals of S4000 continue ue forever 1. American General offers a 14-year annuity with a guaranteed rate of 9.78% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $1200 annually over the 14 year period? How much should a customer pay for this annuity? (Round to the nearest cent.) 2. E-Loan, an online lending service, recently offered 48-month auto loans at 4.2% compounded monthly to applicants with good credit ratings. If you have a good credit rating and can afford monthly payments of $541, how much can you borrow from E-Loan? What is the total interest you will pay for this loan? You can borrow $ (Round to two decimal places.) You will pay a total of in interest. (Round to two decimal places.) 3. If you buy a computer directly from the manufacturer for $2,335 and agree to repay it in 36 equal installments at 1.62% interest per month on the unpaid balance, how much are your monthly payments? How much total interest will be paid? Your monthly payment is $ (Round to two decimal places.) The total interest paid is $ (Round to two decimal places.) 4. The annual interest rate on a credit card is 16.99%. If a payment of $400.00 is made each month, how many months will it take to pay off an unpaid balance of $2,564.79? Assume that no new purchases are made with the credit card. It will take months to pay off the unpaid balance. (Do not round until the final answer. Then round up to the nearest integer as needed.) 5. The annual interest rate on a credit card is 13.99%. If the minimum payment of $10 is made each month, how many months will it take to pay off an unpaid balance of $850.457 Assume that no new purchases are made with the credit card. It will take months to pay off the unpaid balance (Do not round until the final answer. Then round up to the nearest integer as needed.) 6. The ad for a 4-door sedan claims that a NEW 4-DOOR SEDANI monthly payment of $299 constitutes 0% financing. Explain why that is false. Find the Zero down - 0% financing annual interest rate compounded monthly that $299 per month is actually being charged for financing $17,485 Buy for $17485 with 72 monthly payments of $299. *4-door sedan, 0% down, 0% for 72 months The advertisement is false, because for 0% financing the monthly payments should be $ not $299 (Round to the nearest cent as needed.) If a loan of $17,485 is amortized in 72 payments of $299, the annual interest rate is %, compounded monthly (Round to the nearest hundredth as needed.) 7. You want to purchase an automobile for $24,172. The dealer offers you 0% financing for 48 months or a $4,371 rebate You can obtain 6.3% financing for 48 months at the local bank. Which option should you choose? Rebate 0% financing How much money will you save per month? (Round to two decimal places.) 8. A sailboat costs $24.974. You pay 15% down and amortize the rest with equal monthly payments over a 11-year period. I you must pay 8.1% compounded monthly, what is your monthly payment? How much interest will you pay? Monthly payments: $ (Round to two decimal places.) Interest: $ (Round to two decimal places.) 9. Construct the amortization schedule for a $15,000.00 debt that is to be amortized in 12 equal semiannual payments at 6% interest per half-year on the unpaid balance. Fil out the amortization schedule below. Round all values to the nearest cent. Unpaid Payment Payment Interest Balance Unpaid Balance Reduction 0 15 2 $ Number 10. A woman borrows $8000 at 12% compounded monthly, which is to be amortized over 3 years in equal monthly payments. For tax purposes, she needs to know the amount of interest paid during each year of the loan. Find the interest paid during the first year , the second year, and the third year of the loan. (Hint: Find the unpaid balance after 12 payments and after 24 payments. The interest paid during the first year is $ (Round to the nearest cent as needed.) The interest paid during the second year is $ (Round to the nearest cent as needed.) The interest paid during the third year is $_ (Round to the nearest cent as needed.) 11. Some friends tell you that they paid $20,658 down on a new house and are to pay $630 per month for 30 years. If interest is 5.1% compounded monthly, what was the selling price of the house? How much interest will they pay in 30 years? Selling price of the house: $ (Round to two decimal places as needed) Total interest paid $ (Round to two decimal places as needed.) 12. A family has a $133,788, 30-year mortgage at 6.6% compounded monthly. Find the monthly payment. Also find the unpaid balance after the following periods of time. (A) 10 years (8) 20 years (C) 25 years The monthly payment is (Round to the nearest cent as needed.) (A) The unpaid balance after 10 years is 5 (Round to the nearest cent as needed.) (B) The unpaid balance after 20 years is $ (Round to the nearest cent as needed.) (C) The unpaid balance after 25 years is (Round to the nearest cent as needed.) 13. A family has a $110.442, 30-year mortgage at 8.4% compounded monthly (A) Find the monthly payment and the total interest paid. (B) Suppose the family decides to add an extra $100 to its mortgage payment each month starting with the very first payment. How long will it take the family to pay of the mortgage? How much interest will the family save? (A) Monthly payment: $ (Round to two decimal places) Total interest paid: 5 (Round to two decimal places) (B) Time: years (Round to two decimal places.) Total interest saved: $ (Round to two decimal places.) 14. An ordinary annuity that earns 72% compounded monthly has a current balance of 5700,000. The owner of the account is about to retire and has to decide how much to withdraw from the account each month. Find the number of withdrawals under each of the following options. (A) $6000 monthly B} $5000 monthly C) 54000 monthly (A) Select the correct choice below, and, if necessary, fill in the answer box to complete your choice A. The total number of withdrawals of $6000 will be B. The withdrawals of $6000 continue forever (B) Select the correct choice below, and, if necessary, fill in the answer box to complete your choice. OA. The total number of withdrawals of $5000 will be OB. The withdrawals of $5000 continue forever. (C) Select the correct choice below, and, if necessary, fill in the answer box to complete your choice A. The total number of withdrawals of $4000 will be OB. The withdrawals of S4000 continue ue forever 1. American General offers a 14-year annuity with a guaranteed rate of 9.78% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $1200 annually over the 14 year period? How much should a customer pay for this annuity? (Round to the nearest cent.) 2. E-Loan, an online lending service, recently offered 48-month auto loans at 4.2% compounded monthly to applicants with good credit ratings. If you have a good credit rating and can afford monthly payments of $541, how much can you borrow from E-Loan? What is the total interest you will pay for this loan? You can borrow $ (Round to two decimal places.) You will pay a total of in interest. (Round to two decimal places.) 3. If you buy a computer directly from the manufacturer for $2,335 and agree to repay it in 36 equal installments at 1.62% interest per month on the unpaid balance, how much are your monthly payments? How much total interest will be paid? Your monthly payment is $ (Round to two decimal places.) The total interest paid is $ (Round to two decimal places.) 4. The annual interest rate on a credit card is 16.99%. If a payment of $400.00 is made each month, how many months will it take to pay off an unpaid balance of $2,564.79? Assume that no new purchases are made with the credit card. It will take months to pay off the unpaid balance. (Do not round until the final answer. Then round up to the nearest integer as needed.) 5. The annual interest rate on a credit card is 13.99%. If the minimum payment of $10 is made each month, how many months will it take to pay off an unpaid balance of $850.457 Assume that no new purchases are made with the credit card. It will take months to pay off the unpaid balance (Do not round until the final answer. Then round up to the nearest integer as needed.) 6. The ad for a 4-door sedan claims that a NEW 4-DOOR SEDANI monthly payment of $299 constitutes 0% financing. Explain why that is false. Find the Zero down - 0% financing annual interest rate compounded monthly that $299 per month is actually being charged for financing $17,485 Buy for $17485 with 72 monthly payments of $299. *4-door sedan, 0% down, 0% for 72 months The advertisement is false, because for 0% financing the monthly payments should be $ not $299 (Round to the nearest cent as needed.) If a loan of $17,485 is amortized in 72 payments of $299, the annual interest rate is %, compounded monthly (Round to the nearest hundredth as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts