Question: please answer all or none A firm is considering two projects A, and B with the given cash flows; the firm's cost of capital is

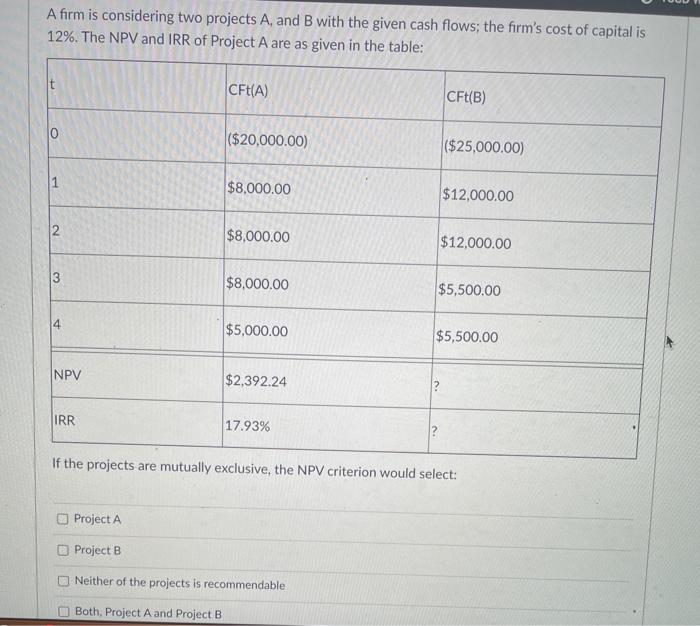

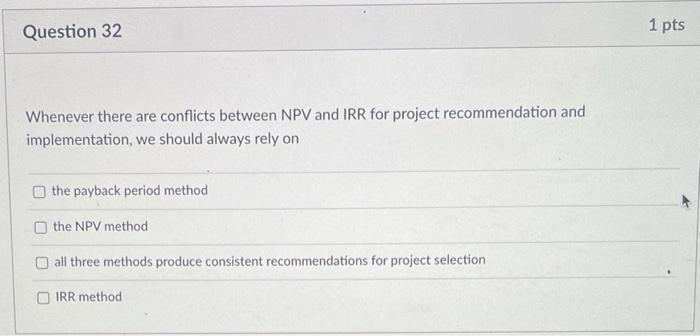

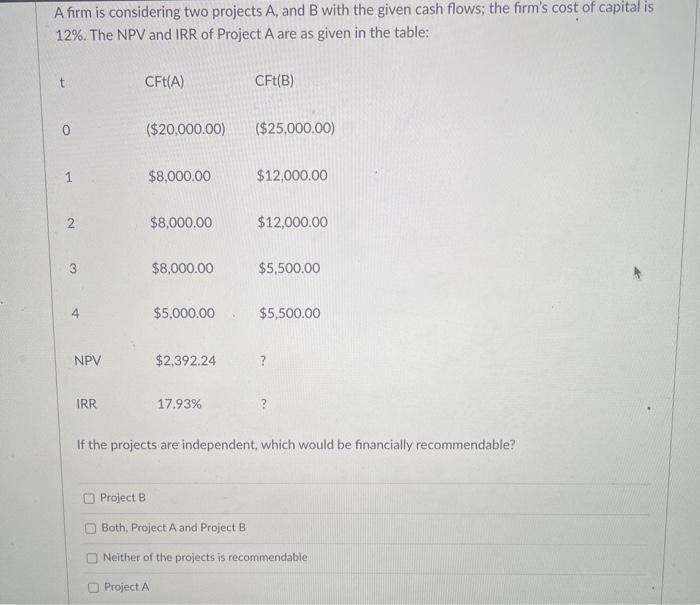

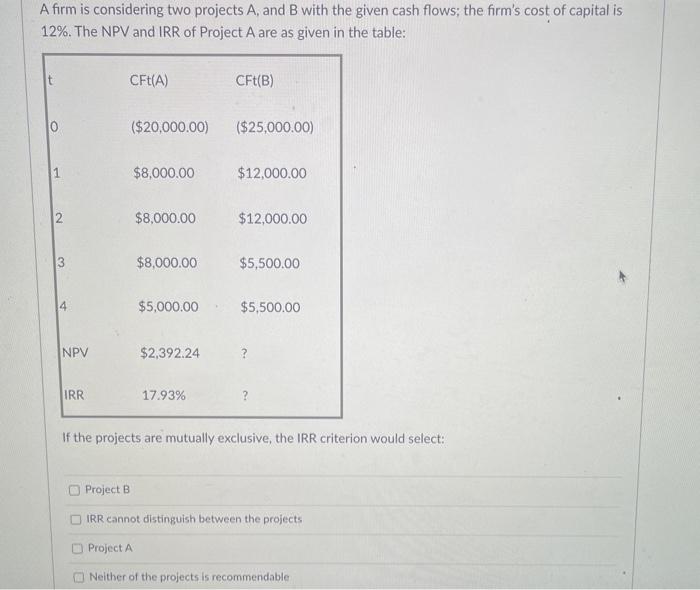

A firm is considering two projects A, and B with the given cash flows; the firm's cost of capital is 12%. The NPV and IRR of Project A are as given in the table: CFL(A) CFt(B) 0 ($20,000.00) ($25,000.00) 1 $8,000.00 $12,000.00 2 $8,000.00 $12,000.00 3 $8,000.00 $5,500.00 4 $5,000.00 $5,500.00 NPV $2,392.24 ? IRR 17.93% If the projects are mutually exclusive, the NPV criterion would select: Project A Project B Neither of the projects is recommendable Both, Project A and Project B Question 32 1 pts Whenever there are conflicts between NPV and IRR for project recommendation and implementation, we should always rely on the payback period method the NPV method all three methods produce consistent recommendations for project selection IRR method A firm is considering two projects A, and B with the given cash flows; the firm's cost of capital is 12%. The NPV and IRR of Project A are as given in the table: t CFT(A) CFt(B) 0 ($20,000.00) ($25,000.00) 1 $8,000.00 $12,000.00 2 $8,000.00 $12,000.00 3 $8,000.00 $5,500.00 4 $5,000.00 $5,500.00 NPV $2,392.24 ? IRR 17.93% If the projects are independent, which would be financially recommendable? Project B Both, Project A and Project B Neither of the projects is recommendable Project A A firm is considering two projects A, and B with the given cash flows; the firm's cost of capital is 12%. The NPV and IRR of Project A are as given in the table: t CFE(A) CFt(B) 10 ($20,000.00) ($25,000.00) 1 $8,000.00 $12,000.00 2 $8,000.00 $12,000.00 3 $8,000.00 $5,500.00 4 $5,000.00 $5,500.00 NPV $2,392.24 ? IRR 17.93% ? If the projects are mutually exclusive, the IRR criterion would select: Project B IRR cannot distinguish between the projects Project A Neither of the projects is recommendable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts