Question: please answer all or none Question 21 1 pts Dramatis Inc. declared today a quarterly dividend of $0.52. Investors expect a rate of return on

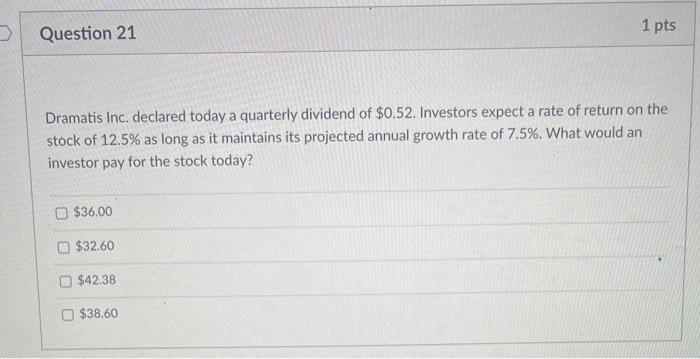

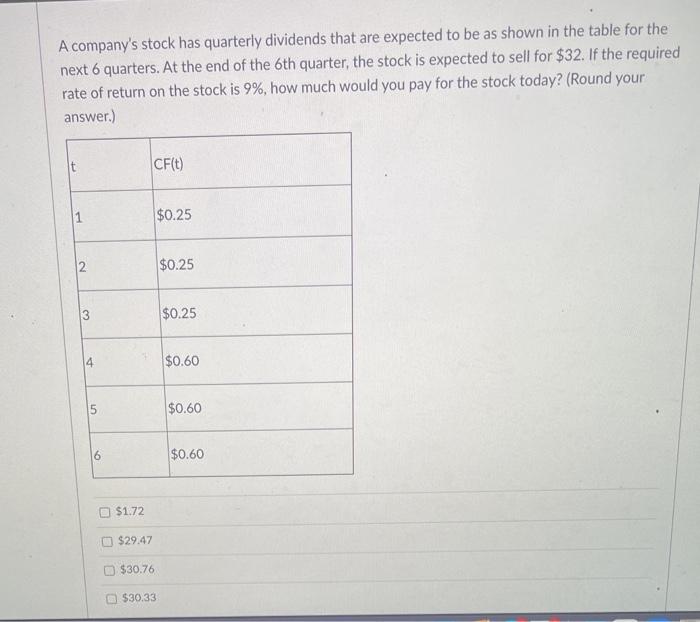

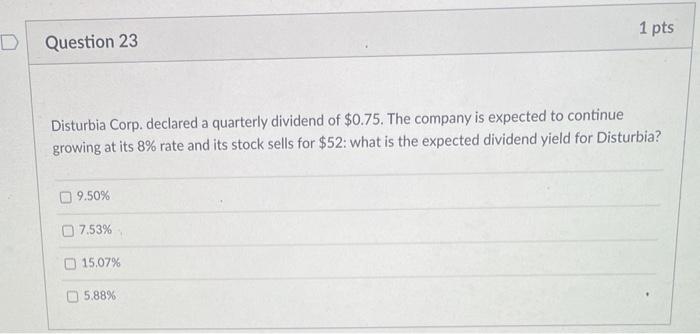

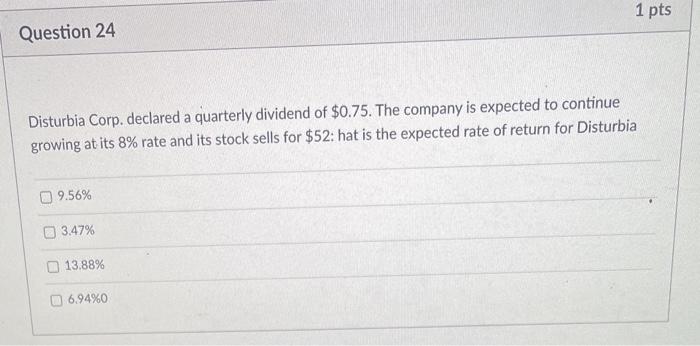

Question 21 1 pts Dramatis Inc. declared today a quarterly dividend of $0.52. Investors expect a rate of return on the stock of 12.5% as long as it maintains its projected annual growth rate of 7.5%. What would an investor pay for the stock today? $36.00 $32.60 $42.38 $38.60 A company's stock has quarterly dividends that are expected to be as shown in the table for the next 6 quarters. At the end of the 6th quarter, the stock is expected to sell for $32. If the required rate of return on the stock is 9%, how much would you pay for the stock today? (Round your answer.) t CF(t) 1 $0.25 2 . $0.25 3 $0.25 4 $0.60 5 $0.60 6 $0.60 $1.72 $29.47 $30.76 $30.33 1 pts Question 23 Disturbia Corp. declared a quarterly dividend of $0.75. The company is expected to continue growing at its 8% rate and its stock sells for $52: what is the expected dividend yield for Disturbia? 9.50% 7.53% 15.07% 5,88% 1 pts Question 24 Disturbia Corp. declared a quarterly dividend of $0.75. The company is expected to continue growing at its 8% rate and its stock sells for $52: hat is the expected rate of return for Disturbia 9.56% 3.47% 13.88% 6.94%0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts