Question: please answer all or none Question 23 1 pts A constant dividend growth stock just declared a dividend of $0.9 paid annually. If the growth

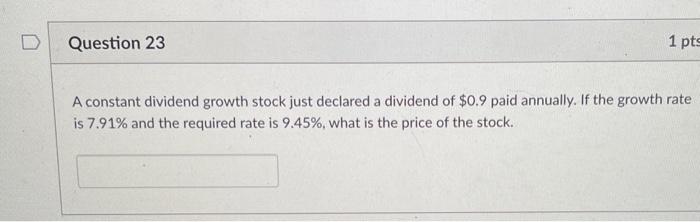

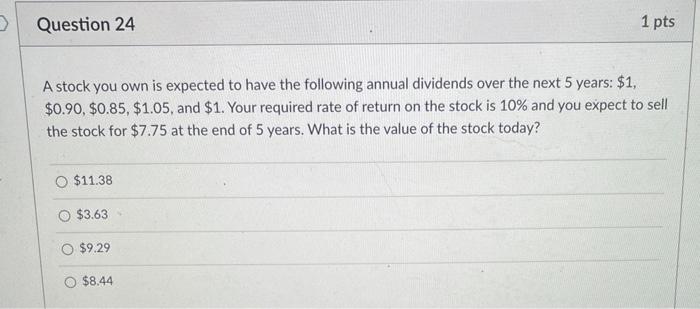

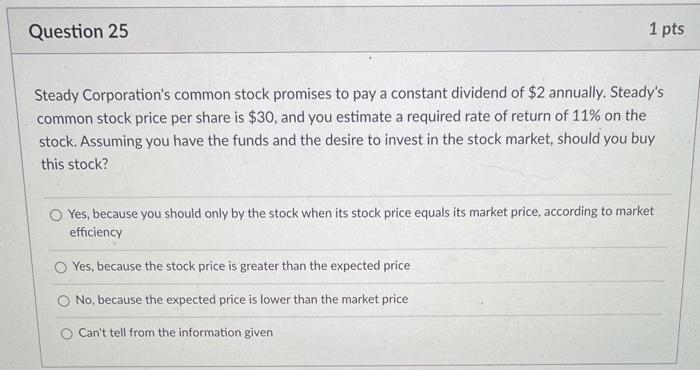

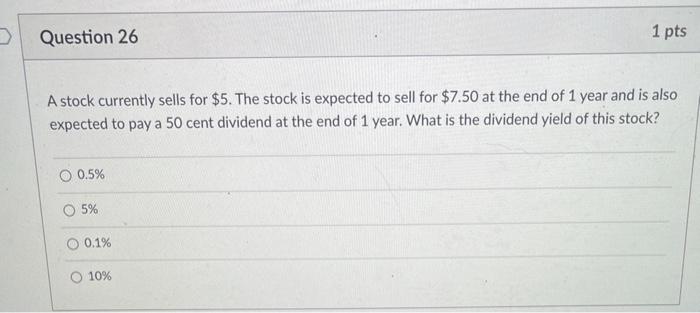

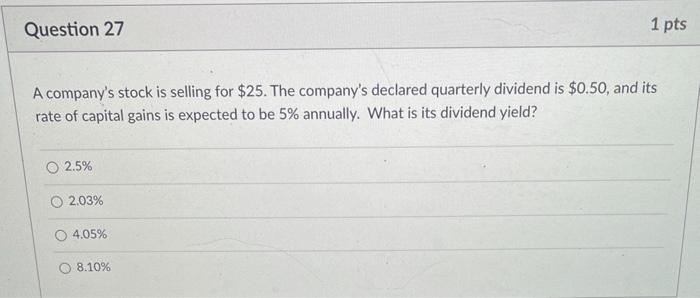

Question 23 1 pts A constant dividend growth stock just declared a dividend of $0.9 paid annually. If the growth rate is 7.91% and the required rate is 9.45%, what is the price of the stock. Question 24 1 pts A stock you own is expected to have the following annual dividends over the next 5 years: $1, $0.90, $0.85, $1.05, and $1. Your required rate of return on the stock is 10% and you expect to sell the stock for $7.75 at the end of 5 years. What is the value of the stock today? O $11.38 $3.63 $9.29 $8.44 Question 25 1 pts Steady Corporation's common stock promises to pay a constant dividend of $2 annually. Steady's common stock price per share is $30, and you estimate a required rate of return of 11% on the stock. Assuming you have the funds and the desire to invest in the stock market, should you buy this stock? Yes, because you should only by the stock when its stock price equals its market price, according to market efficiency Yes, because the stock price is greater than the expected price No, because the expected price is lower than the market price Can't tell from the information given > Question 26 1 pts A stock currently sells for $5. The stock is expected to sell for $7.50 at the end of 1 year and is also expected to pay a 50 cent dividend at the end of 1 year. What is the dividend yield of this stock? O 0.5% 5% 0.1% 10% Question 27 1 pts A company's stock is selling for $25. The company's declared quarterly dividend is $0.50, and its rate of capital gains is expected to be 5% annually. What is its dividend yield? 2.5% 2.03% 4.05% 8.10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts