Question: Please answer all parts ABC and please show work so i understand how to get the answer! There are some similar questions i found posted

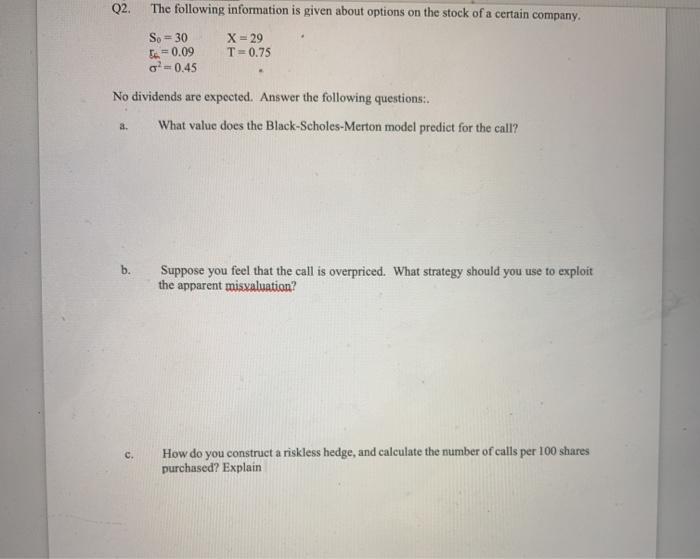

Q2. The following information is given about options on the stock of a certain company. So = 30 t=0.09 -0.45 X = 29 T=0.75 No dividends are expected. Answer the following questions: What value does the Black-Scholes-Merton model predict for the call? a. b. Suppose you feel that the call is overpriced. What strategy should you use to exploit the apparent misvaluation? c. How do you construct a riskless hedge, and calculate the number of calls per 100 shares purchased? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts