Question: Please answer all parts correctly. There are 5 rows in one as well. Please also BOLD answers. You are CEO of Rivet Networks, maker of

Please answer all parts correctly. There are 5 rows in one as well. Please also BOLD answers.

Please answer all parts correctly. There are 5 rows in one as well. Please also BOLD answers.

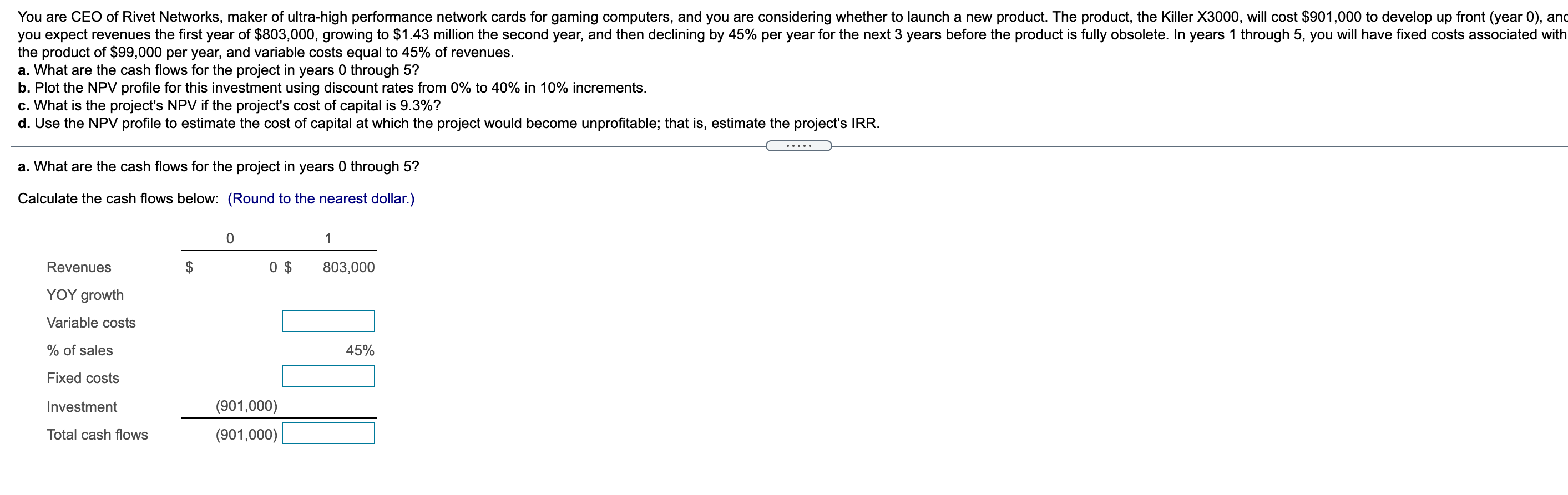

You are CEO of Rivet Networks, maker of ultra-high performance network cards for gaming computers, and you are considering whether to launch a new product. The product, the Killer X3000, will cost $901,000 to develop up front (year 0), and you expect revenues the first year of $803,000, growing to $1.43 million the second year, and then declining by 45% per year for the next 3 years before the product is fully obsolete. In years 1 through 5, you will have fixed costs associated with the product of $99,000 per year, and variable costs equal to 45% of revenues. a. What are the cash flows for the project in years 0 through 5? b. Plot the NPV profile for this investment using discount rates from 0% to 40% in 10% increments. c. What is the project's NPV if the project's cost of capital is 9.3%? d. Use the NPV profile to estimate the cost of capital at which the project would become unprofitable; that is, estimate the project's IRR. a. What are the cash flows for the project in years 0 through 5? Calculate the cash flows below: (Round to the nearest dollar.) 0 1 Revenues 0 $ 803,000 YOY growth Variable costs % of sales 45% Fixed costs I DI Investment (901,000) (901,000) Total cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts