Question: please answer all parts for the one question for a rating P8-1 (similar to) Question Help Rate of return Douglas Keel, a financial analyst for

please answer all parts for the one question for a rating

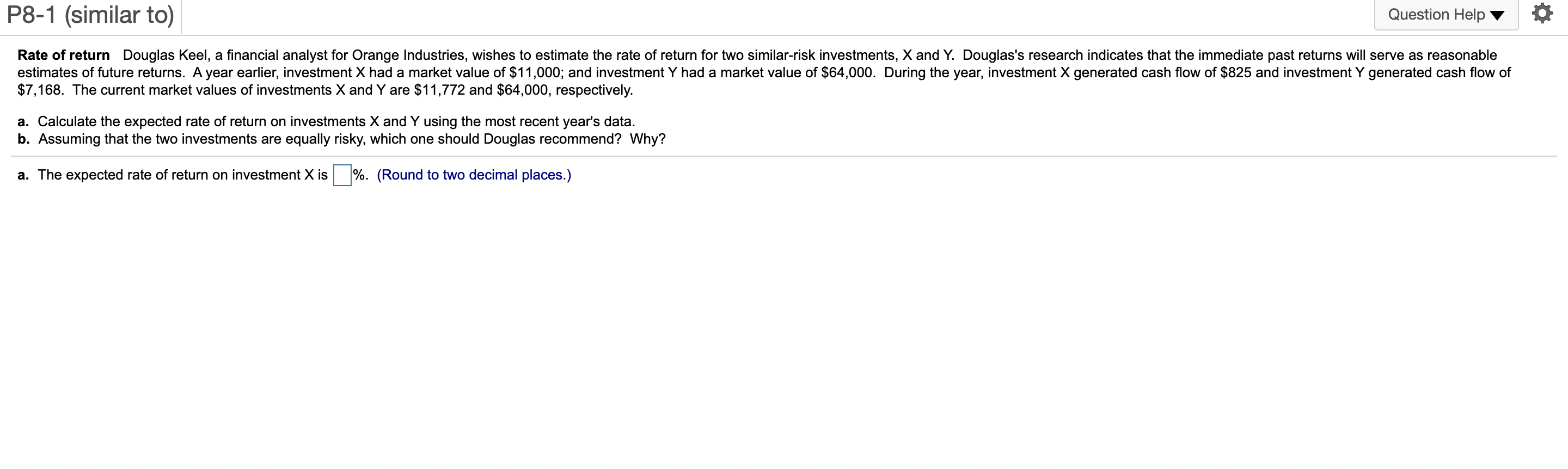

P8-1 (similar to) Question Help Rate of return Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for two similar-risk investments, X and Y. Douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. A year earlier, investment X had a market value of $11,000; and investment Y had a market value of $64,000. During the year, investment X generated cash flow of $825 and investment Y generated cash flow of $7,168. The current market values of investments X and Y are $11,772 and $64,000, respectively. a. Calculate the expected rate of return on investments X and Y using the most recent year's data. b. Assuming that the two investments are equally risky, which one should Douglas recommend? Why? a. The expected rate of return on investment X is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts