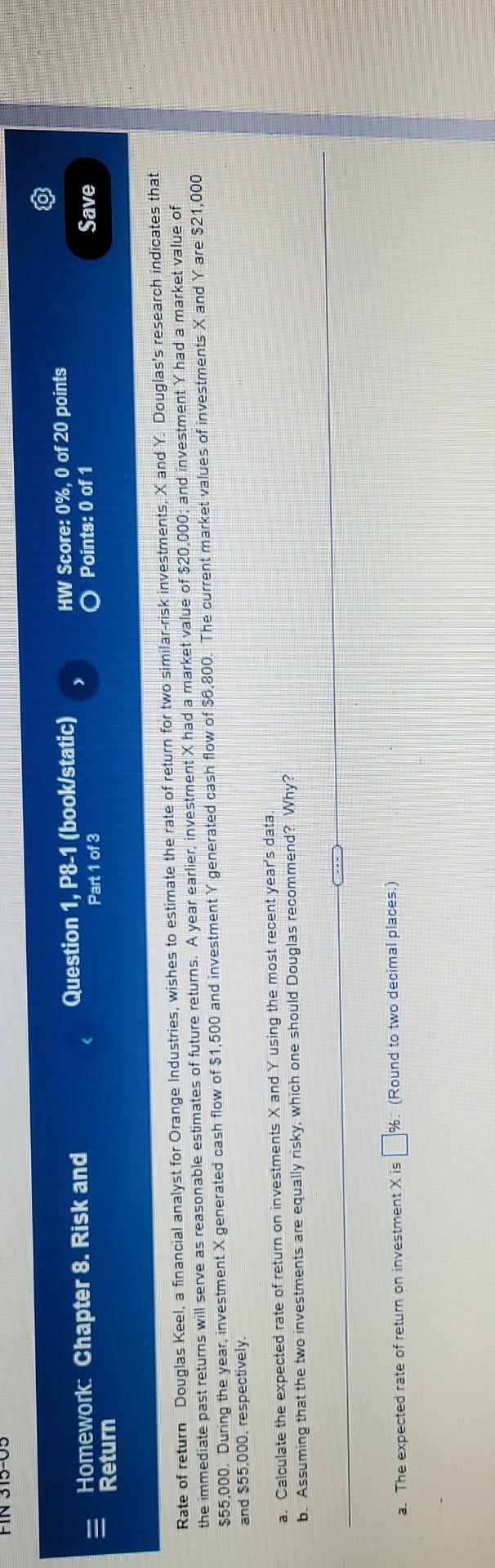

Question: Question 1, P8-1 (book/static) Homework: Chapter 8. Risk and Return HW Score: 0%, 0 of 20 points O Points: 0 of 1 Part 1 of

Question 1, P8-1 (book/static) Homework: Chapter 8. Risk and Return HW Score: 0%, 0 of 20 points O Points: 0 of 1 Part 1 of 3 Save Rate of return Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for two similar-risk investments, X and Y. Douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. A year earlier, investment X had a market value of $20.000; and investment Y had a market value of $55.000. During the year, investment X generated cash flow of $1,500 and investment Y generated cash flow of 58,800. The current market values of investments X and Y are $21,000 and $55.000, respectively. a. Calculate the expected rate of return on investments X and Y using the most recent year's data. b. Assuming that the two investments are equally risky, which one should Douglas recommend? Why? a. The expected rate of return on investment X is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts