Question: PLEASE ANSWER ALL PARTS FOR THUMBS UP!! Problem 7 Intro A corporate bond has 2 years to maturity, a coupon rate of 8%, a face

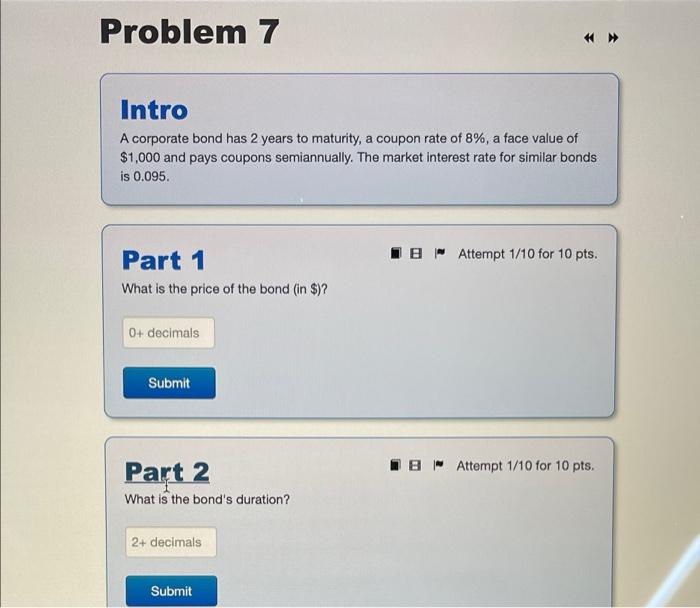

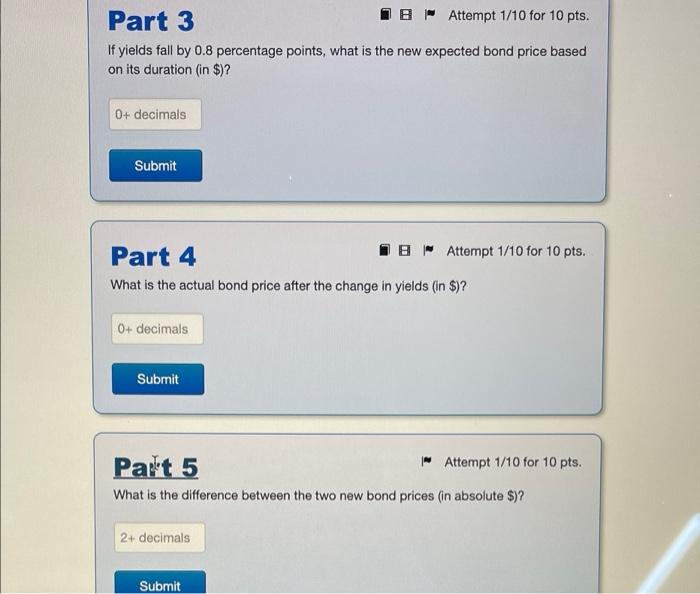

Problem 7 Intro A corporate bond has 2 years to maturity, a coupon rate of 8%, a face value of $1,000 and pays coupons semiannually. The market interest rate for similar bonds is 0.095. IB Attempt 1/10 for 10 pts. Part 1 What is the price of the bond (in $)? 0+ decimals Submit IB Attempt 1/10 for 10 pts. Part 2 What is the bond's duration? 2+ decimals Submit Part 3 B Attempt 1/10 for 10 pts. If yields fall by 0.8 percentage points, what is the new expected bond price based on its duration (in $)? 0+ decimals Submit Part 4 B Attempt 1/10 for 10 pts. What is the actual bond price after the change in yields (in $)? 0+ decimals Submit Palt 5 - Attempt 1/10 for 10 pts. What is the difference between the two new bond prices (in absolute $)? 2+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts