Question: PLEASE ANSWER ALL PARTS FOR THUMBS UP!! Problem 10 Intro As corporate treasurer, you have to pay $19 million in one year and again in

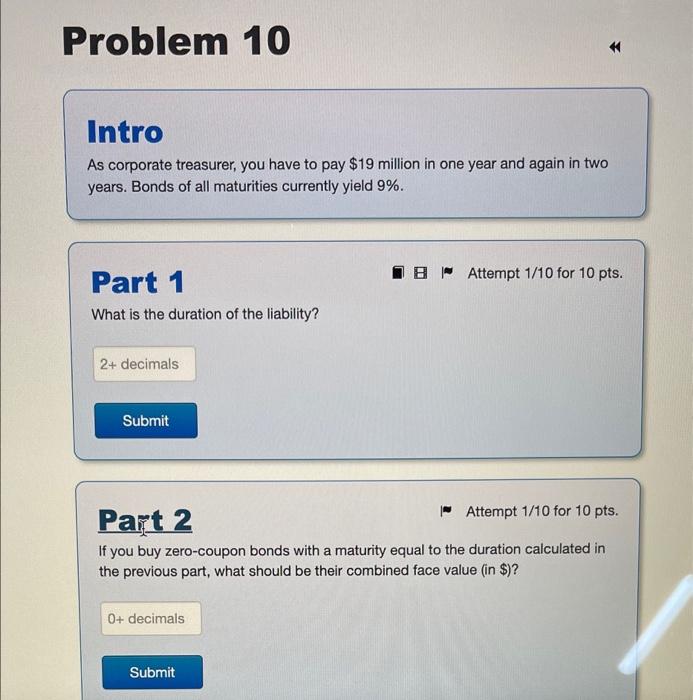

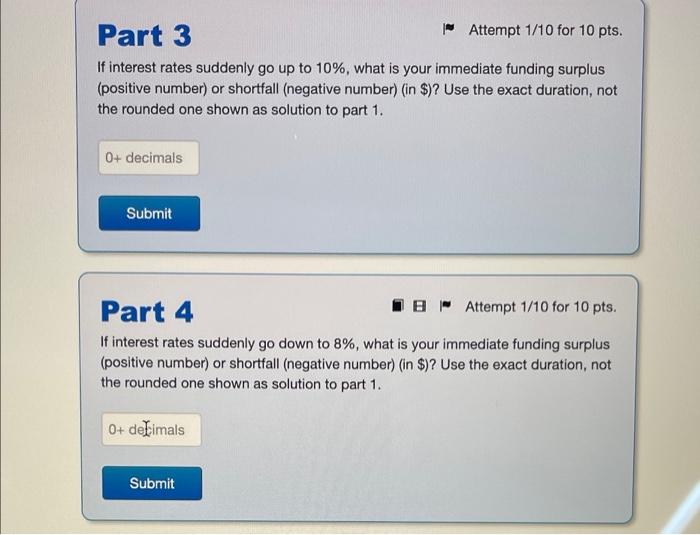

Problem 10 Intro As corporate treasurer, you have to pay $19 million in one year and again in two years. Bonds of all maturities currently yield 9%. 18 Attempt 1/10 for 10 pts. Part 1 What is the duration of the liability? 24 decimals Submit Part 2 Attempt 1/10 for 10 pts. If you buy zero-coupon bonds with a maturity equal to the duration calculated in the previous part, what should be their combined face value (in $)? 0+ decimals Submit Part 3 | Attempt 1/10 for 10 pts. If interest rates suddenly go up to 10%, what is your immediate funding surplus (positive number) or shortfall (negative number) (in $)? Use the exact duration, not the rounded one shown as solution to part 1. 0+ decimals Submit Part 4 IB Attempt 1/10 for 10 pts. If interest rates suddenly go down to 8%, what is your immediate funding surplus (positive number) or shortfall (negative number) (in $)? Use the exact duration, not the rounded one shown as solution to part 1. 0+ de imals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts