Question: Please answer All parts if possible if only 1 question with parts can be answered, ill post 2 and 3 seperately if it cant be

Please answer All parts if possible if only 1 question with parts can be answered, ill post 2 and 3 seperately if it cant be done in one post

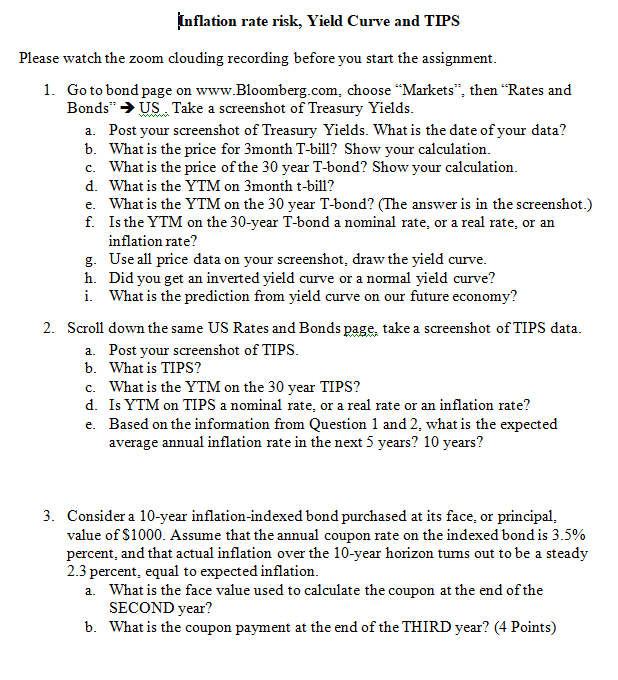

Please watch the zoom clouding recording before you start the assignment. 1. Go to bond page on www.Bloomberg.com, choose "Markets", then "Rates and Bonds" US . Take a screenshot of Treasury Yields. a. Post your screenshot of Treasury Yields. What is the date of your data? b. What is the price for 3 month T-bill? Show your calculation. c. What is the price of the 30 year T-bond? Show your calculation. d. What is the YTM on 3 month t-bill? e. What is the YTM on the 30 year T-bond? (The answer is in the screenshot.) f. Is the YTM on the 30-year T-bond a nominal rate, or a real rate, or an inflation rate? g. Use all price data on your screenshot, draw the yield curve. h. Did you get an inverted yield curve or a normal yield curve? i. What is the prediction from yield curve on our future economy? 2. Scroll down the same US Rates and Bonds page take a screenshot of TIPS data. a. Post your screenshot of TIPS. b. What is TIPS? c. What is the YTM on the 30 year TIPS? d. Is YTM on TIPS a nominal rate, or a real rate or an inflation rate? e. Based on the information from Question 1 and 2, what is the expected average annual inflation rate in the next 5 years? 10 years? 3. Consider a 10-year inflation-indexed bond purchased at its face, or principal, value of $1000. Assume that the annual coupon rate on the indexed bond is 3.5% percent, and that actual inflation over the 10-year horizon tums out to be a steady 2.3 percent, equal to expected inflation. a. What is the face value used to calculate the coupon at the end of the SECOND year? b. What is the coupon payment at the end of the THIRD year? (4 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts