Question: Please answer all parts! Thank you! Using the data from Table 12.3 E , what is the volatility of an equally weighted portfolio of Microsoft

Please answer all parts! Thank you!

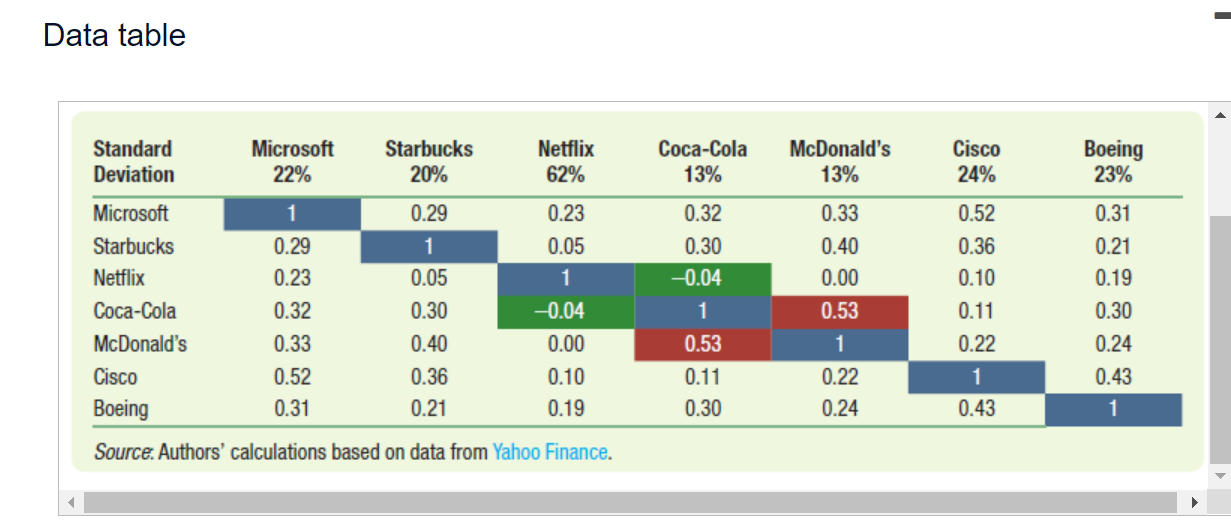

Using the data from Table 12.3 E , what is the volatility of an equally weighted portfolio of Microsoft and Starbucks stock? The volatility of the portfolio is %. (Round to one decimal place.) 1 Data table Coca-Cola 13% McDonald's 13% Cisco 24% Boeing 23% Standard Microsoft Starbucks Netflix Deviation 22% 20% 62% Microsoft 1 0.29 0.23 Starbucks 0.29 1 0.05 Netflix 0.23 0.05 1 Coca-Cola 0.32 0.30 -0.04 McDonald's 0.33 0.40 0.00 Cisco 0.52 0.36 0.10 Boeing 0.31 0.21 0.19 Source: Authors' calculations based on data from Yahoo Finance. 0.32 0.30 -0.04 1 0.53 0.11 0.30 0.33 0.40 0.00 0.53 0.52 0.36 0.10 0.11 0.22 1 0.43 0.31 0.21 0.19 0.30 0.24 0.43 1 1 0.22 0.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts