Question: Please answer all parts This is the missing information 2. a. For the Zero-Coupon Bond 2 above, what will be your effective annual yield for

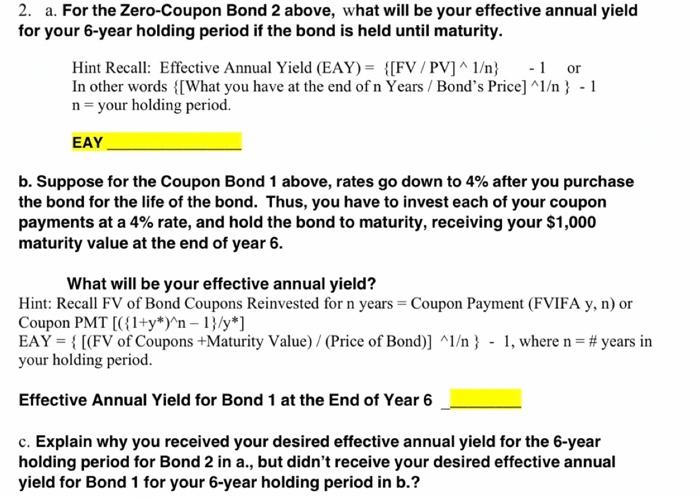

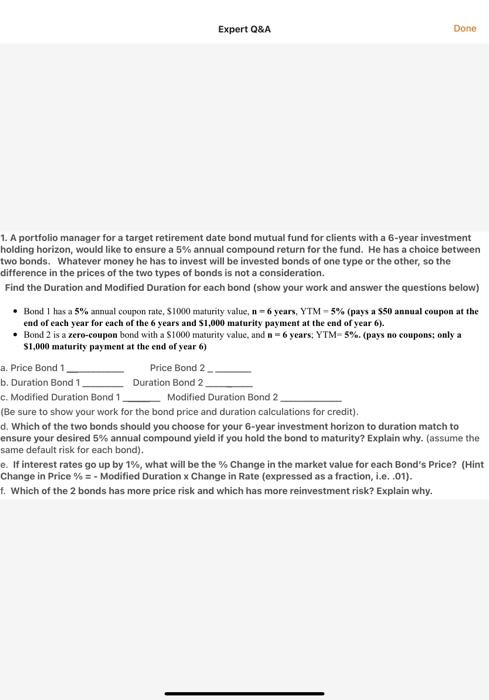

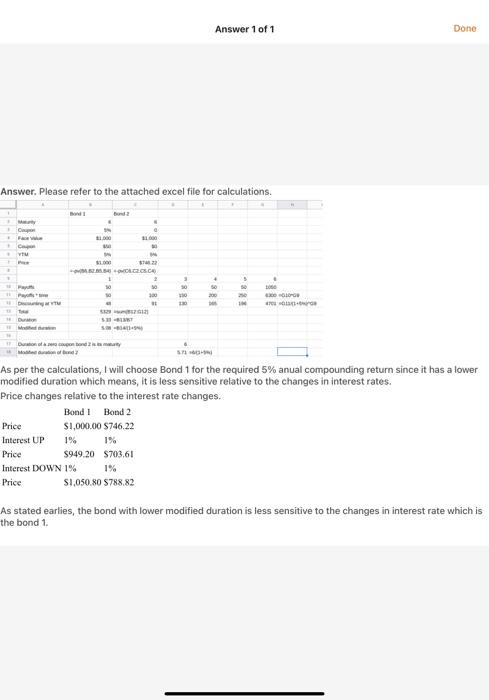

2. a. For the Zero-Coupon Bond 2 above, what will be your effective annual yield for your 6-year holding period if the bond is held until maturity. Hint Recall: Effective Annual Yield (EAY)= {[FV/PV]^1} - 1 or In other words {[What you have at the end of n Years / Bond's Price] ^l) - 1 n=your holding period. EAY b. Suppose for the Coupon Bond 1 above, rates go down to 4% after you purchase the bond for the life of the bond. Thus, you have to invest each of your coupon payments at a 4% rate, and hold the bond to maturity, receiving your $1,000 maturity value at the end of year 6. What will be your effective annual yield? Hint: Recall FV of Bond Coupons Reinvested for n years = Coupon Payment (FVIFA y, n) or Coupon PMT [[{1+y*)n-1}/y*] EAY = { [(FV of Coupons +Maturity Value) / (Price of Bond)] ^1 ) - 1, where n = # years in your holding period. Effective Annual Yield for Bond 1 at the End of Year 6 c. Explain why you received your desired effective annual yield for the 6-year holding period for Bond 2 in a., but didn't receive your desired effective annual yield for Bond 1 for your 6-year holding period in b.? Expert Q&A Done 1. A portfolio manager for a target retirement date bond mutual fund for clients with a 6-year investment holding horizon, would like to ensure a 5% annual compound return for the fund. He has a choice between two bonds. Whatever money he has to invest will be invested bonds of one type or the other, so the difference in the prices of the two types of bonds is not a consideration. Find the Duration and Modified Duration for each bond (show your work and answer the questions below) Band I has a 5% annual coupon rate, $1000 maturity value, n-6 years, YTM - 5% (pays a 550 annual coupon at the end of each year for each of the 6 years and $1,000 maturity payment at the end of year 6). Bond 2 is a zero-coupon bond with a S1000 maturity value, and n = 6 years, YTM-5%. (pays no coupons; only a $1,000 maturity payment at the end of year 6) a. Price Bond 1 Price Bond 2 b. Duration Bond 1 Duration Bond 2 c. Modified Duration Bond 1 Modified Duration Bond 2 (Be sure to show your work for the bond price and duration calculations for credit). d. Which of the two bonds should you choose for your 6-year investment horizon to duration match to ensure your desired 5% annual compound yield if you hold the bond to maturity? Explain why. (assume the same default risk for each bond). e. If interest rates go up by 1%, what will be the % Change in the market value for each Bond's Price? (Hint Change in Price %=- Modified Duration Change in Rate (expressed as a fraction, i.e..01). f. Which of the 2 bonds has more price risk and which has more reinvestment risk? Explain why. Answer 1 of 1 Done Answer. Please refer to the attached excel file for calculations. 1.000 11.00 . 22 MORE. 3 50 50 3 50 Pay XO 30 10 - Duo M As per the calculations, I will choose Bond 1 for the required 5% anual compounding return since it has a lower modified duration which means, it is less sensitive relative to the changes in interest rates. Price changes relative to the interest rate changes. Bondi Bond 2 Price $1,000.00 $746.22 Interest UP 1% 1% Price $949.20 $703.61 Interest DOWN 1% 1% Price 51,050.80 9788.82 As stated earlies, the bond with lower modified duration is less sensitive to the changes in interest rate which is the bond 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts