Question: Please answer them all. (10 pts) Common stock ABC pays a dividend of $10 per share at the end of the first year, with subsequent

Please answer them all.

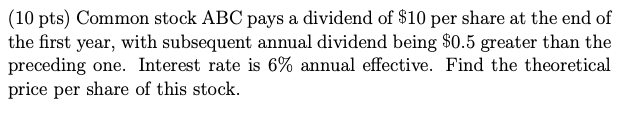

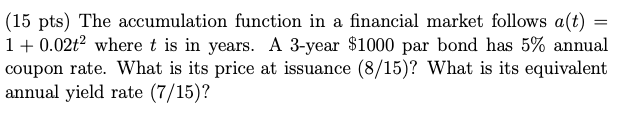

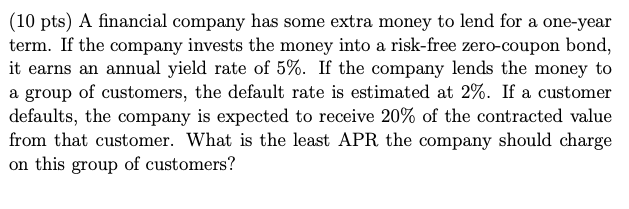

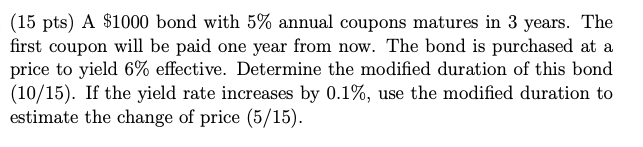

(10 pts) Common stock ABC pays a dividend of $10 per share at the end of the first year, with subsequent annual dividend being $0.5 greater than the preceding one. Interest rate is 6% annual effective. Find the theoretical price per share of this stock. (15 pts) The accumulation function in a financial market follows a(t) 1 +0.02t2 where t is in years. A 3-year $1000 par bond has 5% annual coupon rate. What is its price at issuance (8/15)? What is its equivalent annual yield rate (7/15)? (10 pts) A financial company has some extra money to lend for a one-year term. If the company invests the money into a risk-free zero-coupon bond, it earns an annual yield rate of 5%. If the company lends the money to a group of customers, the default rate is estimated at 2%. If a customer defaults, the company is expected to receive 20% of the contracted value from that customer. What is the least APR the company should charge on this group of customers? (15 pts) A $1000 bond with 5% annual coupons matures in 3 years. The first coupon will be paid one year from now. The bond is purchased at a price to yield 6% effective. Determine the modified duration of this bond (10/15). If the yield rate increases by 0.1%, use the modified duration to estimate the change of price (5/15)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts