Question: Please answer all parts to this one question or let someone else. I need to be able to re-create this same problem with different numbers

Please answer all parts to this one question or let someone else. I need to be able to re-create this same problem with different numbers so I want to see the steps if you can or at least the calculation so I can figure it out. THank you!

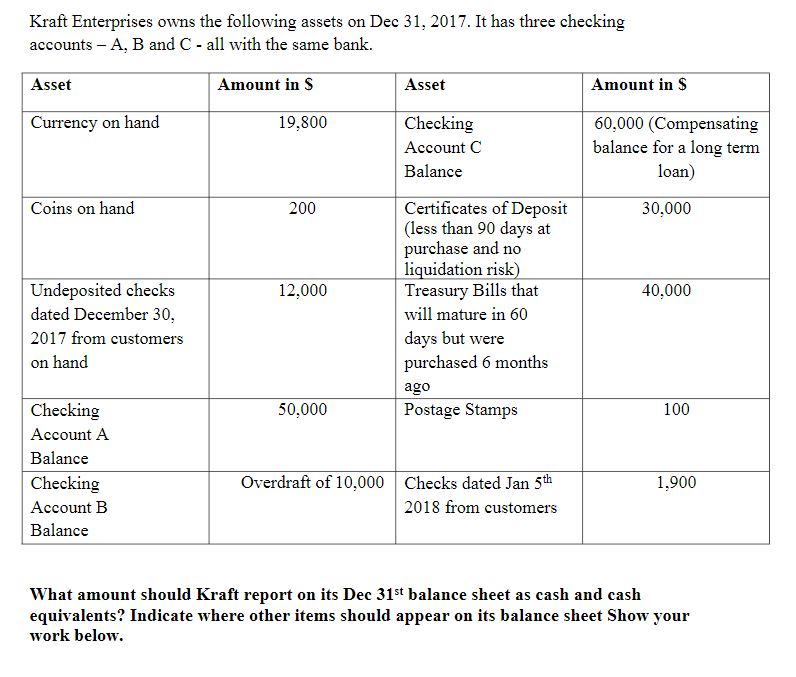

Kraft Enterprises owns the following assets on Dec 31, 2017. It has three checking accounts - A, B and C - all with the same bank. Asset Amount in s Asset Amount in $ Currency on hand 19,800 60,000 (Compensating balance for a long term loan) Coins on hand 200 30.000 Checking Account C Balance Certificates of Deposit (less than 90 days at purchase and no liquidation risk) Treasury Bills that will mature in 60 days but were purchased 6 months 12,000 40,000 Undeposited checks dated December 30, 2017 from customers on hand ago 50,000 Postage Stamps 100 Checking Account A Balance Checking Account B Balance 1,900 Overdraft of 10,000 Checks dated Jan 5th 2018 from customers What amount should Kraft report on its Dec 31st balance sheet as cash and cash equivalents? Indicate where other items should appear on its balance sheet Show your work below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts