Question: please answer all parts with work Equity value in a levered firm. Air Seattle has an annual EBIT of $1,000,000, and the WACC in the

please answer all parts with work

please answer all parts with work

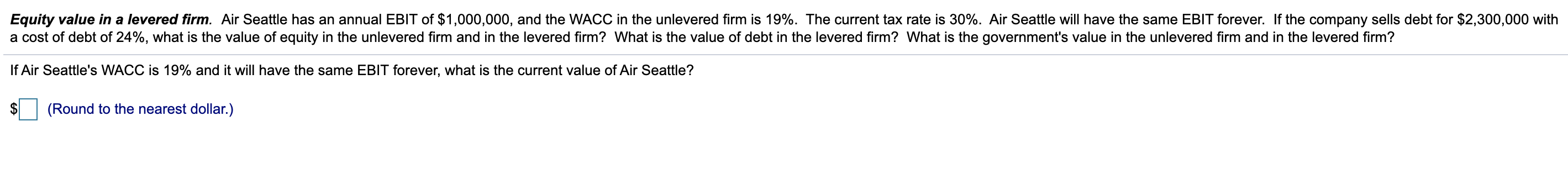

Equity value in a levered firm. Air Seattle has an annual EBIT of $1,000,000, and the WACC in the unlevered firm is 19%. The current tax rate is 30%. Air Seattle will have the same EBIT forever. If the company sells debt for $2,300,000 with a cost of debt of 24%, what is the value of equity in the unlevered firm and in the levered firm? What is the value of debt in the levered firm? What is the government's value in the unlevered firm and in the levered firm? If Air Seattle's WACC is 19% and it will have the same EBIT forever, what is the current value of Air Seattle? und to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts