Question: Please answer all points in excel if possible. You are Dr . Shetty's investment advisor. He has given you $ 1 0 million to invest

Please answer all points in excel if possible.

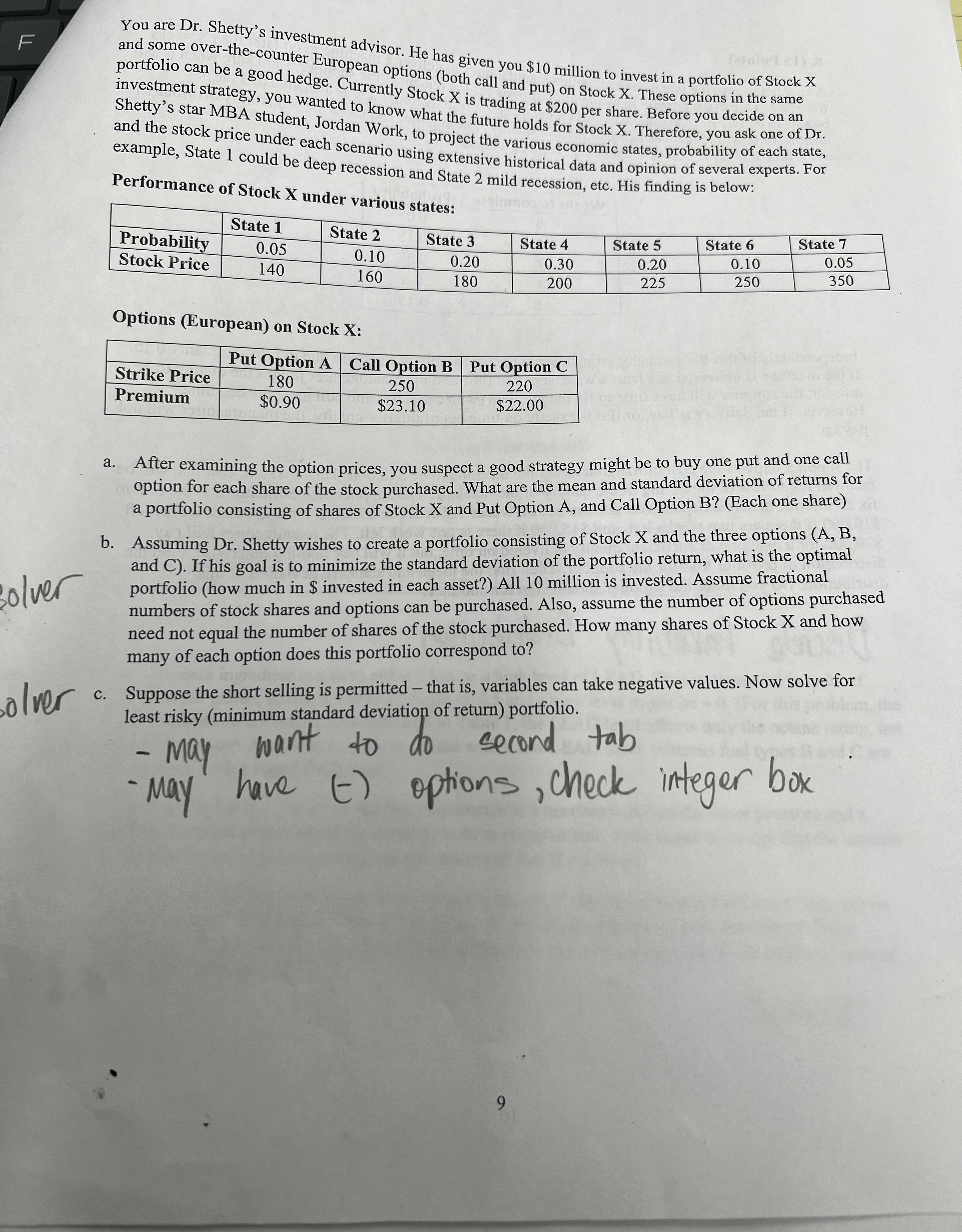

You are Dr Shetty's investment advisor. He has given you $ million to invest in a portfolio of Stock

and some overthecounter European options both call and put on Stock X These options in the same

portfolio can be a good hedge. Currently Stock is trading at $ per share. Before you decide on an

investment strategy, you wanted to know what the future holds for Stock X Therefore, you ask one of Dr

Shetty's star MBA student, Jordan Work, to project the various economic states, probability of each state,

and the stock price under each scenario using extensive historical data and opinion of several experts. For

example, State could be deep recession and State mild recession, etc. His finding is below:

Performance of Stock under various states:

Options European on Stock X:

a After examining the option prices, you suspect a good strategy might be to buy one put and one call

option for each share of the stock purchased. What are the mean and standard deviation of returns for

a portfolio consisting of shares of Stock X and Put Option A and Call Option BEach one share

b Assuming Dr Shetty wishes to create a portfolio consisting of Stock and the three options A B

and If his goal is to minimize the standard deviation of the portfolio return, what is the optimal

portfolio how much in $ invested in each asset? All million is invested. Assume fractional

numbers of stock shares and options can be purchased. Also, assume the number of options purchased

need not equal the number of shares of the stock purchased. How many shares of Stock X and how

many of each option does this portfolio correspond to

c Suppose the short selling is permitted that is variables can take negative values. Now solve for

least risky minimum standard deviation of return portfolio.

may want to do second tab

may have options, check integer box

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock